This Forex broker was registered in the United States of America, where is located the central office of the company. It belongs to the category of discount brokers, since the size of the transaction fee is significantly less than that of many competitors. The broker’s activity is immediately regulated by seven authoritative bodies, including the well-known FCA and SEC.

The peculiarity of the company is the recent disconnection of the minimum deposit limit. This means that even with only $10, the user can replenish his deposit and start trading. True, the limit for margin trading using leverage is set at $2,000. This is a considerable amount for traders who even have extensive experience trading in financial markets.

General statements about the company Interactive Brokers:

• Legal name of the company – Interactive Brokers Group;

• Registration – New York, USA;

• Minimum deposit – $2,000 for trading with leverage and $0 for non-margin trading;

• Availability of a regulator – yes, from 7 organizations.

The company has 7 official representative offices in different parts of the world (USA, Europe, Asia). Therefore, customers are from more than 100 countries.

Types of accounts and trading conditions for customers

The types of accounts with this forex broker can be divided into two broad categories:

• For simple traders;

• For corporate clients (legal entities).

For US customers, additional accounts are available on the example of savings or retirement. They are distinguished by trading conditions, as well as by the presence of deposit functions, savings system and the like.

To master all the provided trading conditions, you can use the access to a free demo account. Please note that the Asset Management service is available only when registering an account from the USA. Therefore, residents of the CIS, Asia and Europe may experience certain limitations.

You can open a deposit in any currency from the list (18 currencies are available).

The requirements for opening an account with a fx broker are quite serious. Verification is required, which involves sending scanned documents: a passport, bills or other certificate indicating the place of residence, the number of an existing bank account. In addition, information is requested about your employer, since the company must establish data regarding the origin of the money used in the account replenishment. On average, the moderation of the data takes about 1 hour. Scanned copies are sent via e-mail or fax (practically not used today).

The broker’s website has detailed registration instructions. But new users note that this procedure is complicated and takes a long time (in comparison with other American brokers).

Deposit and withdrawal methods

The biggest problem for potential customers of the company is the inability to replenish the account through a bank card for non-US customers. For them, only the direct method of transferring money from a bank account to the company’s account is available. Electronic wallets are not accepted.

For residents of the United States of America, the conditions are simplified. There you can use bank cards of VISA and Master Card systems for making payments. The withdrawal fee is charged only in cases where the number of withdrawals exceeds 1 time per calendar month. One withdrawal per month is free. For each subsequent will have to pay about 8 euros.

Trading Instruments

The company offers one of the widest lists of trading instruments. You can trade:

• CFD (shares of companies, raw materials, precious metals);

• Bonds and indices;

• Currency Pairs;

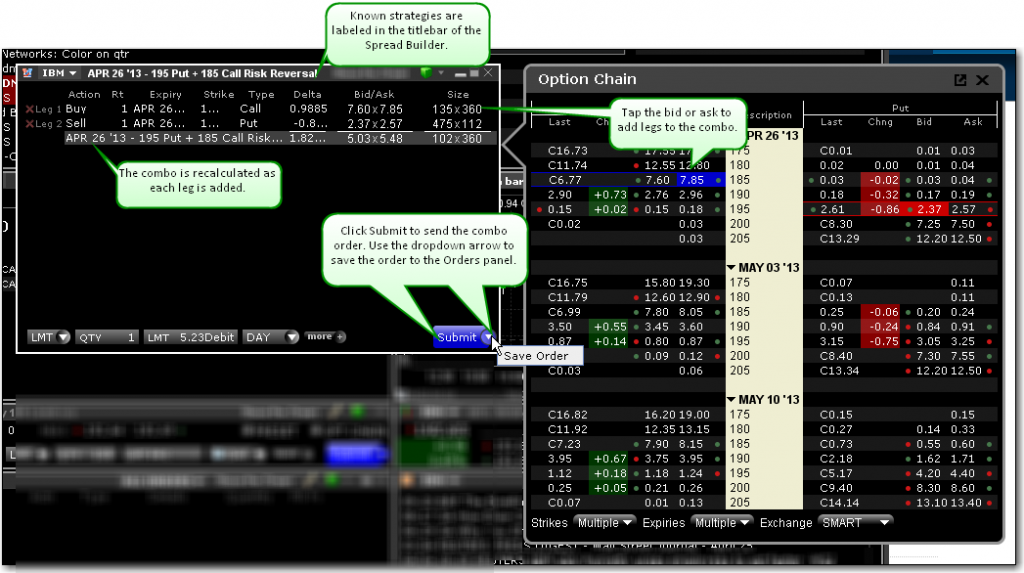

• Options and futures;

• Cryptocurrency;

• ETF assets.

The total number of tools exceeds 150 units.

In total, trading provides access to 74 financial markets. This is the largest figure in the world. For example, in the SAXO Bank the same figure would be 30 with something units.

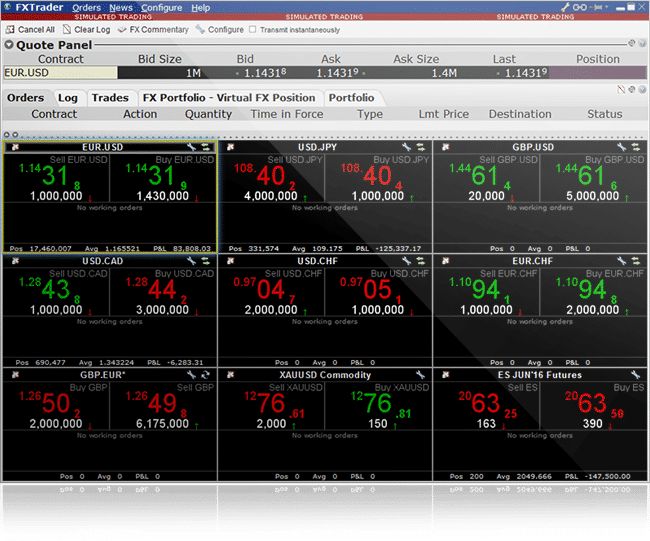

Trading platform

The trading platform of the company is available in the browser. The interface is quite flexible, amenable to numerous settings and optimization. But in terms of information content, it is inferior to the familiar version of Metatrader. Unfortunately, the traditional program MT 4 or MT 5 is not available at this brokerage company.

I’m not sure why but my UserID was locked out for some reason. I tried contacting customer service but they were so unbelievably incompetent. They claimed they were not able to reset the account password because of some type of software error. Not really sure what to do now!

I haven’t had a problem with the platform yet. I’ve tried many in the past and this one seems to be ok. Slippage doesn’t seem to be a big issue either.