IG.com offers several types of assets and a range of efficient, user-friendly trading platforms and direct market access. They provide flexible account types, have convenient options for deposits and withdrawals, and a demo account which beginners can use and test the platform.

Established back in 1974, IG is known as one of the first trading brokerages which today functions as one of the world’s leading online trading and investment provider. With over 195,000 clients around the world, IG offers users access to over 16000 trading instruments across categories such as stocks, forex, indices, commodities and even cryptocurrencies to name a few.

The IG brokerage is usually a trusted option for many brokers worldwide as they are known to offer services which are regulated and authorised across a multitude of jurisdictions stretching across continents. They offer CFD trading with leverage as well.

IG has always carved out a reputation as looking out for its clients’ interests . As part of this commitment, it is also a signatory of the FX Global Code of Conduct which is a common set of directives that aim to establish good practices in the market.

Regulation

IG is the trading name of IG Index ltd (Registered under number 01190902 in England and Wales) and IG Markets Ltd (registered under number 04008957 in England and Wales). Both these entities are regulated and authorised by the Financial Conduct Authority of FCA in the United Kingdom. The FCA is known to have a tight grip on the brokers it regulates. Additionally, IG is a registered IB and RFED with the commodities Futures Trading Commission or CFTC in the United States. It is also a member of the National Futures Association.

Some Key Features of IG

Some key features of this platform that deserve to be highlighted include the following:

Competitive commissions, tight spreads, and fast trade execution speeds

Offers trading in more than 16000 markets including over 80 forex markets.

Plenty of educational and training resources such as seminars that are especially helpful to inexperienced traders new to the world of trading.

Offers a demo account

The support team is responsive and efficient when managing customer queries on a 24/7 basis.

How to open an account at IG

IG offers a multitude of account types, each possessing different features to cater to the needs and wants of the different classes of traders and investors. It should be noted however that not all accounts are available to all countries. Users can also trade through one of their international offices, based on their requirements. IG market also offers Muslim friendly swap-free accounts that fully comply with Sharia law.

Account Types on offer:

- IG Trading Account

- IG Options Trading Account

- IG turbo24 Trading Account

- IG professional account

- Limited Risk Account

- Share Dealing Account

- Swap-Free Account

- Exchange Account (NADEX)

Account Opening

Opening an account with IG is a seamless and fully digital process. The minimum deposit for traders using credit/debit cards or PayPal is $300 and there is no minimum deposit for bank transfers. The full registration process only takes about 5 to 10 minutes. However, the verification of the account could take a while, with some reporting wait times of about 3 working days.

By following some simple steps, users can easily register their account at IG.com.

- Users have to enter their name, e-mail address, country of residence, and then select their preferred account type.

- Users have to provide some personal details such as physical address and date of birth.

- They are then required to provide information about their financial knowledge by filling out a short test.

- Finally, users are required to verify their residency and ID as per KYC rules. A copy of a national ID, drivers license or passport is required to be uploaded in order for verification. For residency verification, they can use utility bills and bank statements.

Base Currencies for Account Opening

IG.com gives users the option of choosing any one of the 6 base currencies. Namely USD, AUD, GBP, EUR, SGD, and HKD. The base currency cannot be selected when a user opens an account. It can only be changed if the user sends an email to their customer service, which seems a bit odd compared to other brokers. However, the fact that they offer multiple base currencies to choose from is helpful for users in avoiding any conversion fee. Users can do this by opening multi-currency bank accounts at a digital bank.

It should be noted that IG.com cannot accept users from countries such as Afghanistan, Belgium, Anjouan, Myanmar, Canada, Nigeria, North Korea, Poland, Yemen, and Zimbabwe to name a few.

Money Management

Since they cater to a wide variety of traders and investors, IG.com offers several convenient methods for users to deposit and withdraw from their accounts as per their preference. This includes debit or credit cards, bank wire as well as online payment systems such as PayPal. However, the availability of all these methods depends greatly on the user’s country of operation.

Users may be charged a fee when they use certain payment methods, which also vary from country to country. Requests for withdrawals are usually processed within the same day or the next. It can also vary depending on the method and payment provider.

