Hodlbot is an automated software that invests cryptocurrencies on autopilot. It allows traders to scan the market and automatically rebalance the portfolio when the market is highly volatile. The platform supports trading on two exchanges: Binance and Kraken. This review aims to investigate its functions, strategies, safety, profitability, and pricing.

First HodlBot quick summary

The platform does not provide information on the bots’ trading approach and the system’s features. The docs on the website mention the strategies like passive investing, active trading, portfolio rebalancing, and utilities.

| Upsides | Downsides |

| Traders can backtest their strategies. | The bots require a $200 initial deposit to start trading |

| The platform has low-cost pricing plans | The platform lacks detailed features and trading techniques |

| The company has no verified customer reviews on Trustpilot |

| Platform Reliability: | 2/5 |

| Pricing: | 4/5 |

| Ease of Investment: | 3/5 |

| Customer Support: | 2/5 |

| Exchanges Supported: | 2/5 |

What is HodlBot?

Hodlbot has some unique tools that make it different from other bots in the market, such as:

- The system provides a few indices as starting points for beginners so they can easily adjust to market conditions.

- Traders can create and customize portfolios as they wish.

- It allows the investor to block cryptocurrencies they do not like.

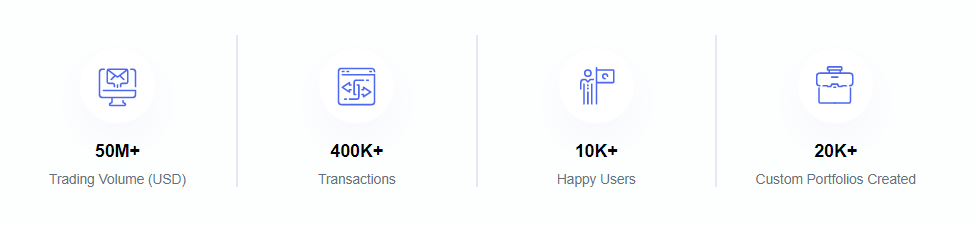

- The website states that it has $50M+ trading volume and 400K+ transactions, but no certificates exist to verify these claims.

How does HodlBot generate profits?

Hodlbot automatically indexes the cryptocurrency market; the users can choose a strategy in which they can switch portfolios into stable coins during a downward trend. The platform’s founder states that the bot uses dollar-cost averaging to lower the average entry price. The website does not further explain the system’s working and trading approaches, which shows a lack of vendor transparency.

Safety and security

At HodlBot, they use API keys with trading access and no withdrawal rights, protecting users’ funds. The data is protected with cryptographically secure hash function encryptions. In case of suspicious activity, the system shuts down.

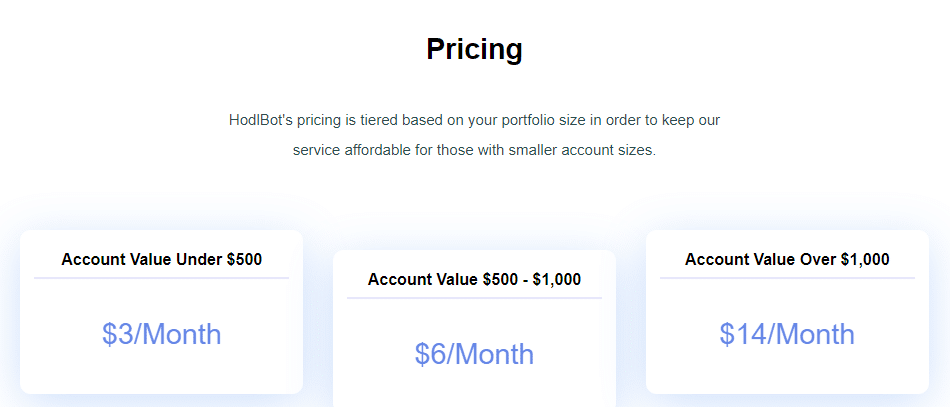

How HodlBot’s pricing works

Trades can purchase HodlBot in three subscription plans based on the account value of the portfolio. A portfolio size under $500 is $3/month, between $500-$1000 is $6/month and over $1000 is $14 each month. The platform offers a free trial for seven days and discounts for three months, and annual plans are available. They do not charge percentage fees from the profits or trades.

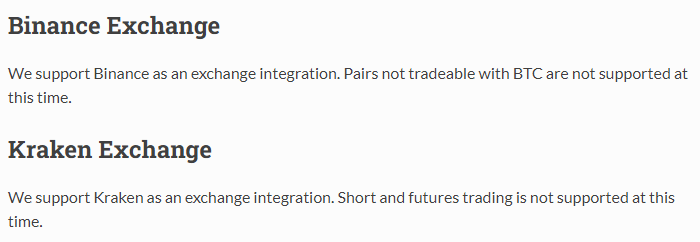

Available exchanges

At Hodlbot, traders can buy/sell cryptocurrencies on the following exchanges:

- Binance

- Kraken

- Kucoin

- Bittrex

The platform does not support pairs not tradeable with BTC on Binance and short/futures trading at Kraken.

How long has HodlBot been in business?

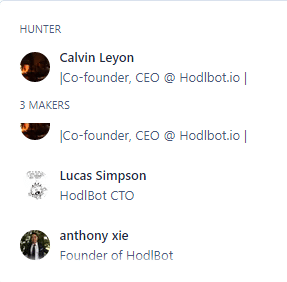

The website does not have an about us option or company information. However, it is featured on the producthunt platform, which shows that HodlBot was launched in 2019 and developed by Anthony Xie, Calvin Leyon, CEO, and Lucas Simpson, CTO. Again, the lack of vital information about the company, vision, and mission of creating the bot raises concerns about the product’s legitimacy.

How to get started with HodlBot?

Before starting with HodlBot, traders need to have $200 in their exchange account. If they fulfil these requirements, they can set up their bots in the following steps:

- Connect your exchange and link API keys

- Choose a trading strategy

- Configure the bot settings

- Run the bot

Customer support

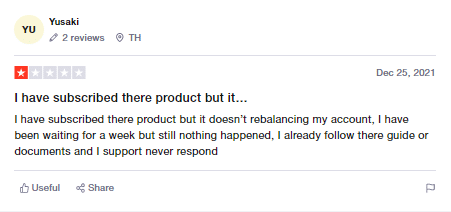

The customer support at HodlBot is not up to the mark and lacks live chat, contact number, contact form, etc. Traders can email the devs for inquiries. An unclaimed profile for the platform is present on TrustPilot with only one negative review. The user writes that the company does not provide the services it promises.

After reviewing the product, we found that it can be hard for beginners or traders to rely on this platform. Hodlbot only supports four cryptocurrency exchanges and lacks information on its features, working, and trading approach. The user feedback indicates the system's performance, and the lack of it raises eyes on the authenticity of a product.

Leave a Reply