The oil trading market is one of the most liquid and volatile in the global financial markets as the commodity accounts for more than 30% of the world’s energy usage. Strong demand for the commodity to power various operations often triggers wild swings that traders look to profit from. Therefore, oil is one of the most traded items, given the opportunities to profit that always crop.

Oil trading is simply the act of buying and selling the various types of oil instruments to squeeze profits as prices oscillate. The finite nature of ‘black gold’ explains the wild fluctuations that come into play daily, attributed to changes in supply and demand forces. Heightened volatility and liquidity also make it a preferred commodity of trade for most traders.

How is oil traded?

Oil in the global financial markets is traded through various financial instruments offered by brokers. The instruments include:

- Oil companies shares

- Contracts for Difference

- Exchange-Traded Funds

- Futures

- Options

Oil companies shares

In the oil markets, traders can buy shares of oil companies that they feel have solid fundamentals and are well-positioned to appreciate. By purchasing the shares, traders essentially bet that prices will increase. Brokers offer shares of various companies, and some engaged in the exploration process while others in the mining and distribution business.

In this case, traders must open an account with a broker; deposit some money to buy shares of oil companies.

Contract for difference

The contract for difference allows oil traders to enter contracts with brokers in a bid to exchange the difference in price from when one enters a trade to when they exit. With CFDs, leverage is usually given, allowing traders to enter long and short positions conversely betting on whether oil prices will increase or decrease.

Oil ETFs

On the other hand, exchange-traded funds are financial instruments that allow oil traders to gain exposure to a broader oil company pool. Instead of investing in a single company’s shares, an oil ETF consists of a collection of oil companies that track an underlying index.

Oil futures

On the other hand, Oil Futures allow oil traders to exchange an agreed amount of oil at a set price in the future. Such oil securities are traded in exchanges and designed to reflect the demand for various oil products. With futures, oil traders get to bet on oil prices rising or falling.

Oil options

Oil options are similar to oil futures. However, with oil futures, there is no obligation to buying or selling as initially agreed. The oil instruments offer traders a right to buy or sell an amount of oil upon the contract’s expiry.

The type of oil instrument that traders chose depends on several things, key among them being:

- Margin requirements

- Leverage

- Contract expiry dates

- Management costs

- Security costs

- Physical delivery of assets

Trading the oil markets for a profit

Oil is no different from other securities traded in the global financial market. Forces of supply and demand influence trader’s sentiments, conversely influencing the various oil instruments’ prices. Likewise, would-be traders should be ready to carry in-depth analysis to profit from trading the various oil instruments.

The two types of analysis carried out are:

- Technical analysis

- Fundamental analysis

Technical analysis

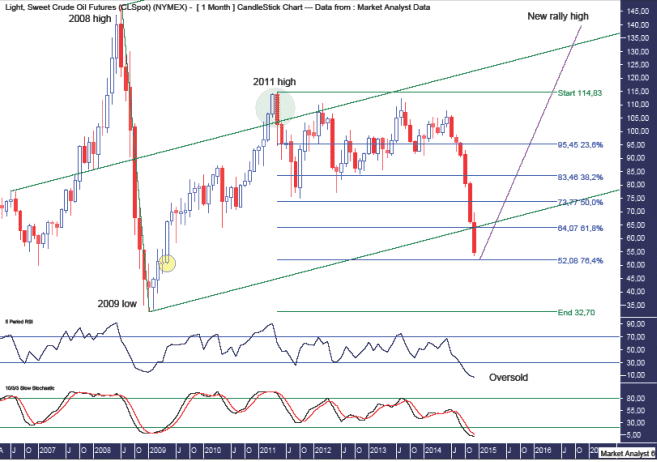

Technical analysis entails leveraging various analysis tools to understand price charts and analyze historical price patterns. In this case, traders analyze past price action activity to predict how prices are likely to move in the future.

Some of the analysis tools used include moving averages, relative strength index, and Fibonacci expansion. Knowledge of various price patterns is also crucial as it provides insights into how the price is likely to behave going forward.

Fundamental analysis

To profit in the oil markets, one must analyze various developments and their potential impact on trader’s sentiments and oil prices in the process. In this case, a study of factors that influence supply, such as production and political stability in oil-producing countries, is necessary. Besides, one must have a firm grasp of prevailing demand levels as many times influence oil prices.

Fundamental analysis is all about analyzing oil news concerning production and consumption.

Making a profit in oil trading

While oil trading offers excellent trading opportunities given the elevated liquidity and volatility, traders must grasp some basic requirements to profit from the business.

Understand What Moves Oil Prices

Many factors influence oil prices by influencing the forces of supply and demand. As an oil trader, it is important to understand these factors and their potential impact clearly. For instance, over-production amid declining demand often results in a decline in prices. Likewise, whenever there is under production amid increasing demand, prices tend to edge higher.

Political instability in some of the major oil-producing countries triggers an increase in prices due to its negative impact on production.

Similarly, a convergence of positive elements many at times increases in oil price while a convergence of negative elements triggers downtrends in the oil markets.

Market psychology

Trading psychology is also vital for trading the oil markets. The fact that oil trading pools millions of traders worldwide, traders should be able to study crowd psychology to understand how they are likely to trade.

Understanding how oil traders would react to various developments in the oil markets and price actions makes it easy to understand how the price is likely to trend.

Focus on the long term trend

Like any other security in the financial market, oil prices fluctuate while moving in a given direction. In this case, traders should focus on the long-term trend to take advantage of the trading opportunities that come into play.

By focusing on the long-term trend, a trader can avoid the impact of short-term swings. Investing for the long haul is a sure way of generating profits in the oil markets.

Leave a Reply