If you wish to be successful in the volatile world of business, you need to think of the future. Any seasoned investor or trader will tell you that anticipating the market is crucial in this regard. In this article, we shall discuss how you can best apply your understanding of the Forex market by anticipating changes.

Economic growth

In this method, we consider the various degrees of increase in economic services and products for different countries. When the country’s economic situation is stable and the rate of growth is quite high, more and more investors are attracted to it. And, when an investor invests in the economy of such a country, they buy its currency, which consequentially enhances the requirement, causing its value to go up.

In this method, the comparison of the respective economic growth of different countries is not enough. Here, the approach is more widespread and considers all kinds of capital flows. For instance, the interest rate is another factor that investors often consider while investing in the market of a certain country.

Unlike Purchasing Power Parity, the economic growth method doesn’t envision the ideal exchange rate. Using this method, the investor can get a general idea regarding whether the value of a currency is going to rise or fall. When combined with other methods, it generates a comprehensive result.

Purchasing Power Parity

This concept compares the price of goods in several countries. But, this can’t be done by considering the price of only a single product group. In order to paint a clearer picture, a large variety of goods should be compared.

Calculating PPP requires you to find out the expense of a specific item in different countries. In this regard, you will need to be aware of the exchange rates for every currency you’re taking into account. After finding out the exchange rate, you can calculate the Purchasing Power Parity.

The formula for the same is as given below:

When the two currencies are close to being equal, we can say that they have almost achieved PPP.

Trader sentiment

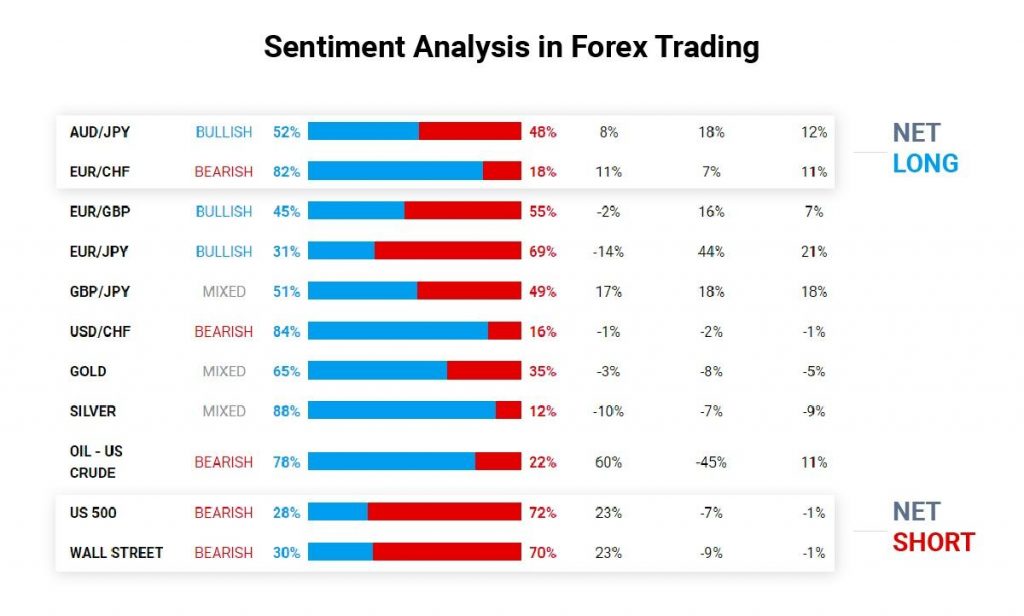

Sentiment analysis involves calculating and signaling the mental state of all individuals engaged in Forex trading. It tries to express a quantity of the uptrending or downtrending nature of the Forex market. After identifying the majority sentiment in the Forex market, merchants will often assume that the crowd is wrong and adjust their position accordingly.

This is a contrarian trading technique that is dependent on the ratios of bulls and bears. In order to understand the Forex market better, traders often compare sentiment analysis with technical analysis. While it can be difficult to utilize different analyzing techniques at the same time, it produces much better results.

Interest Rates

Investors who want more ROI will definitely be attracted to a nation where the prime rates are high. This again enhances the demand for the particular currency, resulting in the currency soaring.

In contrast, when the prime rates for a country are low, investors usually steer clear of it. But, it might also lead to some of them borrowing the currency due to the low-interest rates, which allows them to sponsor other expenditures.

Geo-politics

Due to rising geopolitical tensions, some currencies stand the risk of depreciation as the risks related to trades tend to reverse during these periods. In a key economic region, geo-political tension adversely affects the growth of the economy and, in turn, the demand for different goods.

Currencies of countries like Australia, Canada, and New Zealand depend on advantageous trade conditions to aid the positive sentiment with regard to enhanced rates of interest. This may cause income disparity. This favors the flow of capital into the currencies of these nations from other regions where the interest rate is low.

Thus, these currencies stand the risk of being affected heavily by carry trade reversal. In this scenario, investors often seek the security provided by:

- USD

- JPY

- EUR

- CHF

It is vital that you take the right steps and stick to the tried and tested ways, like entering short trades on risky currencies.

Mergers and acquisitions

When a country’s equity market is solid, the volume of cash flowing in increases significantly. Foreign capital is more likely to enter such a market, and merchants have to purchase the currency of a nation where the equity market is solid by selling the currencies of their respective home countries. This leads to the currency’s increase in strength.

Most traders consider this to be a minor factor in regard to anticipating shifts in the Forex market. But, while dealing with momentary swings in currency rates, mergers and acquisitions must be taken into account.

This phenomenon occurs when one company belonging to a certain region desires to acquire an organization belonging to a different country. A seasoned trader will always be aware of these kinds of activities since they allow them to foretell near-term alterations in currency rates.

Trade and capital flows

Before you make the ultimate forecast related to the currency trends, you should take into account one important factor. You should figure out whether the given currency depends on the trade or capital flow of its nation of origin.

The flow of capital in a nation is defined by how much merchants are investing in it worldwide. On the other hand, trade flow can be defined as the amount of money gained from conducting a trade. There are a few countries in the world that depend heavily on capital flow, while others are highly susceptible to trade flows.

In a nutshell

Thus, we saw the various ways you can foresee fluctuations in the Forex market. If you are new to the market, it can be a little overwhelming to deal with a large amount of information and tools needed to make profits. Using different kinds of financial tools in tandem can give you a competitive advantage in this regard.

Leave a Reply