It should also be noted that some payment systems might have inherent transaction limits, requirements and restrictions which are generally provided in an unambiguous manner on their respective websites. Some methods in some countries require the user to verify their account first before removing certain limits. IG.com does not accept any third party payments.

IG accepts all major prepaid cards, Visa and MasterCard credit cards, as well as Maestro, Electron, Visa and MasterCard Debit cards.

Fee for Deposits and Withdrawals

| Country name | Minimum Deposit | Deposit/ Withdra-wal fee |

| UK | €250 | Debit Card/Credit Card/PayPal fees: Free |

| Europe (Excluding UK and Switzerland) | €300 | Debit Card/Credit Card/PayPal fees: Free |

| Switzerland | CHF 2500 | Debit Card/Credit Card fees: Free |

| Singapore | $450 | Debit Card/Credit Card fees: 2.3% |

| Australia | $450 | Fees Vary |

| New Zealand | $450 | Debit Card fee: free Visa Credit Card Fee: 1% MasterCard Credit Card fee” 0.5% |

| Japan | ¥35,000 | Fees Vary |

| Dubai | $300 | Debit Card/Credit Card fees: Free |

| USA(IG) | $250 | Free Except for withdrawal by wire |

| USA(Nadex) | $250 | Fees vary |

| South Africa | R4000 | Debit Card/Credit Card fees: Free |

The fee for deposits and withdrawals tends to vary from country to country. To better understand this, we have presented this information in the following table.

When it comes to withdrawals, IG.com does not charge any fees. A normal debit card withdrawal usually takes about two business days to complete.

How to Withdraw money from IG.com?

A user can withdraw money from IG.com by following the steps given below.

- A user has to first login to their “My IG” Account.

- They have to then select the account from which they wish to withdraw.

- A user then has to click on the three dots menu, available on the right side and go to “withdraw funds”.

- He/ she then has to specify the preferred withdrawal method.

- Finally, after entering the withdrawal amount, the user can initiate the entire withdrawal process.

Commissions, fees, and charges

IG.com charges different fees for stock index CFDs, forex, and other instruments. They also charge an inactivity fee which is only applicable after 2 years of inactivity. The fees for S&P 500 CFD, Europe 50 CFD and for EUR/USD are built into the spread.

The average spread cost for the above instruments are as follows:

- EUR/USD: 0.7 pips

- Europe 50 CFD: 1.5

- S&P 500 CFD: 0.6

The Inactivity fee is $12 per month after 2 years of inactivity.

Asset-wise Trading Fees

IG.com provides a very transparent fee structure where users will easily find everything they need to know on the website. Depending on the asset class, they provide different fee structures. For instance, IG.com charges a trading commission for real shares, options and Share CFDs. As mentioned before, they have all-inclusive spreads for stock index CFDs, forex, commodity CFDs, bond CFDS and cryptocurrency CFDs. Smart Portfolios have separate administrative fee and spreads.

To better understand the fees associated with each class of instruments, we shall take a look at them one by one. In the following examples, the leverage used were as follows,

- 30:1 for Forex

- 5:1 for stock CFDs

- 20:1 for stock index CFDs

Fees for CFDs

When it comes to index CFD trading, IG.com offers some of the lowest fees compared to other platforms. However, the fees for stock CFD is quite high. The fees for the following CFDs are as follows. All of them are for a $2000 long position which is held for a week.

- S&P 500 Index CFD fee: $2.1

- Apple CFD fee: $1.6

- Europe 50 index CFD fee: $1.6

- Vodafone CFD fee: $25.7

Fees for Forex

The fees for the EUR/USD, GBP/USD, AUD/USD, EUR/CHF and EUR/GBP are provided below. The benchmark fees are for a $20000 long position with 30:1 leverage, held for a week.

- Benchmark fee for AUD/USD: $14.1

- Benchmark fee for EUR/USD: $16.9

- Benchmark fees for GBP/USD: $15.1

- Benchmark fees for EUR/CHF: $6.9

- Benchmark fees for EUR/GBP: $11.1

Fees for trading with real stocks

IG.com provides trading with real stocks to users who are residents of Australia or the United Kingdom. The Stock and ETF commission for some of the stocks are given below. Each of them are calculated for a $2000 trade.

