Forex traders and central banks are always watchful of the rate at which prices rise in economies globally. Interest rates are what brings these two groups of people together.

Inflation is a double-edged sword where a little bit of it is significant for economic growth, but too much of it is detrimental to the economy. Central banks base their interest rate decisions on economic data that evaluates inflation, such as PCE and CPI. Forex traders use the interest rate information to perceive currency values.

The interplay between national interest rates and currency values is indirect but not complicated. Exchange rates, which act on currency values, tell in turn on the interest rates. Let us now walk through this relationship.

National Interest Rates: How They Act on Exchange Rates

On Thursday, November 5, 2020, the US Federal Reserve’s Federal Open Market Committee (FOMC) decided to keep national interest rates between zero and 0.25%. The committee highlighted low economic growth levels as the main reason for the decision. November is the seventh straight month that the Fed has kept benchmark rates this low due to its efforts to guide the US out of the pandemic-related recession.

Once every month, FOMC and other open market committees in other countries meet to set short-term borrowing rates for their respective economies. The rates are telling in terms of central banks’ view of the state of the economy and inflation rate expectations. If the officials perceive the economy as stable and inflation as likely to rise, they decide to increase borrowing rates – also called national interest rates. For forex traders, this signifies the possibility of higher currency values in the future.

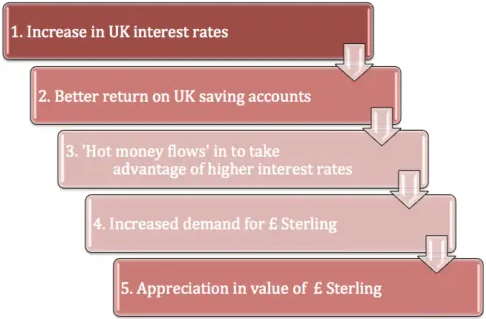

Here is how this relationship unfolds. Consider a situation when the Bank of England has to raise borrowing rates to anchor the desired inflation rate. Higher interest rates increase the real interest rates on UK savings accounts and better returns on investments within the UK.

Foreign investors also rush their funds into the UK economy to exploit higher interest rates. Investors call the movement of funds hot money flows. To invest in the UK, foreign investors would need the Pound Sterling (GBP) and, hence, must exchange their home, or local, currency. Therefore, demand for the GBP increasingly inflates as more hot money cross into the economy.

The exchange rate between two currencies is a factor of supply and demand. Too much supply puts downward pressure, which is bearish in nature, on the exchange rate. Higher demand for the GBP leaves fewer units available to exchange for the inflowing hot money. Currency markets then push up the price of GBP, given the prevailing imbalance. Eventually, the Sterling appreciates against other currencies.

Other Factors Influencing Exchange Rates

Any factor that shifts a currency’s supply/demand influences exchange rates. We have already seen how national interest rates exert their influence on exchange rates. Before evaluating some more factors, let us see how exchange rates behave during changes in currency supply and demand forces.

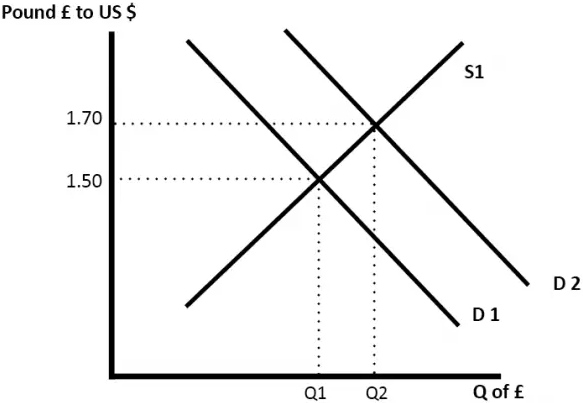

The currency supply and demand diagram below shows the effect of demand shift on the exchange rate of the British Pound (GBP) to US dollar (USD). Initially, the quantity of GBP supplied equals the quantity demanded at the equilibrium price of $1.50.

Increased demand for pounds, perhaps due to an increased hot money inflow, shifts the demand line from D1 to D2. As a result, a new equilibrium level develops and moves the price of one pound to $1.70. In short, an increase in demand for a currency increases the currency’s value.

Inflation and interest rates

Central banks adjust interest rates in response to shits in inflation. Therefore, one can argue that these factors act in conjunction with each other to register their effect. An uptick in inflation often triggers tighter rates (contractionary monetary policy). Higher borrowing rates reduce the money flow volume in the economy. Meanwhile, higher borrowing rates attract foreign money, which ups the demand for domestic currency. The result is a higher domestic currency value.

Speculation

Currency speculators move exchange rates by influencing the demand for given currencies. Let us say a sizable number of speculators are confident that the US dollar will strengthen in the future. They will acquire more greenbacks today, hoping to sell in the future at a profit. The speculators’ actions will create a shortage of USD in the market, and, based on the supply and demand diagram discussed earlier, the USD’s exchange rate will jump to a higher value.

Government debt

Governments often tap into money markets by selling bonds to plug budget deficits. However, unexpected events, such as economic recessions can make governments unable to honor debt obligations. For example, Argentina could not repay sovereign debt in late May 2020 as the effects of the COVID-19 pandemic set in. As a result, the Argentine Peso slid against the USD as investors dumped the country’s bonds. Sometimes, the fear of a government defaulting on the debt alone influences exchange rates because investors often do not want to wait for the actual event.

Currency Valuation: Its Economics and Politics

The exchange rate – also called the price of a currency – rules all the other prices in an economy. Interestingly, government policy is the most potent instrument – even more than open market activities – that controls exchange rates. Therefore, currency policy is the highest priority of any government, primarily when trade relations between an economy and others significantly affects other economic conditions.

In many countries, policymakers in charge of currency policy answer stakeholders, voters, and other constituents directly or indirectly. In open economies, policymakers make many trade-offs, which end up creating winners and losers. Some policymakers may attempt to manipulate currency valuations to avoid the stakeholders’ wrath, especially the voters. As such, the exchange rate policy gives an extraordinary glimpse into the political economy of a nation.

Conclusion

National interest rates play an essential role in a government’s ability to direct its economy in the desired direction. They are a tool for controlling currency values and, by extension, the economy’s growth rate. Unfortunately, the need to appease specific stakeholders, such as voters, pushes policymakers to engage in currency value manipulation activities.

Leave a Reply