Most traders are well-inclined with technical and fundamental analysis as the two strands of speculating in currencies. Yet, an avenue that doesn’t get spoken enough of is sentiment analysis.

Put simply, this analysis provides one with data on how many people are currently long (buying) or short (selling) within a particular market. As expected, this information can be highly beneficial, particularly if you’re interested in long-term trends.

To conduct sentiment analysis requires a sentiment indicator from a particular broker. The options are quite limited in this regard for forex. However, worry not, you don’t need to look too far.

IG’s client sentiment indicator/index is one of the most commonly-utilized tools for sentiment analysis; best of all, it’s free of charge and doesn’t require you to have an account with the broker.

IG is an old player in the derivatives game. The broker was established in 1974 and is now a publicly-traded company on the London Stock Exchange. IG is primarily UK-based, serving around 250 000 traders globally, and claims to be the ‘world’s #1 spread betting and CFD provider.’

This article shall explore how IG’s client sentiment indicator works and, of course, how you can use it for unparalleled trader emotion data in particular forex markets.

What is a sentiment indicator?

So, what exactly is sentiment? This refers to the overall feeling or attitude of traders about a particular market. You can have a bullish, neutral, or bearish sentiment. If you understand this concept, you have valuable insights into how other participants are thinking.

We measure sentiment using positioning data of a group of clients within a particular instrument to observe the percentage of those who are long and short.

Essentially, this is the job of a sentiment indicator. If a majority of traders currently have buy orders, we actually consider this bearish sentiment (and vice versa). This concept sounds counterintuitive, and this is where sentiment analysis gets interesting.

We refer to sentiment as a contrarian indicator because of the prevalent crowd psychology within forex. Most retail traders tend to ‘fade momentum’ or ‘pick tops and bottoms’ by essentially trading in the opposite direction of the predominant trend.

After all, who doesn’t love a bargain? This approach can work in range-bound conditions but is usually a recipe for disaster in trending markets.

Whatever the drivers of the bigger directional move are (whether institutional investors or other factors), evidence continuously suggests that when most retail traders are buying, the trend is likely bearish (and vice versa).

So, using a sentiment indicator is about analyzing momentum dynamics. The beauty of this tool is you can essentially trade against the consensus with real trading data. A later example will demonstrate this phenomenon and how it can provide you with a heads-up of trend continuation.

How does the IG sentiment indicator work?

IG provides sentiment data for 20 markets, all tradeable on their platforms. Below is a list of those instruments:

- AUDJPY

- AUDUSD

- US crude oil

- Germany 30 (DAX)

- EURCHF

- EURGBP

- EURJPY

- EURUSD

- France 40 (CAC40)

- FTSE 100 (UK100)

- GBPJPY

- GBPUSD

- NZDUSD

- USDCAD

- USDCHF

- USDJPY

- S&P 500 (US500)

- Wall Street (US30/DJIA)

- XAUUSD (gold)

- XAUUSD (silver)

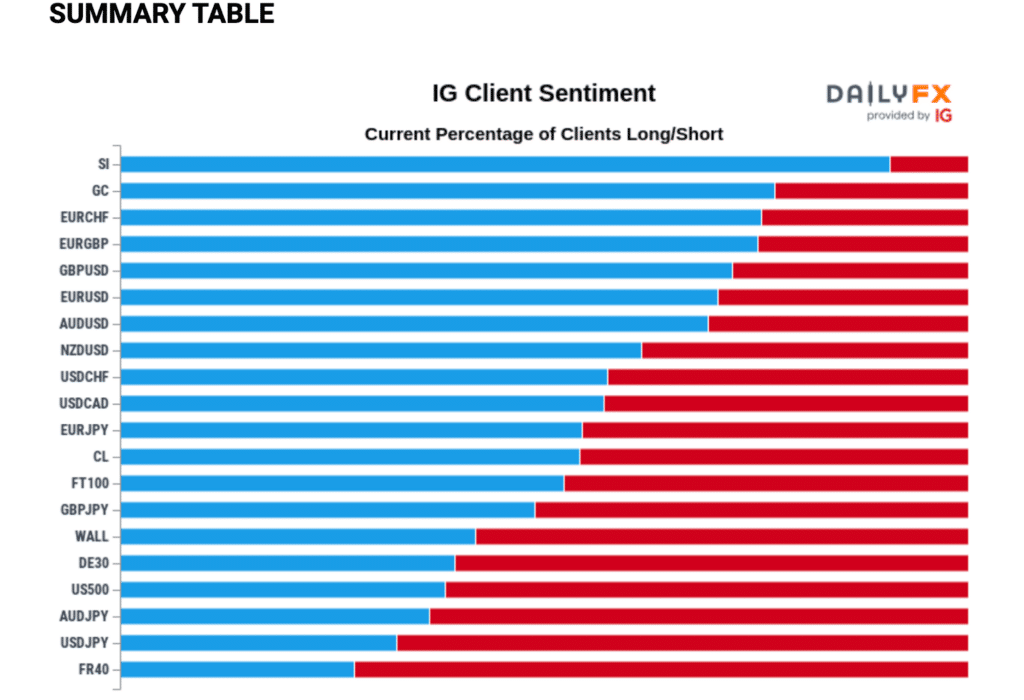

The information is updated once daily. When you search for the IG client sentiment report, you gain a bar graph summary table denoting the number of longs (in blue) and shorts (in red) for each market, as in the image below.