- UK Stock: $9.6

- US Stock: $15.0

- German Stock: $11.0

In case of real stocks however, IG.com charges a commission per trade which can vary between £8 and $0.02 per share and is also free in some cases.

Fees for Smart Portfolios

IG.com offers Smart portfolios to UK residents only. For users investing in Smart Portfolios, they are required to pay a “total cost of ownership” fee. This is calculated based on several components such as the management fee, spread costs, and the cost of underlying ETFs. This is explained in the following table.

| Total Value of Smart Portfolio | £0- £50,000 | £50,000 – £250,000 | Above £250,000 |

| Total Cost of Ownership | 0.86% | 0.56% | 0.31% |

| Average ETF costs | Average 0.14% | Average 0.14% | Average 0.14% |

| Estimated costs of spreads | 0.07% | 0.07% | 0.07% |

| Management fees | 0.65% | 0.35% | 0.10% |

Fees for Options Trading

IG.com provides options trading in Austria, France, Denmark, Germany, Italy, Ireland Norway, Netherlands, Portugal, Romania and Sweden. It is €0.1 per contract for the GBP, USD and EUR markets.

Available Markets

IG.com is primarily considered a Forex and CFD broker, with only US clients being able to deal with forex products. It also provides stock trading to residents of some countries such as the United Kingdom. It also provides Options trading in select countries.

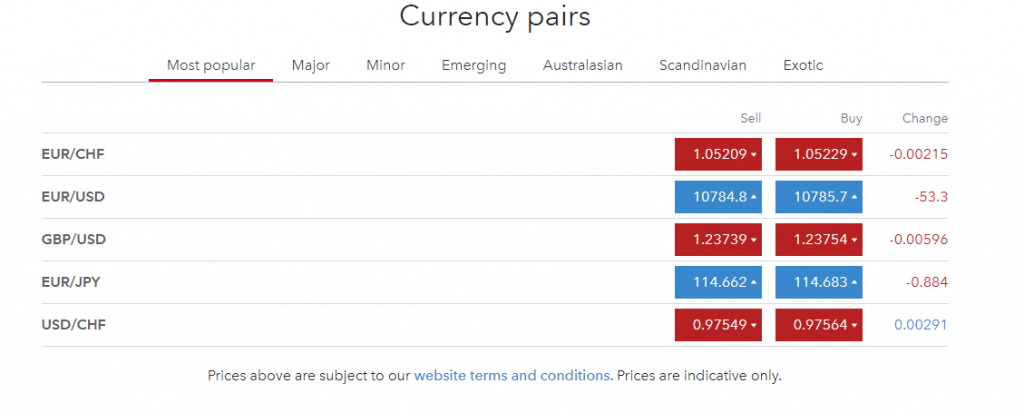

- Forex CFD trading: IG.com provides CFD trading for a total of 95 currency pairs for users to trade with. This includes Major pairs such as AUD/USD, EUR/CHF, EUR/GBP, EUR/JPY, EUR/USD and GBP/EUR as well as other minor, emerging and exotic currency pairs.

- CFD Trading (others): When it comes to CFD trading, IG markets offer an impressive mix of CFDS on currency pairs, stock indices, stocks, commodities, bonds, ETFs, futures, and cryptocurrencies. Apart from Forex CFDS as stated above, IG.com offers 10500 stock CFDs, 1900 ETF CFDs, 13 Bond CFDs, 47 Commodity CFDs, 8 cryptocurrency CFDs and 68 stock Index CFDs to choose from.

The default leverage level of the different products cannot be changed by the user, which is considered as a noticeable drawback in CFD trading.

- Real Stock and ETFs: IG.com offers stock trading to users from United Kingdome, Ireland, Malta, Cyprus, Australia, and some smaller nations such as the British Virgin Islands and Gibraltar. There are a total of 8 stocks and 2000 ETFs to choose from.

- Indices trading: IG offers over 80 indices markets including popular indices such as Wall Street, US 500, US Tech 100 and FTSE 100 to name a few.

