- Bitcoin bounce back stalls

- Bitcoin range-bound

- Bitcoin bearish outlook

Uncertainty appears to be the central theme in the cryptocurrency market. Weakness has crept in, with nearly all altcoins struggling to post significant gains. Caution has taken a toll on investors’ sentiments as most continue to assess the impact of rising inflation. Concerns about recession due to the disruptions triggered, but the Russia-Ukraine war has also weighed heavily on sentiments about crypto investments.

Bitcoin range-bound

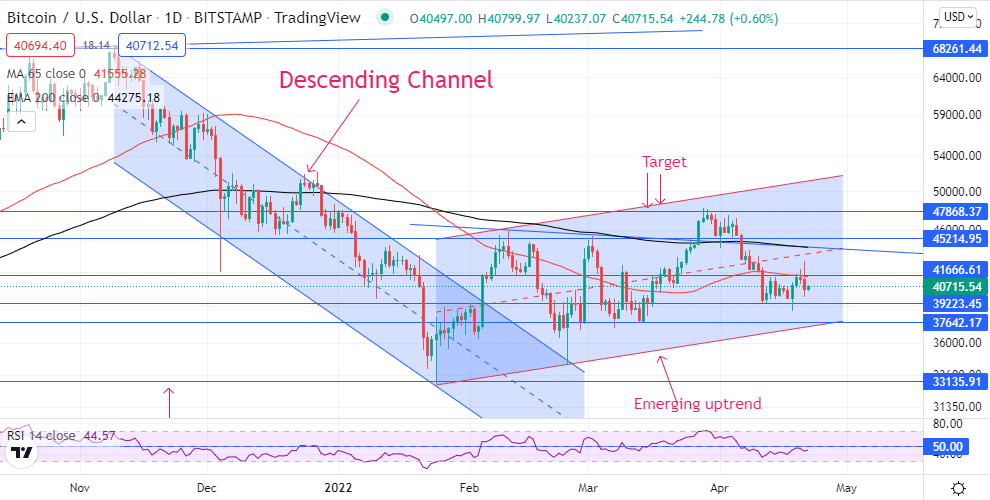

Bitcoin, the flagship cryptocurrency, is also feeling the brunt. The crypto has resorted to trading in a range following stalled breakout. Over the past ten days, bulls have struggled to steer BTCUSD above the $41,600 area, which has emerged as a pivotal resistance level. Likewise, short-sellers have struggled to fuel another leg lower, with the $39,200 area emerging as the immediate support level.

Technical indicators led by the 65 exponential moving average and the Relative Strength Index have turned flat, signaling a lack of direction in the market. As it stands, bears appear to have the upper hand as the RSI is below 50.

Consequently, a sell-off followed by a close below the $39,200 area could reignite renewed sell-off that could see BTCUSD tanking to lows of $37,600, seen as the next support area. The coin finding support above the $40,000 psychological level could heighten the prospects of Bitcoin edging higher.

Conversely, bulls fuelling a rally followed by a daily close above the $42,000 handle would only affirm a bounce back, paving the way for Bitcoin to make a run for the $47,800 area seen as the next substantial resistance level.

Is it the right time to buy Bitcoin

Given that Bitcoin is range-bound, now may not be the best time to enter a long position. The RSI already hints of bearish momentum in play. A lack of clear-cut catalysts also affirms a wave of uncertainty that could see the coin move either way.

Institutional activity around the coin appears to have slowed down, as depicted by the coin failing to find support above key support levels. Unlike last year at the height of the crypto boom when MicroStrategy Tesla and Square were ramping up positions, investment activity appears to have slowed. Consequently, Bitcoin will likely remain under pressure as the focus shifts to other yielding assets.

Rising yields

US treasury yields rising to multi-year highs appears to have had a ripple impact on the capital markets. Investors are increasingly turning their attention to high-yielding assets to take advantage of rising yields. The prospect of the Federal Reserve hiking interest rates aggressively has also given investors a reason to allocate more funds to bonds and treasuries to take advantage of high-interest rates.

Bitcoin and other cryptocurrencies have also found themselves under pressure amid factors affecting the mainstream sector. Concerns over the kind of actions that the FED will take to combat runaway inflation have weighed heavily on the mainstream sector, all but spilling into the crypto markets.

Bitcoin has continued to trade in tandem with the stock markets. The flagship crypto has also shown the affinity to edge lower. Until sentiments and prospects in the equity markets improve, bitcoin could remain under pressure.

Final thoughts

Bitcoin has come under pressure amid concerns of an aggressive shift in US monetary policy. The FED’s prospects of higher interest rates have only triggered fear forcing investors to scamper for safety in safe havens and high yield investments. Choppier Bitcoin prices are expected in the coming months.

Leave a Reply