You are probably aware that central banks exist to manage the inflation rates in a given economy. You might also be aware that the rate of inflation that an economy records affects the rate at which it grows. What you might not know is that inflation and interest rates are joined at the hip.

Interest rates make up the biggest force that influences the direction of the foreign exchange (forex) market. The influence is not direct, as it depends on how the interest rates affect the exchange rates between one currency and another. In this article, we evaluate how interest rates interact with forex markets, and we explain why forex traders must develop an obsession with how central banks determine interest rates.

Explaining interest rates

Interest rate is a broad term referring to the percentage that a borrower pays a lender on the principal sum borrowed. If you save your money in a financial institution, you will be the one receiving interest. The interest rate can be viewed as the cost of debt or the cost of a customer’s savings (from the perspective of a deposit-taking institution).

In this article, we shall be looking at another type of interest rate, one that towers above all the rest in terms of importance. It is called the bank rate/base rate – or the federal funds rate in the United States.

A bank rate is a tool that central banks use to control money flow in the domestic economy. Money flow is the rate at which money changes hands within the economy. Also, money flow impacts inflation, whereby a higher velocity money flow triggers high inflation rates, while a too slow flow of money might cause what economists call deflation – which could be construed as the opposite of inflation, although this assumption is in doubt.

Real versus nominal interest rates

The interest rates that banks charge borrowers play a huge role in determining the velocity of money flow in an economy. Banks determine the interest rates based on several factors, the bank rate, inflation rate, and risk involved being among them.

Banks structure loans such that borrowers can pay a certain amount regularly for a given period. If the bank gave you $100 and after a year you pay back $120, the bank would have charged you an interest rate of 20% per annum. But this is a nominal interest rate.

Nominal interest rate is the percentage you pay on loan at face value, such as the 20% in our above example. You are left with the real interest rate when certain things as inflation, are subtracted from the nominal interest rate.

Let us say the bank in the above example would like to determine the real interest rate you paid in their loan. Assuming the inflation rate over the term of the loan was 5%, the real interest rate would then be 15% (20 – 5 = 15). In short, the real interest rate is simply nominal interest rates adjusted for inflation. The formula is:

Real Interest rate=Nominal Interest Rate-Inflation

The same is true if you were to put money in a savings account. Assume you put $100 in a savings account, and after two years, the funds have grown to $120. Simple subtraction tells you the money earned an interest of $20, which translates to an interest rate of 10% per annum.

Remember, the 10% is nominal, and you will have to subtract inflation – at 5% per annum – to get the real interest rate. Total inflation for the two years will be 10%, assuming it stayed constant. A quick arithmetic yields real interest as 10% i.e., 20% – 10% = 10%.

How interest rates and exchange rates interact

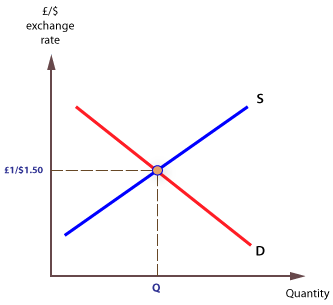

Higher interest rates often lead to an appreciation in the value of a given currency. Let us consider the case of the exchange rate between the sterling pound and the US dollar. At first, the GBP/USD exchange rate is at equilibrium (at 1.50 in the figure below).

However, inflation is high in the UK, and the Bank of England feels it should do something to stabilize the situation. So, it goes for its most trusted monetary policy tool, the bank rate. The Bank of England then raises the bank rate to tighten liquidity in the economy – this policy often goes by its technical term, contractionary monetary policy.

Something else happens when the Bank of England (BoE) raises the base rate. The higher base rate implies that saving and investing in the UK pays better returns than, say, the US, whose base rate is low. Therefore, US-based investors move their funds across the Atlantic into UK-based assets.

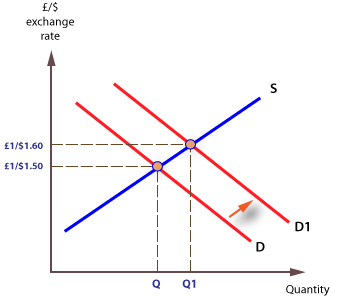

To invest in the UK, the US-based investors will have to buy sterling pounds and simultaneously sell their USD holdings. What then follows is a higher demand for GBP against a limited supply. In the figure below, line S (blue line) represents the limited supply for GBP, while line D and D1 represent the initial and the new GBP demand levels, respectively.

Because of the shift in GBP demanded from Q to Q1, the exchange rate – the value of the GBP against the USD – climbs from 1.50 to 1.60.

Why forex traders should track changes in interest rates

We have illustrated that changes in interest rate generate changes in the exchange rate between one currency and another. Central banks adjust interest rates regularly to keep inflation rates within the desired region. They raise interest rates when inflation crosses or threatens to cross the upper threshold, and they cut interest rates when inflation falls below target rates.

Any adjustment of interest rates induces a change in the value of a currency. As such, the market will always price in the expected interest rate even before the central bank comes up with the final decision. Because the expectations influence the exchange rate of given currencies, you are better off keeping abreast of new developments concerning the expected interest rate. This way, you will be able to stay a step ahead of the market.

Leave a Reply