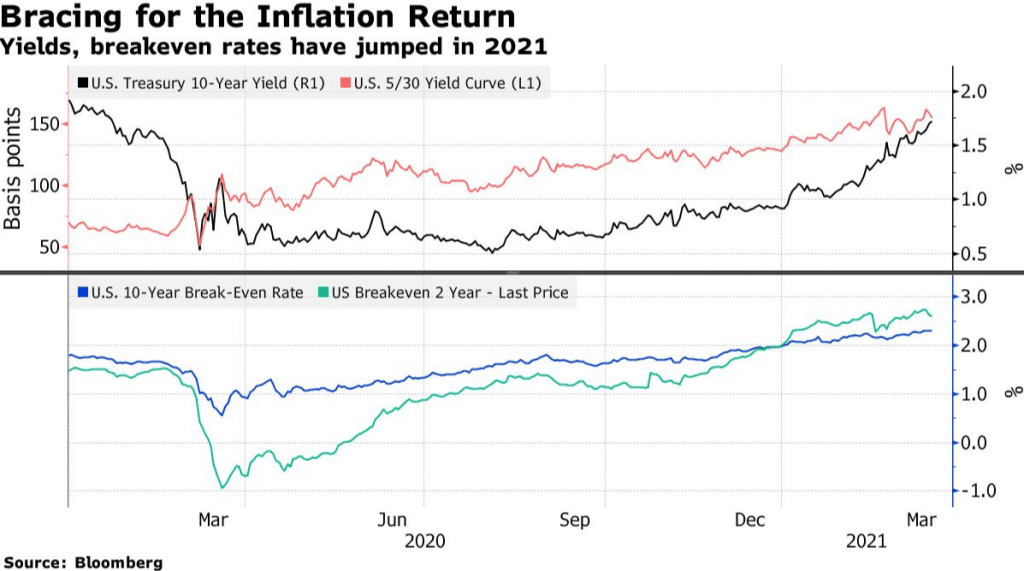

Government and corporate bonds have fallen to their worst start to a year this century. The tumble has been linked to the prospect of resurgent inflation which could eat into fixed-income returns.

- Inflationary pressures have risen with the passage of the $1.9 trillion stimulus package this month even as central banks vowed to keep rates near historic lows.

- The Fed expects a rise in consumer prices this year to be short-lived

- Last week, a market proxy for inflation over the coming decade rose to about 2.3%, the highest since 2013.

- The ICE BofA MOVE index, which uses one-month implied price swings across different bond maturities in the U.S. Treasury market, has averaged the highest this month since April last year.

- Investors are tracking the measures of bond volatility to find when to pile back into their favorite risk bets for the year.

- The rise in borrowing costs is also fueling sell off of notes with corporations globally having sold more than $740 billion so far this year.

Strategists predict large quarter-end rebalancing flows out of equities and into Treasuries, as longer treasuries have lost about 14% this year while notes have shed 3.7% on inflation worry.

Leave a Reply