Stop-loss and Take profit are common types of forex orders that traders looking to engage in automated trading or manual trading of the forex market must have a clear understanding of. The two order types go hand in hand with entry and exit points and are often used in trade management.

Most traders, especially novice traders, place exit targets in the form of stop-loss orders at arbitrary levels. Similarly, professional traders leveraging forex expert advisors for automated FX trading also do place stop and profit targets at arbitrary levels. However, that should never be the case if one is to have a successful and profitable investment career in the forex market.

Knowing where to place stop and price targets when hedging, scalping, or swing trading is an essential money-making hack in the trillion-dollar forex market. Therefore, stop and profit targets should be placed at levels that ensure optimum returns while keeping losses low.

Placing a stop order too tight or too wide from the entry-level can lead to unimaginable losses should the market turn and go against you. Similarly, placing a take-profit order close to the entry-level reduces the chances of generating optimum profits as soon as a trade is moving in favor.

Therefore stop and take profit orders are necessary forex trading instruments for any serious trader looking to generate consistent profits and keep losses low.

How to Place A Stop Order

A stop-loss order is a significant risk management order that allows traders to protect their capital when things are not going in their favor, in the forex market. For that matter, placing a stop-loss order manually or using an FX EA, too far from the entry-level, increases the risk of a larger loss. Similarly, putting a stop loss too close or too tight increases the risk of being stopped out in case of small swings.

Conversely, traders need to identify critical support and resistance levels in chart patterns to use as stop levels depending on trades taken. Support and resistance levels are some of the most obvious levels that professional traders use for setting stop-loss levels. When identifying support and resistance levels, it is vital to pay close watch to daily charts. More extended time frames tend to provide ideal support and resistance levels ideal for placing stop orders

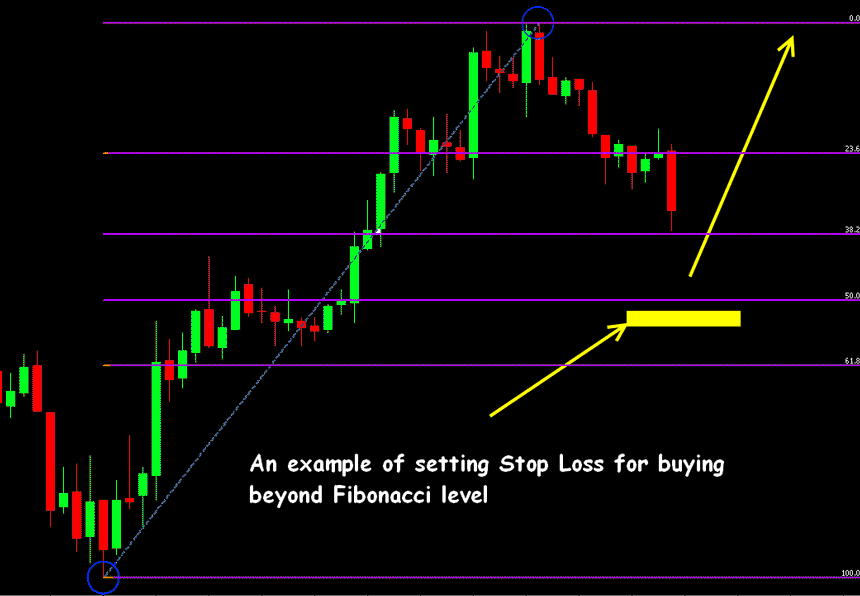

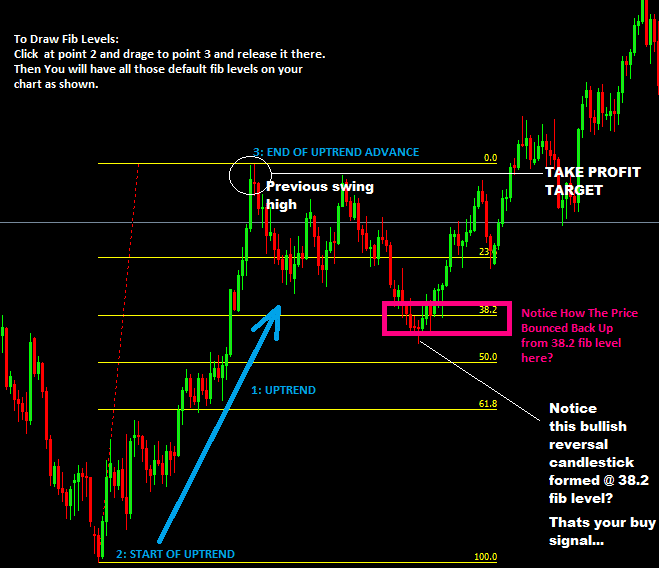

Fibonacci is one of the best forex indicators for automated trading that can also be used for identifying ideal levels for stop-loss orders. The charting tool comes with extension levels that act as support and resistance levels.

Some of the commonly watched levels are 38.2% and 50% levels, as they act as reliable support and resistance levels. In this case, you can place your stop loss manually or with the help of a forex robot a few pips below or above these critical levels.

A trailing stop is another important stop-loss order that can be used to lock in profits as trade moves in favor. These types of stop-loss orders trail the prevailing market price allowing traders to lock in as much profits as possible. As soon as a trade starts going against, the stop-loss order triggers based on the preset percentage difference.

How To Set Profit Targets

Setting profit targets is as important as trying to mitigate losses by placing stop-loss orders. A profit target makes it possible to lock in profits while growing the bottom line. Conversely, setting a profit target, manually or through algorithmic FX trading, increases the risk of one failing to lock in profits. In most cases, the market might reverse and trigger the stop-loss order instead.

Similarly, placing a profit target too close to the entry-level might cause you to lock in a small amount of profit and miss out on a much larger profit. Therefore it is important to define profit targets at levels that can guarantee optimum returns all the time.

While trend trading or news trading, it is essential to identify support and resistance levels as they act as ideal profit target levels. Profit orders placed close or slightly above support and resistance levels allow traders to amass the optimum amount of profits with each opened position.

Similarly, Fibonacci is one of the best forex indicators that can be used for setting profit targets levels in the forex market. Fibonacci extension levels, such as 38% and 50%, act as crucial support and resistance levels. Conversely, professional traders use them to place profit target levels.

Bottom Line

Stop targets and profit targets should always complement any trading strategy if one is to accrue optimum returns while keeping losses at the bare minimum. It is important to remember that setting stop and profit targets at ideal levels is as crucial as identifying high probability trade setups.

Leave a Reply