If you are new to Forex trading, you might not have heard of margin calls before. But, for you to conduct successful trades, learning about this concept is vital. Depending on the broker, there might be some serious consequences attached to it.

In this article, we shall discuss what this phenomenon is, what the reasons for its occurrence are, and how you can avoid it.

What is a margin call?

It is an alert that tells you to secure the positions you are losing or add more money to your account in order to free space for more margin. If you have negative Forex trading positions, your account’s margin level might get dwindled.

In this event, your account balance also drops, but you nevertheless need to pay the broker money. In order to compensate for the margin call, you either need to sell your Forex trading positions or add funds to avoid the liquidation of assets.

What causes margin calls?

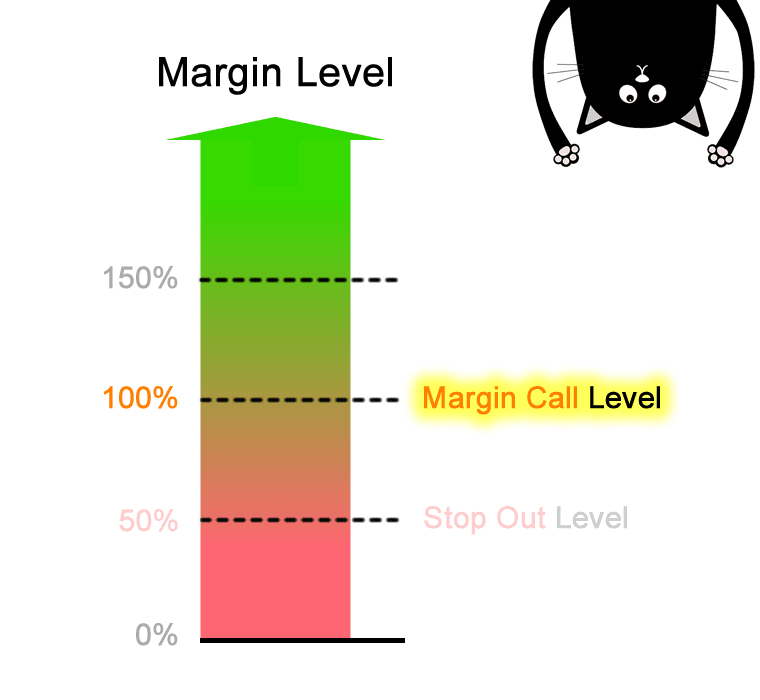

When the margin level sinks below the margin call level, your broker issues you an alert. Margin Call level is expressed as a percentage that is fixed by the broker, and you can see it mentioned in the Account Specifications details.

The margin call phenomenon takes place when the floating losses exceed the used margin. Fundamentally, this means that your equity has gotten reduced, and it now lies beneath the used margin.

For example, in the NYSE, the margin call level is 25%, but other firms might have higher requirements of 30-40%. Next, let us compare margin calls with margin call level.

Margin call level vs. margin calls

Although margin call and margin call level are not one and the same, some traders get the two mixed up, leading to a lot of confusion.

- Margin call level is the point where you are in danger of getting some of the positions liquidated. The approximate value for the margin call level is 80%, but with the changing volatility of the market, the value is subject to change.

- On the other hand, a margin call is a phenomenon where the brokerage firm or the individual broker you’re dealing with conducts some activity. This task normally leads them to dispatch you an alert. This happens when the Margin Level plummets below a set value that is the margin call level.

How to avoid a margin call?

Here is a brief look at some of the ways a margin call can be avoided.

Gain some knowledge about margin maintenance requirements

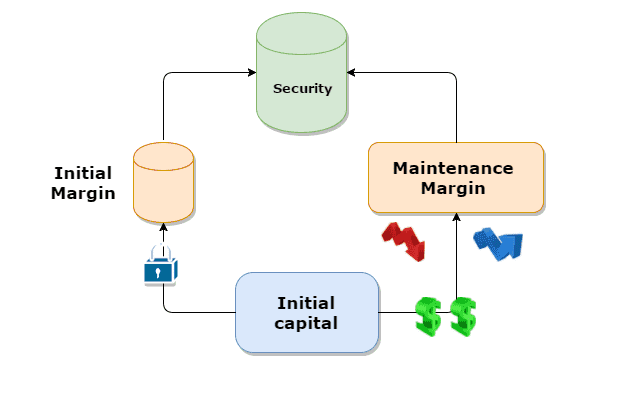

In the Forex market, trading on margins lets merchants expand the size of their position and allows them to enter a market for which the primary disbursement is less. Nonetheless, when it comes to managing money and margin trading, very few individuals seem keen to learn about these procedures.

There are margin requirements for each financial security you trade in. These are different from security to security. When a trader does not know much about these requirements, they could find themselves facing a roadblock.

There is a sheet for Forex margin requirements, where you can find the MMRs for different currency pairs. While dealing with a brokerage firm or a broker, you should check out their website, where these terms should be listed.

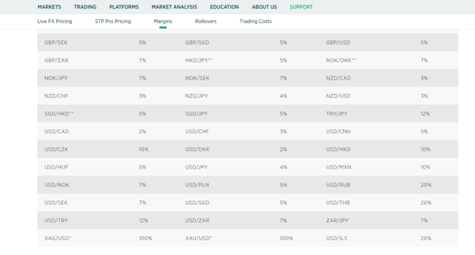

While trading in Forex pairs having great volatility, you might need to use more funds than what you have available with you. In this case, you should definitely consult the list. The government has established a set of requirements for several firms like the ones you see below.

We can notice that the margin maintenance requirements for some of the volatile currency pairs are 100%. Thus, for you to hold your position, you need to have a specific cash balance available to you. Talking about the short positions, they need more coverage since upside risk is not something the brokerage firms want to tackle.

Use Stop Orders

By using stop orders in a sensible manner, you can remove almost the total amount of losses incurred or at least some of them before the trigger point is attained. Through stop orders, various ways of maintaining the account margin can be decided. Normally, the broker dictates these terms, but this way, you can control your dealing with greater effectiveness.

Contriving a sequence of swaying stop orders can help you make sure the maintenance margin is being met at all times, thus effectively avoiding margin calls. However, if it so happens that the currency pairs fall swiftly in a short amount of time, you will still get a margin call. So it is advisable to use a minimum margin amount in this case.

Having a large amount of margin risk for the short term is a bad strategy for minimizing your risks. Additionally, you stand the risk of making your account balance reach a negative value, which essentially spells disaster.

It is vital, therefore, to be circumspect and avoid taking risks whenever it’s reasonable as this might allow you to retain a considerable amount of money.

Enquire about the margin requirements

It is considered good practice to know about the margin requirements of a particular piece of financial instrument. This is due to merchants carrying out their trades in more than a single position.

Suppose the margin requirement for an open position you are maintaining is quite high, and additionally, you hold a couple of active positions. Normally, this order would get rejected by the brokerage firm, but this is not always the case. Hence, you may find yourself in a tight condition after your last order has ended and be compelled to lessen the proportion of your commitment.

Key takeaways

The people who engage in day trading make most of their money through margin trading, but if you are not careful, it might end in disastrous consequences. You should thus be careful and not trade in bulk amounts except when you are entirely sure you can carry out margin trades. You should exercise more caution, especially if you are trading without the help of a broker.

Leave a Reply