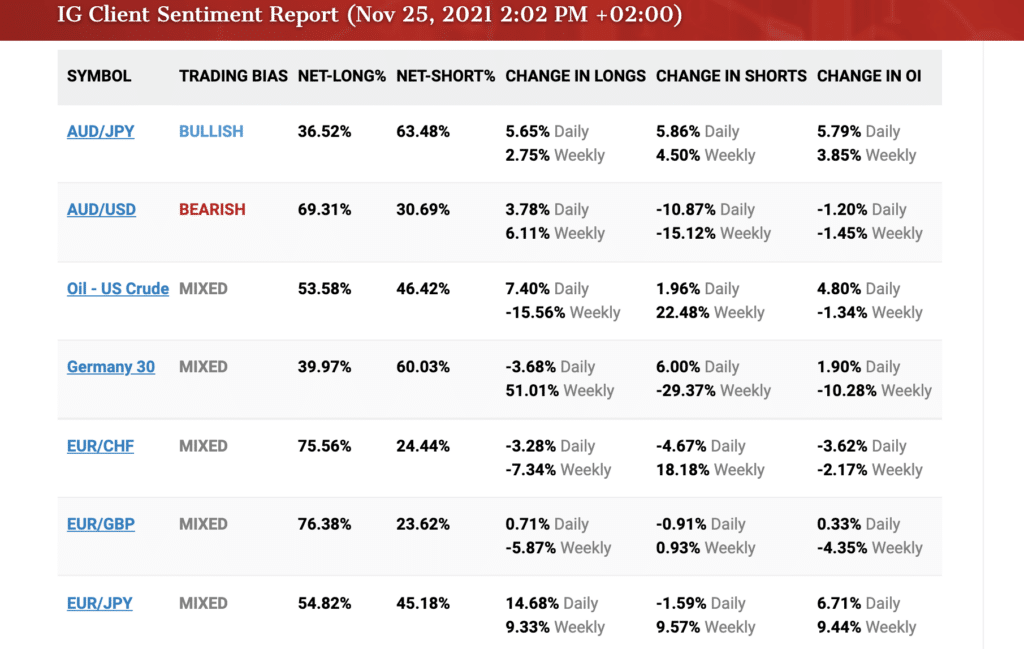

Below this table is a more numerical overview of the percentage of longs/shorts, daily and weekly changes to these figures, and the overall trading bias according to each ticker symbol.

