Source: CNBC

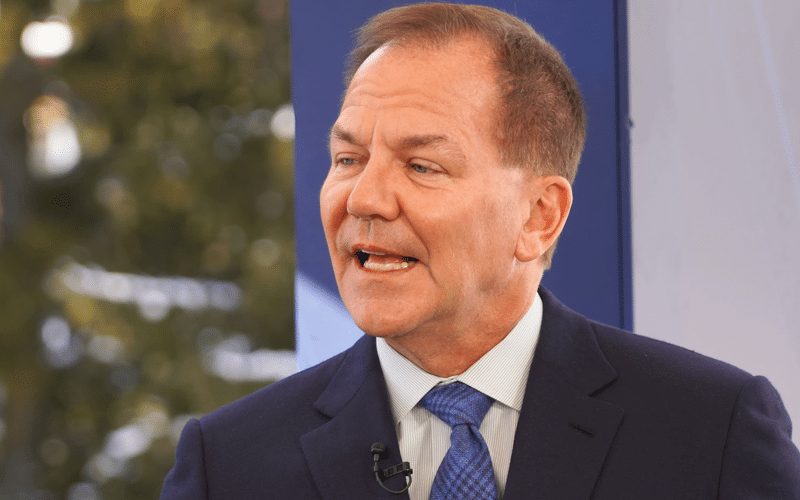

Billionaire hedge fund manager Paul Tudor Jones suggests that inflation is likely to stay, posing a major risk to the U.S. markets and economy. DXY down -0.12, EUR USD up +0.12%

- On CNBC’s “Squawk Box,” Jones stated that the number one issue facing Wall Street investors is inflation, and it is clear that inflation is not transitionary.

- Jones stated that the trillions of dollars in the fiscal and monetary stimulus is propulsion for inflation to remain higher for longer. The Fed had added over $4 trillion to its balance sheet to rescue the economy from the COVID-19 pandemic.

- The experienced trader also stated that price pressures will continue to increase in the coming months. Inflation soared to a fresh 30-year high in September amidst supply chain disruptions.

- The core personal consumption expenditures price index rose 0.3% in August and was 3.6% higher from a year ago.

- The legendary investor did not sound concerned about stocks, signaling that they could be a good bet amid the heightened inflation.

Leave a Reply