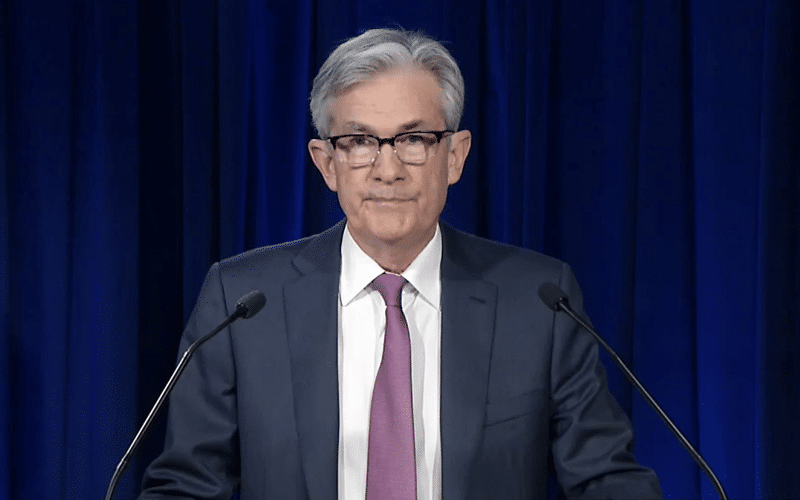

Source: Federal Reserve

Inflation is likely to remain elevated in the short term and hover above the 2% target due to base effects from the impact of the COVID-19 pandemic in 2020, according to Federal Reserve Chair Jerome Powell.

- Inflation has increased notably and will likely remain elevated and exceed 2% in the coming months before moderating.

- The Fed will aim inflation moderately above 2% for some time to ensure that the index average remains on target and long-term expectations stay anchored at 2%.

- Monetary policy will remain appropriate until labor market conditions have hit the maximum employment and inflation at the target range.

- The Fed will also continue boosting its Treasury and agency mortgage-backed securities at the current pace until goals are met.

- Powell believes “there is still a long way to go” in terms of the labor market as openings remain at record-highs.

- Powell said reaching “substantial” further progress is “still a ways off” but will continue to move forward.

Leave a Reply