You are a serious forex trader if you spend a lot of time reading financial news outlets searching for actionable information. If you do so regularly, you might have come across stories about manufacturing data. Traders use the data to gauge the possible direction of the economy. This information is compiled into what experts call purchasing managers index (PMI).

In the United States, the preparation and dissemination of PMI data fall under the Institute for Supply Management (ISM). ISM is an international organization, but it focuses on the US economy while IHS Markit produces PMI data for Europe and other regions.

PMI: Definition and explanation

ISM conducts surveys on the broader economy, including services, construction, and manufacturing, and reports the data separately. For this discussion, we will confine ourselves to PMI for the manufacturing sector.

ISM’s Manufacturing PMI is a product of monthly surveys that usually target about 400 purchasing managers of manufacturing businesses. The questions asked cover five different fields of manufacturing, which are:

- New orders from customers

- Speed of supplier deliveries

- Inventories

- Employment

- Level of production

The questions in the surveys anticipate one of the following answers:

- there was an improvement in production during the month,

- there was no change in production during the month, and

- production deteriorated during the month.

Unlike other economic data that looks at historical performance, ISM and IHS Markit PMI data are forward-looking. Forex traders depend on the information for its predictive value. No wonder each PMI release is a considerable occasion.

Specifically, the information helps traders to estimate the condition of the economy. In case of a slowdown, PMI comes in low, and the numbers would be high if consumer demand is growing. PMI’s sensitivity to aggregate consumption and changes in consumer behavior makes it invaluable to forex traders.

Formula and calculation of PMI

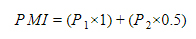

PMI might sound complicated, but you will be surprised how simple it is after seeing how it is determined. We shall first look at the formula and then see the interpretation of PMI values. The formula for PMI is:

In the formula, P1 stands for the percentage of responses reporting an improvement, i.e., an improvement in employment, and P2 stands for the percentage of responses not reporting any change, i.e., there was no change in inventories.

ISM designed the formula in such a way that 0.5 (50%) is the middle value. When PMI comes out at 50, it means the economy did not experience any change in employment, inventories, etc., within the given month. Suppose PMI figures come out lower than 50. In that case, it implies that the manufacturing sector contracted during the month, and a reading above the threshold tells investors that the manufacturing sector grew during the month.

Using PMI in forex trading

In simple terms, PMI is a gauge that experts use to tell how the market is performing. The index provides more accurate values than other measures, such as gross domestic product (GDP). Additionally, PMI data is more actionable because it is forward-facing. Investors can rely on the insights to make predictions about currency fluctuations.

Most importantly, PMI is one of the critical indicators that monetary policymakers watch so that they can find the right bearing of the economy. In the US, the FOMC – the institution mandated to adjust monetary policy – uses PMI data to evaluate the economy’s status. The insights gleaned from the report help the FOMC to arrive at the most appropriate federal funds rate.

Consider an ISM report that claims the PMI for the past month is 65. The data tells investors and policymakers that the US economy expanded last month. FOMC will then consider the consumer price index (CPI) or personal consumption expenditures (PCE) levels. If they are high, the economy is almost overheating, and that a rate hike should happen.

The federal funds’ rates are a primary influence on the US dollar’s price movement (USD). A higher funds rate increases the cost of borrowing. On the one hand, expensive borrowing rates will discourage ordinary Americans from borrowing. Even businesses will cut down on credit, which implies less investment. Eventually, the velocity of money flow in the economy reduces, and inflation falls (the economy cools down).

On the other hand, high borrowing rates make the US bonds attractive for foreign investors because of better yields. Foreign money will then begin to pour into the economy, and demand for USD climbs. The net effect of higher PMI is the appreciation of the domestic currency. Therefore, forex traders can use PMI to anticipate the future movement of the domestic currency.

Where to find PMI

Seeing how important PMI data is towards profitable forex trading, you now have to make sure you get the news as soon as it breaks. Since the currency pairs in the market respond to a variety of influences, you have to ensure that you are up to date with PMI data of the biggest economies, such as the US, China, and the European Union.

As we stated earlier, ISM publishes US PMI, which you can find on their website. However, summarized versions of the report are accessible on various websites, including Trading Economics, Investing.com, and many others. PMI data for the EU is accessible on IHS Markit’s website, and you can also find a synopsis on the websites mentioned above. You will have to look for the PMI data on the China Bureau of Statistics’ website for China.

How do you know the release date for PMI? Various online platforms, such as Investing.com, keep an up-to-date calendar of important economic events, including PMI release dates. Make sure you visit the platforms regularly to avoid missing the release. Many financial news media also report the PMI for major economies widely. Therefore, regular visits to Bloomberg, Reuters, Financial Times, Wall Street Journal, and others will do you a lot of good.

Leave a Reply