Huckster is an Expert Advisor that has a high risk-to-reward ratio, downloadable from the MQL5 site. It is fully automated, can trade in many currencies, and operate over multiple timeframes. When it comes to market analysis and trade execution, Huckster relies on artificial intelligence (AI). It will do an in-depth market analysis before initiating any trades. Is it really as good as the devs promise?

Detailed Forex Robot review

Huckster is an Expert Advisor (EA) that has been optimized for trading on the EURUSD as well as all of the EUR minor pairs. The EURGBP, EURAUD, EURJPY, EURCHF, EURNZD, and EURCAD are among the minor currency pairs. This brings the total number of supported assets to 7 different currency pairs. This app was created by the Poland-based developer Jakub Norbert Bogusz who has experience in trading and coding.

Main features

- It runs on Artificial Intelligence (AI).

- It is not broker sensitive in any way, which means that you can use it on any broker.

- It employs custom-made trend and volume indicators.

- Does not employ any risky methods such as Martingale, Grid, and so on.

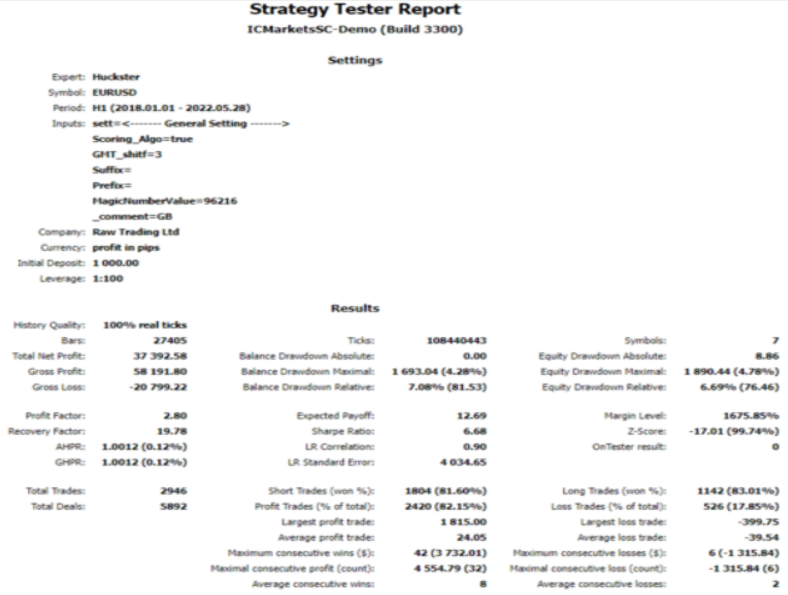

Huckster Strategy Tests

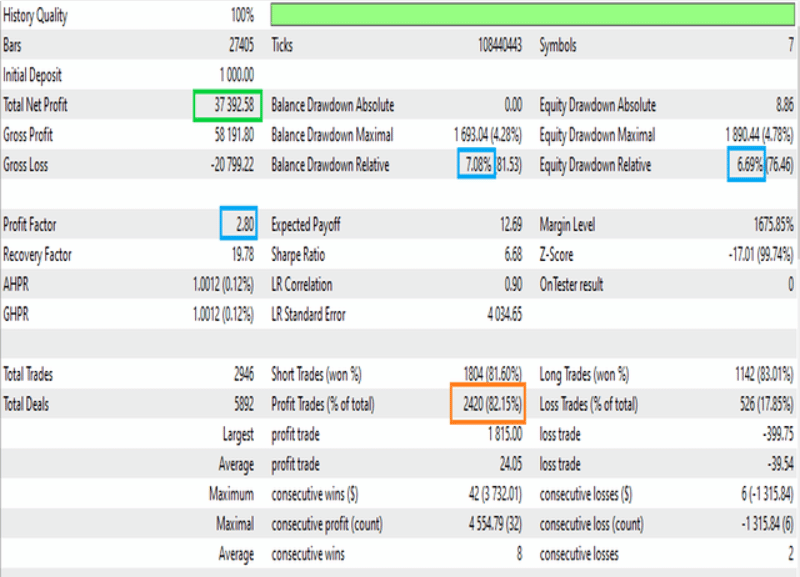

According to its vendor, Huckster can also pass the FTMO test. Also, the developer claims that backtests from 2022 show a drawdown of less than 4% with 1% risk and a profit of over 60% UTD by the end of May. There is no evidence to support these claims on any authoritative third-party websites. As a result, some traders may be put off by the lack of transparency.

