If you are a keen follower of global financial developments, you must be familiar with these two terms, currency manipulation and quantitative easing (QE). The terms grew into the mainstream news at different times, each perpetuated by different circumstances.

Although QE is an old concept, it grew into prominence in the wake of the 2007/08 Great Recession. Major central banks looked to nontraditional monetary policy tools to counterbalance a recession that was not heeding conventional medicine.

On the other hand, currency manipulation has been part of conversations in global finance for many years. Since time immemorial, countries have been accused of – manipulating their currencies to certain ends. In the age of QE, there have been widespread claims equating the policy to currency manipulation. We evaluate these two concepts to establish similarities and differences.

Explaining QE

QE is a tool that the US Fed applied in 2009 – and still does – to fill the gaps that traditional monetary policy tools left. This tool entails the Fed buying up debt from the private sector in massive quantities. The assets targeted in the first QE program in March 2009 were US Treasury securities, mortgage-backed securities, and federal agency debt. More recent asset purchases have expanded to include the purchase of corporate debt.

The US Fed explains that the purpose of QE is threefold. Primarily, the Fed purchases debt as a means of absorbing the impact of a recession. Normally, a recession tightens liquidity in the economy, and QE mainly aims to keep money flowing into consumers’ pockets.

Interestingly, the Fed acknowledges that QE expands the monetary base substantially, potentially leading to a dramatic rise in inflation. However, the central bank has avoided the grim predictions by convincing banks to hold large amounts of reserves. The more reserves banks hold, the less the money flows.

And what is currency manipulation?

Currency manipulation is a controversial concept. First of all, the concept is not internationally overarching. Secondly, the US Department of Treasury is the only prolific user of the concept against countries it deems hell-bent on maintaining an unfair trade balance.

According to the US Treasury, currency manipulation helps a central bank to achieve artificially lowered exchange rates. Primarily, currency manipulation targets to make exports cheaper and imports more expensive. Currently, the US Treasury’s monitoring list of currency manipulators has 10 culprits, including India, Switzerland, and Vietnam.

What amounts to currency manipulation as per the US Treasury Department?

To recap, we have already discussed that currency manipulation’s primary aim is to lower a currency’s market value artificially. Usually, this activity corresponds with immense growth due to a favorable balance of payments.

According to the US Treasury Department, currency manipulation happens in three steps. First, the central bank goes into the global currency market and sells large domestic currency quantities. Usually, the operation targets a favorable trade balance with a specific country.

If the central bank is targeting to weaken the domestic currency against the US dollar, it will buy the greenbacks and sell the domestic currency simultaneously. Two things happen as a result. As the domestic currency floods the market, its price experiences downward pressure, while increased demand raises the US dollar price.

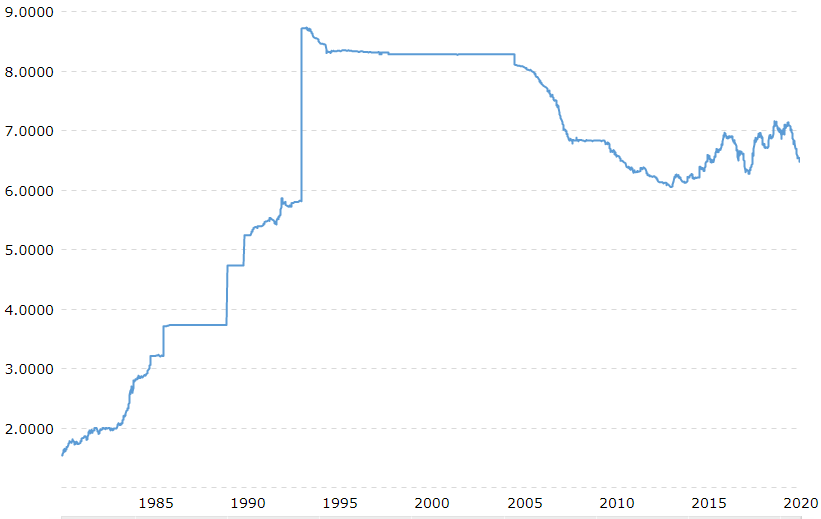

China has been a long-term member of the currency manipulator monitoring list. Since the 80s, the value of the yuan remained significantly low against the US dollar even when China’s economy grew exponentially.

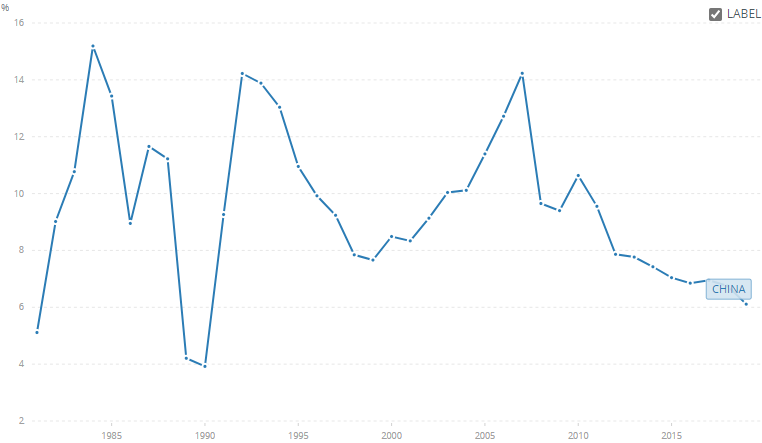

In figures 1 and 2 below, notice that China’s GDP’s annual growth rate was averaging at 15%, yet the value of the Chinese yuan (CNY) continued to decline against the greenback. This goes against conventional wisdom, which suggests that a country’s currency strengthens as its GDP expands.

Some other indicators of currency manipulation include a country maintaining an account surplus for a period extending beyond six months. A country is also suspected of manipulating its currency if it adds to its foreign exchange reserves over the same period of extended account surplus. The last test that the US Treasury Department applies is if a country’s foreign exchange reserves excess over three months of normal imports.

Does QE amount to currency manipulation?

The US Treasury exempts QE from currency manipulation practices ostensibly because it is a valid monetary policy tool. Backers of this narrative argue that QE does not directly impact exchange rates, something that currency manipulation achieves with a massive ruthlessness.

But there are those who suspect that QE is, in fact, a form of currency manipulation. They argue that – using the US example – when the US Fed buys bonds, it ends up driving down the yields. Lower yields make the bonds unattractive to investors, and those investors who had bought US dollars for which they would use to buy US bonds would no longer have the incentive to hold the greenbacks. What could happen is the investors would start selling off the USD, eventually causing the greenback to depreciate.

Still, the official line of argument is that QE does not overtly target exchange rates. Instead, the tool targets interest rates as a primary objective. But what else could massive money printing aim to do other than keeping the value of a currency artificially low?

Conclusion

The global financial community cannot obtain a consensus on currency manipulation because the concept is highly subjective. On the one hand, the US arbitrarily brands countries as currency manipulators, especially when the trade balance tilts out of their favor.

On the other hand, suspected currency manipulators accuse the US of being the biggest offender via QE. They argue that massive money printing’s ultimate goal is to undermine the USD’s value against rivals. The argument is predicated on the narrative that money supply is a significant factor influencing exchange rates. In short, the tug of war over currency manipulation – and its intended purpose – does not have an end in sight.

Leave a Reply