As a Forex Robot using the trend approach, Happy Trend uses high volatility along with news filters to ensure high returns. The efficient money management feature used helps the EA to minimize the risks. Chiefly designed for all traders including newbie traders, this ATS is capable of trading on bigger client accounts using the Metatrader platform.

Detailed Forex Robot Review

Happy Forex promotes Happy Trend and several other EAs like Happy Power, Happy News, and more. When it comes to presenting its Forex Robots, the company does not provide any elaborate info on the strategy, performance, etc. For this EA, we could see the info includes features and requirements along with the updates done to the EA.

One factor that is common to all the Happy Forex EAs is the lack of vendor transparency. We could not find details about the developer or the team behind the FX EA. The company does not provide location addresses, phone contact, and other relevant info. There is an online contact form for customer support.

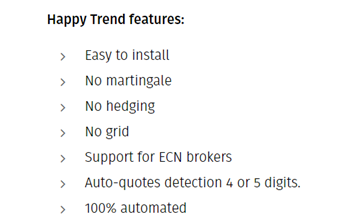

Minimal requirements for this FX robot include the Metatrader 4 platform and a minimum deposit of $100. You can use a standard, mini, or micro account with this software. Easy installation, ECN broker support, auto-quote detection up to 5 digits, and full automation are the main features of this EA. Several updates are featured on the site including the addition of new indicators, use of the UseReverse setting, the inclusion of additional currency pairs, and a lot more.

Happy Trend Strategy Tests

As the name implies, this MT4 tool uses the trend approach for trading. Dynamic stop-loss and take-profit points and precise entries are made possible with the approach used. While the vendor does not elaborate on the trend strategy, there is mention of the system not using the grid, Martingale, or hedging methods.

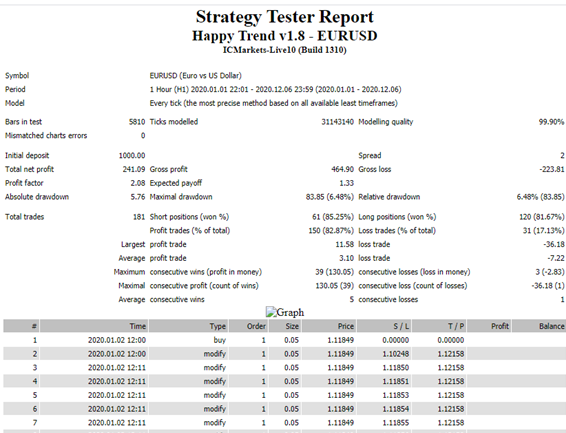

A few backtests are present on the site with a modeling quality of 99.9%. Here is a screenshot of one of the backtests.

The strategy tester report above indicates trading done over six months using the H1 timeframe on the EURUSD pair. For a deposit of $1000, the account has gained a total net profit of 241.09 and a drawdown of 6.48%. The profit factor is 2.08. While the drawdown is not high, the profit gained is very low.

Real Account Trading Results

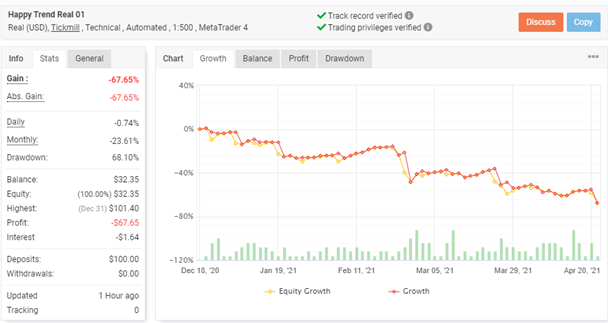

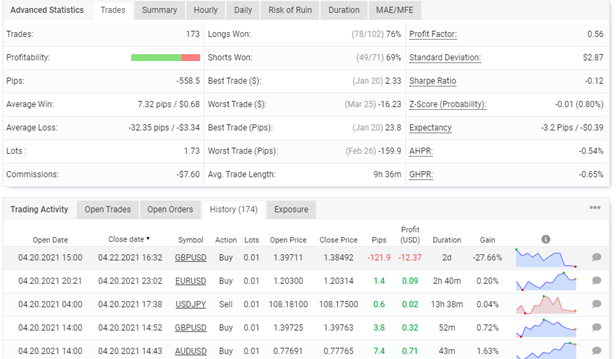

We found a verified real account on the myfxbook site. Here are screenshots of the results:

The real USD account using Tickmill broker and the leverage of 1:500 on the MT4 platform reveals a loss of 67.65% and a similar value is seen for the absolute loss. We could see the account suffering daily and monthly loss at 0.745 and 23.61% respectively. A drawdown of 68.10% is seen. For deposits of $100, the balance amount present is $32.35.

For the trading that started in December 2020 and ending in April 2021, a total of 173 trades have been completed with a profit factor of 0.56. The trading has been stopped due to the account losing money and also due to the high drawdown.

Pricing

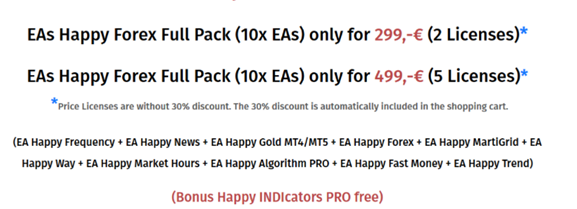

This EA is not available separately. You can purchase it along with 9 other EAs of Happy Forex for the cost of €299. The package includes two real accounts, a user guide, 24/7 support, free updates, and more. Two bonuses namely Happy Indicators Pro and Happy Gold MT5 are offered with the package. A 30 days refund offer is available. The cost looks very affordable as the package includes 12 trading tools including the bonus offers.

Customer Reviews

There are no reviews from users of the Happy Trend EA. We look for reviews on sites like Forexpeacearmy, Trustpilot, etc. as they provide unbiased views on a trading system. Without genuine user feedback, we are unable to do a proper evaluation of the performance, customer support, and other important aspects of the FX EA. The absence of reviews indicates the FX robot is not a well-known EA in the market.

Happy Trend is an ATS that shows poor performance and a lack of vendor transparency. Our analysis of the real account trading result verified on the myfxbook site reveals the account has been closed due to the poor performance of the EA. The high drawdown indicates the MT4 tool is not using an effective trading approach.

While the backtest result reveals decent profits and a low drawdown, since it is based on historical data, we cannot use it as a benchmark for evaluating the performance. The absence of vendor transparency, failure of the vendor to explain the trading approach, and lack of user reviews further make this expert advisor an unreliable product.

Leave a Reply