The JAFX Ltd. was founded in 2013. But it started to provide online trading services a bit later, in 2016. The company’s registration area is St. Vincent and the Grenadines. This is an offshore territory, which often opens financial offices, investment companies with limited liability.

From the official description on the broker’s website, we learned that clients get access to Forex trading by the type of STP / ECN. Accordingly, if you wish, you can choose the ECN-account, where transactions are displayed directly on the interbank market. STP accounts, on the contrary, imply processing orders on forex broker servers. These are completely different models with individual advantages and disadvantages. And the company’s customers have a choice, following their own desires and needs.

The JAFX overview:

• The minimum deposit is $10 (micro account)

• There are no restrictions on trading style, scalping and hedging are available

• The trading terminal is MetaTrader 4

• The site interface language is only English

• The language of support service is only English.

Please note that fx broker representatives communicate only in English. Therefore, many customers from the CIS and Asia are losing the possibility of full cooperation with the company. The broker does not open accounts for citizens of Cuba, Congo, Iran, Syria, Libya, Japan, North Korea, and Vietnam.

Trading conditions and types of accounts

JAFX has only one trading account with standard terms. It is very convenient that there is no multifaceted separation with a lot of nuance and difficulty of choice.

• The minimum deposit is $10

• Leverage is up to 1: 500

• The minimum lot is 0.01

• The number of currency pairs for trading is 47

• The number of CFD assets for trading is more than 100

• Cryptocurrency for trading is more than 30 coins

It is worth highlighting the high-quality interface of the site so that even without knowledge of English, you can clearly understand the trading conditions and all the possibilities of a potential client company.

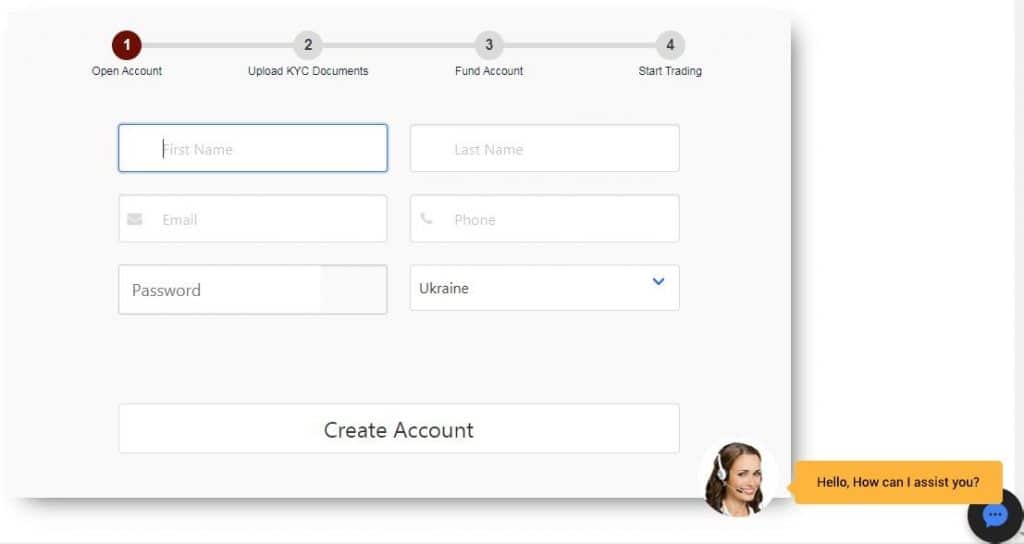

Going to the block of registration of a new user, we will need to enter key data: a telephone number for communication, an e-mail address, a new password invented. After this, a transition to the block with verification is performed. Immediately you will need to upload PFD documents or images confirming your residential address, name and other personal data. This can be scanned copies of a passport, ID-card, receipt of payment of utilities.

Only after that, the client will go to his account, where you can deposit money through a bank card, an electronic payment system Skrill or Bitcoin wallet.

Investment services, training, and analytics

One of the disadvantages of the JAFX broker is the lack of developed investment programs and a training section. The company is positioning itself as a progressive broker with an innovative approach. This can be concluded based on the high quality and modern interface design. Investing money according to the principle of PAMM-accounts or copying transactions of managing traders will not work.

Support Service

We already wrote above that the JAFX support service works in English. On the official website, you can use the online chat widget and directly contact the manager. We checked the operator’s activity, and the answer was followed in just a few minutes, which is a neutral result.

On the site, we see a separate contact section where the telephone numbers of central office and representative offices are published: +44 20 8089 1402 (UK) and +61 39 9997 331 (Australia). Additionally, you can send a request in the same Contacts section and wait until the managers independently contact the user.

Trading Platform

The main trading terminal for broker clients is the JAFX Web Terminal, which was integrated into the requests of the company’s management. You can also use a well-known to many clients MT4 in the desktop or mobile version. But many consider it already outdated and are switching either to MT5 or to web versions of terminals with nice graphics and advanced functionality.

I’ve been going back and forth with them for months now. I never got my money and I was trying to get them to fix this issue. They apparently didn’t believe me and demanded my bank statements to prove I never got my funds. This is the worst broker ever and will drag their feet and do everything they can to avoid giving your money back. Now they are saying I have to use other withdrawal methods. A bunch of nonsense!

I saw in another forum that they are being sued. I would stay away!