When they begin trading crypto, most people aim to buy low and sell high. Whilst there is nothing fundamentally wrong with this strategy, it tends to leave money on the table when the market is bearish. Though risky, shorting can present investors with unique profit opportunities or can even be used as a hedge against their long positions. Thanks to their high liquidity, large-cap cryptocurrencies can be perfect candidates for this trading style.

How shorting works

We have established that shorting aims to take advantage of falling crypto prices. To achieve this, investors borrow some crypto from their broker whenever they anticipate their prices will fall. After the downtrend plays out, they buy back the coins at the lower market price and pay back the broker. This way, they will have made a profit equivalent to the difference in price from when they borrowed the assets to when they paid back their broker. With modern platforms, the good news is that this process can be carried out at the touch of a button.

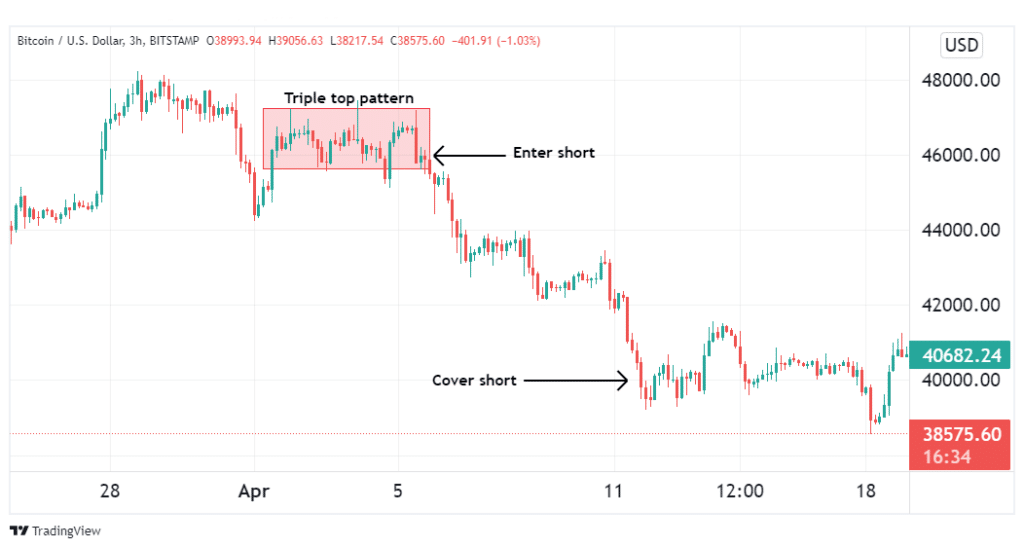

As an example, consider the below scenario. A triple top pattern manifested on a BTC price chart that was bullish in prior moments. This signaled a reversal in trend direction, prompting a short trade. Let’s assume we went short when the price of BTC was $46,000, and we closed our position when the price hit $40,000. If our position size was 2 BTC, then this trade would have yielded a profit of ($46,000 – 40,000) * 2 = $12,000.