- Options trading: IG.com offers options trading to clients of Australia, France, Denmark, Germany, Ireland, Italy, Norway, Netherlands, Portugal, Romania and Sweden. Options are available for commodities, forex and equity index. Users have the option of choosing between two option types, namely, Vanilla options and Barrier Options.

- IG Smart Portfolio: IG.com offers a product called IG Smart Portfolio which is only available in the UK. They are actually IShares ETF portfolios which are a robo-advisory service managed by Black Rock.

- Turbo 24: Turbo24 is an innovative product offered by IG.com. However, it is only available for users in Spain, Germany, France, Netherlands, Italy, Sweden and Norway. They are exchange traded products, tradable on a 24/5 basis.

Trading Platform and Features

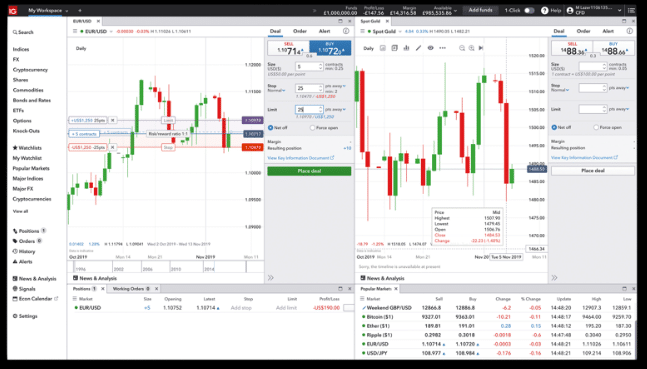

IG.com provides a healthy mix of trading platforms which cater to the individual needs of different types of users. This includes ProRealTime(PRT), L2 Dealer and MetaTrader 4. For professional traders, they provide direct access markets or DMA.

1. The IG Web Trading Platform:

Available for all users, the IG web trading platform is provided by ig.com for users interested in CFD trading and spread betting (UK). From this web app, users can manage their accounts, make payments, register cards, withdraw funds and a lot of other functions. It also comes with browser-based research tools like signals, economic calendar, and signals. It is compatible with almost all modern browsers across operating systems.

2. ProRealTime (PRT):

ProRealTime (PRT) is regarded as one of the leading, most advanced charting packages available on the web. It is packed with several monitoring tools, resources for advanced analysis and flexible access. It is thus ideal for users who have proficiency with using technical charts. Users get PRT for free if they trade spread bets in the UK, or CFDs in general, at least for four times a month. Trading can also be conducted using API through the PRT.

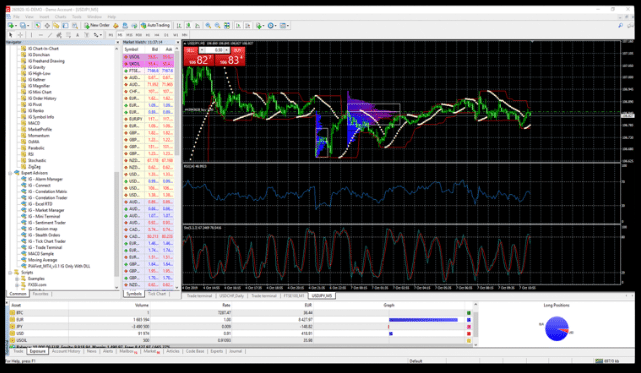

3. MetaTrader 4:

Arguably one of the most popular third party- platforms for CFD trading and spread betting in the UK, Meta Trader 4 is a popular trading platform which offers automated trading tools and advanced analysis. Users have an option to choose between 18 bespoke app add-ons. It is available for free, and supports trading forex, commodities, metals, energies, indices etc.