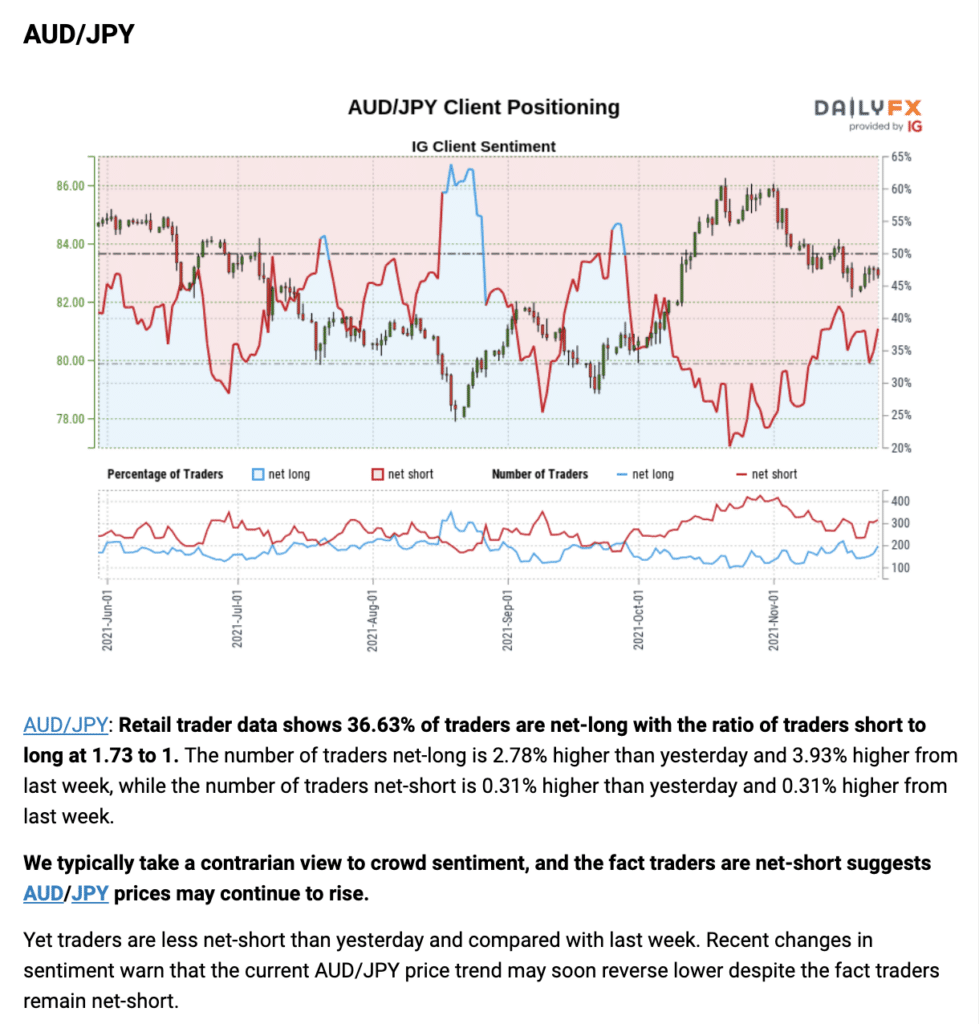

After this section, you see a more detailed write-up for each instrument, as in the example below.

IG offers a summary of the percentages of net-long and net-short, how these have changed over time, along with the bias traders should have, whether bullish, bearish, or mixed.

Fortunately, you don’t need to work this out yourself as IG provides this information, which is useful mainly if the number of net-long and net-short is closer to 50% each or you’re not sure how the recent changes could affect the sentiment.

Implementing the IG sentiment indicator into your trading

This indicator is useful in confirming a trend, the likelihood of its continuation, and potential changes. For instance, when there is a bearish bias, there’s usually an extreme where there are overwhelmingly more net-long than net-short clients.

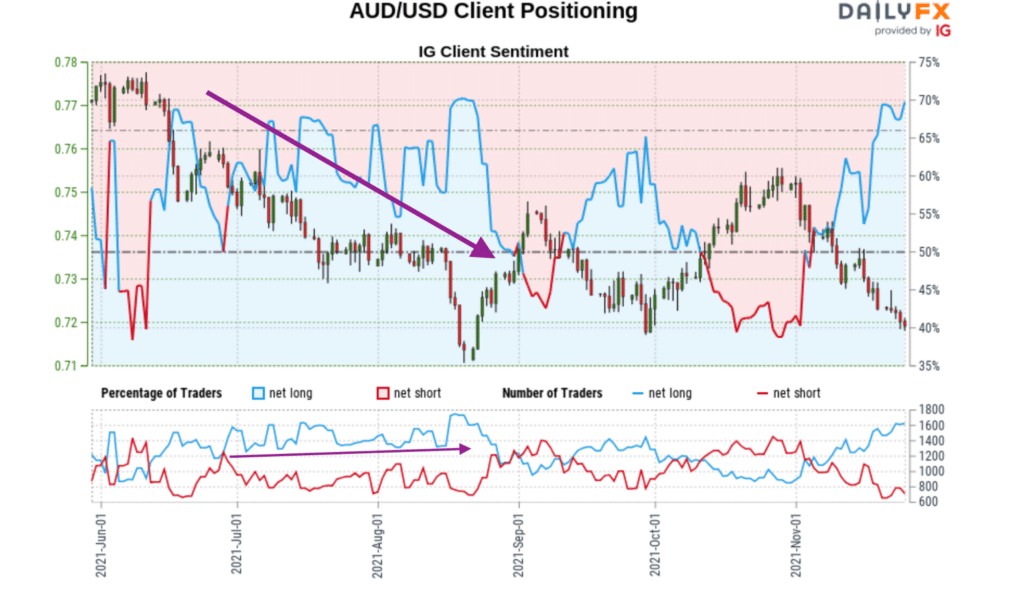

If IG does not report any notable changes to these numbers, it’s safe to assume the trend is bearish, which is the first way to use this indicator. Let’s consider an example with AUDUSD as in the image below.

The two arrows on the image show the correlation between the increase in net-longs and the actual downward price direction on the price chart. If one had sold this pair sometime in July 2021 after learning the bias was bearish, they could have netted several hundred pips.

The second way this indicator is beneficial is by providing traders clues for potential trend reversals. IG also considers the differences between the bulls and bears. So, in the previous example, IG would have informed readers of any notable changes.

So, although the bias may have been bearish at the time, if more net-shorts came into the picture after a day, IG may suggest the bias is now bullish instead.

Final word

One of the criticisms of such indicators is they technically offer a microcosmic view that doesn’t consider the behavior of all forex traders. We should remember the currencies market is decentralized, meaning there is no central order book as in other centralized instruments like futures.

Nonetheless, this indicator is relatively accurate in confirming the long-term trends, making it a precious tool in this regard. Getting the most out of this indicator means observing it daily and appreciating trends develop and change over time rather than instantly.

Of course, this tool is not a leading indicator, meaning you need to adapt to any sudden changes. Ultimately, using this tool as a confirmation layer can provide you with valuable information to enhance your analytical skills.

Leave a Reply