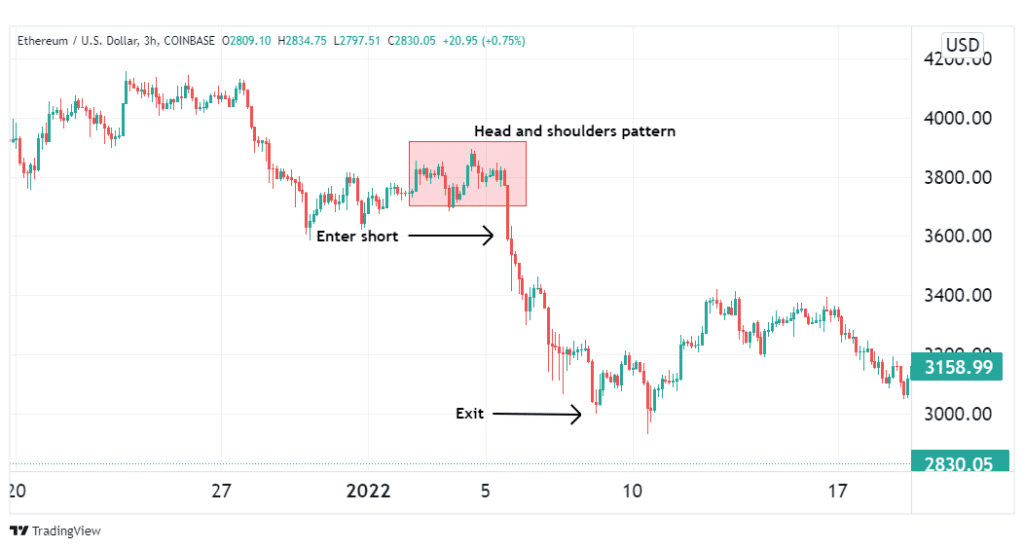

Similarly, the image below shows a bearish setup for Ethereum. This time, the signal was provided by a head and shoulders pattern, which prompted a short trade.

Assuming the same position size of 2 ETH, this trade would have yielded a profit of $(3,600 – 3,000) * 2 = $1,200.

Drawbacks of shorting

Whether you are shorting BTC, ETH, or any other altcoin, there will always be risks associated with your trade. Some common ones are listed below.

Losses could exceed your initial deposit

Usually, shorting involves the use of leverage. This means that you only need to put up a fraction of the capital you need to open a large position, and your broker lends you the rest. If you use too much leverage, then even a slight retracement to the upside could place you hundreds, if not thousands of dollars in loss. Even for these large-cap cryptos, it is not uncommon for them to quickly spike hundreds or thousands of dollars in price in moments of high volatility.

There is no limit to the losses you can incur

When shorting, the best-case scenario would be dropping to $0, which is as far as they can possibly go. This means that your profit, even in an ideal world, is finite. On the flip side, prices could rise practically to infinity, meaning there is no cap on the losses you can make.

Crypto markets are highly volatile

Every trader worth their salt knows that crypto prices will at times fluctuate violently. When the volatility is high, any significant spikes could place you in large, irrecoverable losses.

Shorting necessitates active trade management

Due to the characteristic volatility of crypto markets, short positions will often require you to actively manage your trade. You would need to look out for valid support levels, other technical indicators, and the coin’s fundamentals.

Popular shorting techniques

Shorting on an exchange

This is the most commonly used method. It entails using the margin offered on the exchange platform. This makes for a seamless transaction, whereby you don’t need to know who you’re borrowing from. You only need to press sell when you intend to short and the close button when you need to exit your position.

Longing inversely correlated markets

Instead of shorting BTC or ETH, you could opt to buy an altcoin with an inverse correlation to your preferred coin. This means that the altcoin in question tends to rise in price whenever BTC or ETH is in a downtrend, and vice versa. For instance, Repocoin (REPO), Qubitica (QBIT), Digitex Futures (DGTX), and Bitcoin Gold (BTC) are altcoins that have historically been negatively correlated with both BTC and ETH. Buying any of these altcoins when the top cryptos are dwindling in value could present unique opportunities for profit.

When to short BTC and ETH

If you’re a technical trader, there are several patterns you can look out for that can inform you when to place a short trade. Such reversal patterns include bearish wedges, triangles, pennants, double or triple tops, and head and shoulders patterns, just to mention a few. Alternatively, you could look at the fundamental factors, such as major regulatory changes, events causing uncertainty and fear in the crypto market, deteriorating risk sentiment, and the likes.

For best results, it always pays off to look at the long-term outlook of the coin you intend to short. Depending on your trading style, this may represent different time periods. For instance, if you’re a scalper, you could look at the 4-hour or 3-hour chart to determine the day’s prevalent trend, while positional traders would need to study several years of price charts. Preferably, enter short trades when the prevalent long-term trend is bearish.

Conclusion

Shorting is a trading style that aims to take advantage of falling crypto prices. Traders borrow the digital assets from their broker at the current market price, then pay them back later after their price falls. However, cryptocurrencies are marked by high volatility, which makes shorting a risky endeavor. For that reason, always perform your due diligence before shorting. Additionally, avoid overleveraging your trades as this could lead to large losses. As always, risk management is of paramount importance when trading.

Leave a Reply