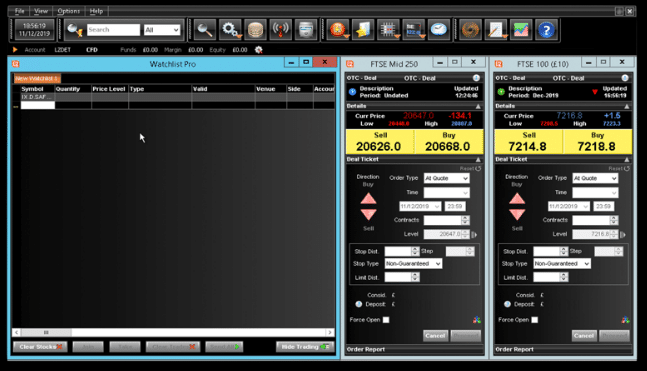

4. L2 Dealer:

L2 Dealer is a downloadable share trading platform, available for free. It offers direct market access(DMA) to users, with the ability to trade CFDS. It can also be used as a share dealing service, which is supported by helpful monitoring tools such as orders, price alerts and watch lists.

5. IG FIX API:

The term API stands for application programming interface, which connects two applications. In this case it connects a user’s IG trading account with his/her custom-built platform. Trading with an API offers an easy way to access live market data and historical prices, allowing users to execute trades directly from any of their own IG trading accounts.

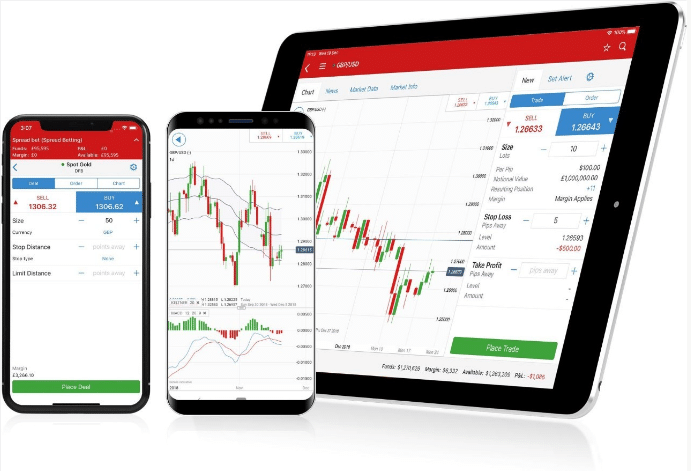

Mobile Trading

For trading through mobile devices, IG.com offers several options. First and foremost, it offers the IG Mobile Trading platform. It is optimised for both iPhone and Android devices. It is ideal for users who are interested in spread betting in the UK, stock/shares and CFDs.

Apart from the above, IG.com also offers a progressive web app, that can work on any type of device across operating systems, including both iOS and Android devices.

Research

Alerts and Notification

IG.com offers alerts and notifications which can be set from the settings sections under “communication preferences”. Multiple alerts and deal notifications are available including economic alerts, automated or manual deal opening/closing, automated or manual position editing, indicator alerts and price alerts.

Education

- Education Section: The IG Academy offers a lot of educational resources for users to develop trading skills, knowledge, and experience, through a wide range of courses and webinars. There is a section for interactive education, which grapples the essentials of trading through infographics, videos and end of-course quizzes. IG also regularly hosts both seminars and webinars, covering a wide range of topics involving spotting trading opportunities and using different trading platforms.

- Demo Account: IG.com provides Demo trading accounts for users who want to try IG’s award-winning platform for free. They provide $20000 virtual funds and also allows access to exclusive educational content from the IG Academy. Apart from being a helpful tool for beginners, experienced traders can also use demo accounts for testing out new strategies on the platform.

To open a demo account, users can click on the “open demo account” option which will redirect them to the registration page. They must enter their name, a desired username, their country of residence, main contact number, and email address. After entering all the required information, they can instantly use the demo account and access almost all the features.

Support Service

IG.com offers a high standard of customer support. Users can contact their support team via telephone, Twitter, and online chat. They have a 24/7 knowledgeable and responsive support team that can answer any technical queries that a customer may have. IG.com also provides a separate help and support site, where users can search answers covering a range of topics. The customer support team operates from Saturday 8 am to Friday 10 pm.

Safety and Security

In addition to being regulated by both the NFA and the FCA, IG is also regulated by many other international regulators as it operates across multiple jurisdictions. These include countries like New Zealand (regulated by FMA), Japan (regulated by JFSA) and South Africa (FSCA), just to name a few.

Leave a Reply