One of the first rules of trading on the Forex currency market, which is persistently put into the head of the trader, is the mandatory placement of a stop loss order to limit your possible loss if the price goes in the opposite direction to an open transaction. There is no doubt that one of the most important qualities of a trader is the ability to manage his losses – this is the direct purpose of the StopLoss order.

Table of Contents

What is a Stop Loss Order?

Stop Loss is a type of stop order placed by a trader in order to limit possible losses in a situation when the market went against an open transaction. An order is a necessary element of Forex money management rules and allows, in the event of a price reversal against a transaction, closing a losing position with a pre-planned loss, enabling the trader to manage his trading risks.

In today’s turbulent markets, trading without this is simply unthinkable. Trading without stop loss orders is more common among amateurs. For trade professionals, the main priority is to protect trading capital from ruin – everything else (the amount of profit or loss) is already secondary. Stop-loss automatically closes the position at the specified price value. The order is stored on the server of the broker company, so there is no need to keep the terminal turned on for its operation.

A StopLoss order can close a deal either for the entire volume at once, or for 1 contract (lot). The opposite application, the main purpose of which is profit taking from the transaction, is Take Profit. Stop-loss can be set for any types of orders, including pending ones.

Stop loss types & strategies

The main problem of stop loss on Forex is the standard rules for their installation. For example, you set values above or below local extremes, support or resistance levels, and so on. Most unprofessional traders place their stop loss according to these standard rules. In turn, market makers often use this for their own benefit.

Often in the market one can observe such a picture – before starting the main movement, the price makes a sharp jump in the opposite direction, “knocking out” standard stop-losses, and only after that it moves in the right direction. This phenomenon among forex traders is called stop hunting. As a result, the majority of traders who correctly calculated the situation on the market and opened a position in accordance with the classical rules of technical analysis, receive a loss instead of profit.

Alternative methods for limiting losses mainly involve some “multi-way combinations”, according to which the initial position has a relatively small volume. Then, as the market situation develops, the size of the position increases. As a result, the trader receives a distributed position, consisting of a series of orders with different opening prices, different volumes and, sometimes, different directions. Consider several alternative ways to limit losses in the Forex market.

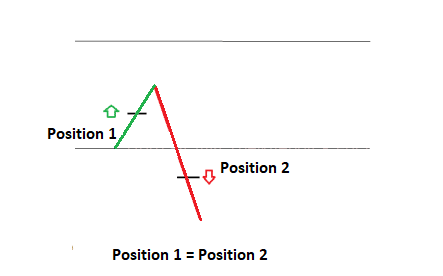

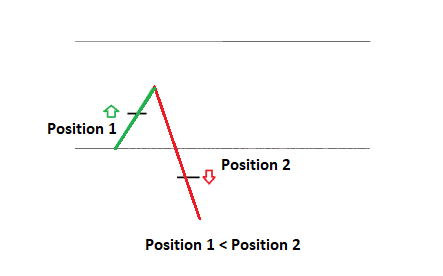

Locking Method

When locking, the trader opens a new position in the opposite direction. It can be manual or automatic. This helps to avoid loss or even get profit. This scenario is permissible if the trader makes a mistake. Locking levels out losses.

Position Reversal

This option allows you to open a reversal position with a large volume. Thus, we focus on the fact that the new position is cut at a loss from the previous one. This format is possible when trading at support and resistance levels.

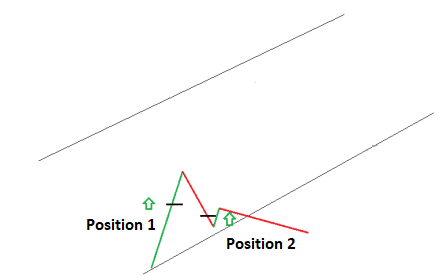

Averaging Method

Consider a situation where the price is moving in the opposite direction from your forecast. You need to open a position in the same direction at the best price. This will allow you to expect to cover losses and possible income.

How to calculate stop loss

In fact, the size of a stop loss is a reflection of the amount that a trader is willing to risk in an open transaction. Entering the market, as traders say, “for the whole patty,” the risk, of course, is 100%. Ideally, the recommended risk level should be 2-5% of the deposit for each transaction.

For example, a trader’s deposit is $ 5,000. The trader has set for himself a maximum risk of 5%. Accordingly, the loss on the transaction should not exceed 5000 x 0.05 = 250 dollars.

Next, you should evaluate the relationship between the size of stop loss, the price of one point and the volume of the position. The trader calculated that when opening a position at a given point, the stop loss will be located at 50 points from the entry point. The cost of one point will be 250: 50 = 5 dollars. Given that with a position size of 1 standard lot, the price of 1 point is $ 10, we get the recommended position volume of 0.5 lots.

The above example is optimal and does not take into account such a psychological factor as greed. Unfortunately, many traders, in the pursuit of profit, trade in a whole lot with a deposit of $ 1,000. Accordingly, we are no longer talking about any risk management and any calculations. When placing stop-loss and take-profit orders, one more very important detail to remember is the spread.

For example, a long position is opened in the EUR / USD pair with a stop loss of 1.1150 and a take profit of 1.1230. The spread is 2 points. Accordingly, take profit will work when the price reaches the level of 1.1232, and stop loss when the price reaches the level of 1.1152.

An example is given for a fixed spread. For accounts with a floating spread, everything is a little more complicated, since during the release of the most important economic data or fundamental events, the size of the floating spread can increase significantly.

How to set & where to place a stop loss order

To place a stop loss order in the MetaTrader 4 terminal when opening a position, you need to enter the necessary price value for the order to be triggered in the Order Panel. For an open transaction, the value of the StopLoss order can be changed using the “Change / Delete Order” tab.

Stop loss for a buy transaction is set below the position, for sale – above the position.

Conclusion

Of course, a separate article is needed to describe each Forex stop loss control technique. However, no descriptions and recommendations can replace the personal experience that can be gained only during practical trading in the foreign exchange market. And in order for the price of the experience gained not to be too high, you can use a demo account. Stick to your chosen strategy and focus on the current market situation. Proper installation will reduce your risks to a minimum.

Leave a Reply