Life as an investor in money markets revolves around certain data points that help you to make sense of the future. After all, currency trading is all about making predictions about a given currency pair’s exchange rate.

Federal funds rate and the London interbank offered rate (LIBOR) are very important data points that influence the foreign exchange’s direction (forex) market cannot be gainsaid. But many traders fail to leverage the information that these data points offer, mainly because few understand what they are and their significance.

What is LIBOR?

London interbank offer rate (LIBOR) is the average cost of loans between large global banks whose maturity ranges from one day to one year. For a long time, LIBOR came to symbolize the consensus interest rate for banking products, which transformed it into a base rate for short-term floating rates of financial products such as interest rate swaps, mortgages, and currency swaps.

Until 2012, the British Bankers Association managed the benchmark, but the institution passed on the Intercontinental Exchange (ICE) responsibility after a bad scandal. This is why a keen eye will notice that the base rate is ICE LIBOR today and no longer BBA LIBOR.

LIBOR’s significance to professionals and private investors places substantial weight on its fluctuations. Because of LIBOR’s role as a benchmark rate, any fluctuations in the rate impact the interest rates levied on banking products, including loans and savings accounts.

ICE quotes LIBOR in five currencies. That is in Japanese yen (JPY LIBOR), the US dollar (USD LIBOR), the Swiss franc (CHF LIBOR), and the Sterling pound (GBP LIBOR). ICE announces the current LIBOR rates every business day at 11 am London time.

What is the federal funds rate?

The federal funds rate is the price of overnight loans that extend to each other. Usually, banks (or depository institutions at large) need to maintain a specific amount of funds with the central bank (Federal Reserve in the US) as reserve funds. When the reserve balance is below the required threshold, banks often borrow from other banks to plug the difference.

The US Fed agency called the Federal Open Market Committee (FOMC) meets regularly to set the target federal funds rate. Interestingly, the federal funds rate serves a higher purpose: to control the money supply within the economy. The Fed applies the tool every time there is a need to achieve a shift in economic activity.

There is another federal funds rate (apart from the target federal funds rate) called the effective federal funds rate. When banks lend to each other overnight, they choose a unique rate, as long as it falls within the target range that the Fed established. Therefore, the Fed averages out the rates based on weight, and the result is the effective federal funds’ rates.

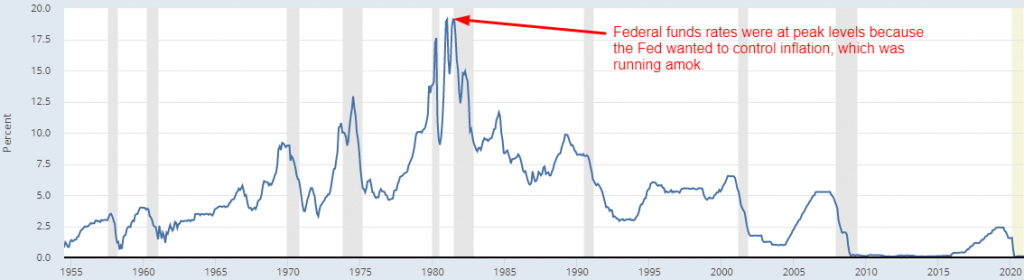

When inflation is too high, the Federal Reserve increases the target federal funds rate, hence hiking the price of overnight loans among commercial banks. Because of the knock-on effect, the high price spreads to the consumer market, where banks begin to charge higher interest rates on mortgages, bank loans, and credit cards. Eventually, the money supply in the economy drops, and so do prices. As you can see in the image below, federal funds rates were ultra-high in the 1980s when US inflation was very high.

Differences between LIBOR and the Federal funds rate

Before we dive into the differences between LIBOR and federal funds rate, it is worth mentioning that both of the rates are critical benchmarks for interest rates charged on banking products on both sides of the Atlantic.

Federal funds rates are unique to the US, while LIBOR has a more global influence

As we saw earlier, LIBOR is the base rate for the interest rate on financial products such as swaps and many other derivatives, even though London-based banks mostly determine it. Conversely, the federal funds rate largely influences interest rates in the US.

LIBOR is quoted in five currencies

To demonstrate LIBOR’s global reach, ICE quotes the rate in EUR, CHF, USD, JPY, and GBP. LIBOR covers maturity dates between one day and one year, while federal funds rates are reckoned only overnight.

Calculation of the federal funds rate has the backing of a market mechanism

Recall when we spoke about the target federal funds rate and effective federal funds rate? Well, the FOMC sets the target band to set the tone for what commercial banks should in terms of setting interest rates for overnight lending. Nonetheless, the Fed establishes a discount rate – which creates a discount window in which the Fed will lend to banks. If the discount rate is higher than the target federal funds rate, banks would instead borrow from one another.

Such a market mechanism is absent when ICE determines the current LIBOR. Instead, ICE simply calls global banks and asks them to provide a hypothetical rate they would charge for loans to other banks. ICE then averages the figures out, and the result becomes the current LIBOR.

The time frame of change is different

FOMC is firmly in charge of adjusting the target federal funds rate. Eight times a year, the committee meets to deliberate on what the target range should. If there is a need to invoke the federal funds rate to shift the money supply direction, then FOMC might adjust the target range.

Conversely, LIBOR changes daily. ICE calculates new values for LIBOR every business day, after which it publishes the current LIBOR rate at 11 am London time.

Conclusion

Federal funds rate and LIBOR play a similar role in their regions. Both rates influence the price of banking products, which ends up affecting the wellbeing of consumers. Nevertheless, the rates differ in terms of their sphere of influence, with LIBOR being more influential globally.

Calculation of federal funds rates involves complex operations by the Fed and commercial banks, after which the effective federal funds rate is determined. On the contrary, LIBOR is simply an average of rates provided by large banks.

Leave a Reply