The only thing the developer does offer is a test screenshot with an indiscernible report.

There is YouTube instruction on how to run the backtest yourself.

Strategy explanation

Huckster employs three distinct timeframes, which include H1, H4, and daily. Using AI in trading allows for the most accurate representation of human trading activity.

The developer advises users to open an account with a minimal spread (ECN or Raw) and at least 1:100 leverage. On top of that, you must operate Huckster on a hedge account, or it won’t work. Also, the strength of the signal affects both the Take Profit and Stop Loss levels. As a result, TP and SL will rise if the signal is strong enough.

For a fixed lot size, the minimum ideal starting balance is $500 for every 0.01. This is the risk percentage you should aim for if you decide to use the lot sizing method:

- With at least $3,500, you’ll get a risk percentage of 0.5%.

- Minimum of $2,000 is required for a 1% risk percentage.

- 2.5% for a minimum of $750.

- 5% of a minimum of $350.

With a sizing technique based on the balance of equity, Huckster will gradually raise the lot size over time. That sounds too high for the unverified software by an unknown developer.

Verified account results analysis

According to the developer, the EA’s monthly drawdown is often less than 5%. That is so if you choose to use 1% risk every transaction. At the same time, they claim 82.15% of the trades to be profitable.

However, we couldn’t verify these claims because Huckster hasn’t integrated its trading outcomes with credible verification services like Myfxbook and FX Stats.

Pricing

The robot is available at $349 for a limited period, after which the price will rise to $499. For the vast majority of EAs, this number falls within the typical range. However, getting value for money also depends on whether the EA can deliver on its claims. Huckster is sold on the MQL5 website exclusively, and the developer does not provide a refund.

Customer Reviews

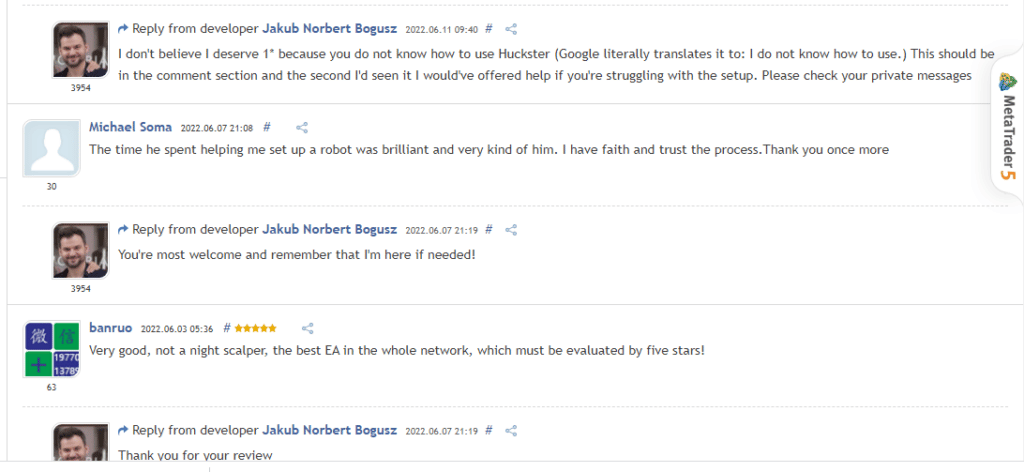

Neither Trustpilot nor Forex Peace Army list Huckster on their review pages. One possible explanation is that it is still in its early stages. However, the fact that the company does not provide details of its address does not help matters. Notwithstanding this, mql5.com, the only website selling Huckster, has reviews that cannot be verified.

Leave a Reply