Did you know that one of the best currency pairs you can get for swing trading is the EURJPY? It is positioned within the Top 10 in the Forex market, which tells us that it is a pair with good trading volume.

The euro and the Japanese yen are major currencies in the world economy, which increases the chances of achieving large pip movements.

If you are wondering which are the pairs with the highest percentage of weekly movement, the statistics show that the EURJPY is in second place, with 1.24%. Such volatility gives us confirmation of how profitable it would be to trade this pair.

When trading, we must consider some technical and fundamental aspects that help us anticipate the direction of the market. This guide will talk about what news and economic indicators you should pay attention to and what timetable and strategy you can apply to generate profits in this currency pair.

Fundamental aspects

European Central Bank policies and reports

Usually, economic and political data affect relatively new currencies such as the euro.

One of the most important economic indicators in the European Union is Gross Domestic Product (GDP). In general, GDP growth is a sign that the economy is strong and healthy, which is positive for the currency.

Looking at the following graph, we realize that between 2008-2009 and 2019-2020, the GDP of the European Union presented negative numbers, which caused the euro to lose strength against other currencies.

The European Union comprises several countries, so reaching an agreement on monetary policies can be complicated.

Still, the decisions they make will be vital for the stability of the currency. You can get more detailed information on this topic on the European Central Bank’s website.

The sentiment of the market

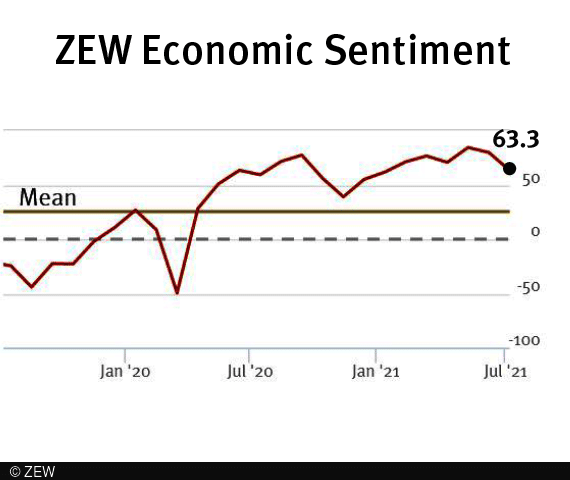

One of the most widely followed sentiment reports is the German ZEW Survey, prepared monthly by the Centre for European Economic Research. Three hundred sixty financial experts from Europe, Great Britain, the United States, and Japan give their views on the economy over the medium term. These points of view are resumed in the ZEW indicator.

A ZEW number above zero indicates optimism, and below zero indicates pessimism. This sentiment indicator, being one of the most important, can influence the decisions of big investors. These decisions can positively benefit the region’s economy or affect the currency’s value.

If you want to see the detailed views and reports, you can go to the ZEW page and get a deeper insight into the news and sentiment of the European market and how it may affect the price of the euro.

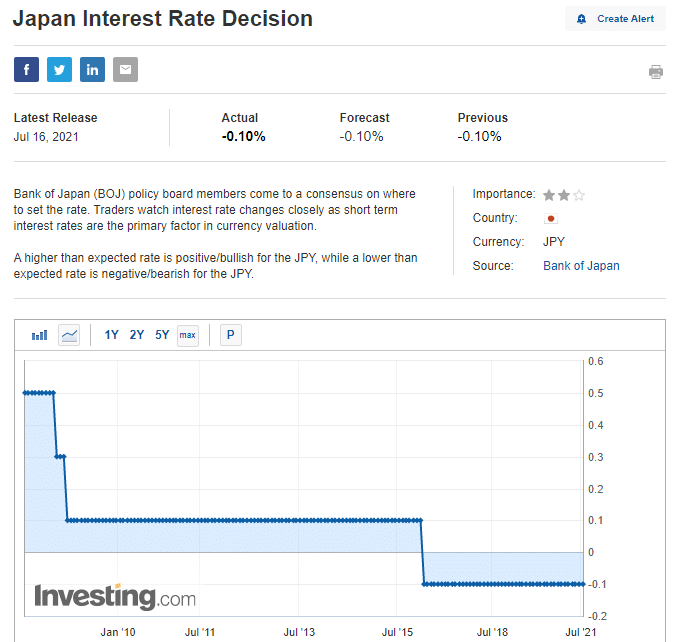

Reports from the National Bank of Japan (BOJ)

Many traders and investors pay special attention to the interest rates proposed by the BOJ. Remember that the yen is considered a safe-haven currency, so a low interest rate is more favorable for investors seeking refuge from a possible financial crisis.

Different economic data such as unemployment figures and GDP should provide a general overview of the Japanese economy.

Climatological factors in Japan

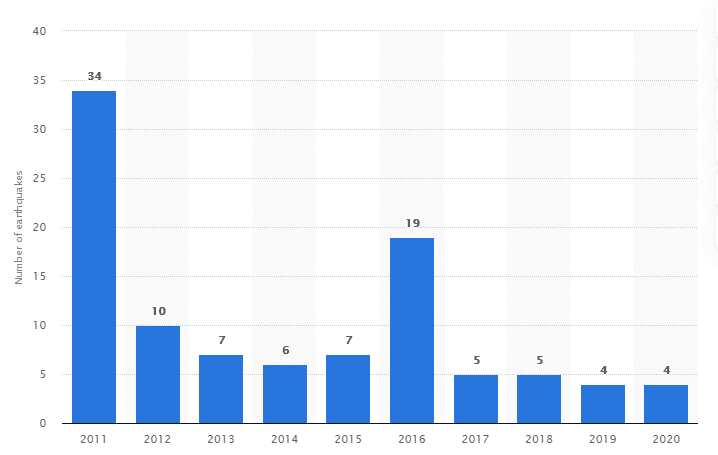

One of the few currencies that nature itself can seriously affect is the JPY. Japan is a country prone to earthquakes and tsunamis due to its geographical position. This condition means that investments in the Asian region can be considered a bit risky. If natural catastrophes occur, the economy would be seriously affected, so as the value of the currency.

As we can see in the following graph, 2011 and 2016 were years when many earthquakes occurred.

On March 11, 2011, the largest earthquake in Japan’s history and the fourth most powerful earthquake in the last 500 years occurred, measuring 9.1 on the Ritcher scale.

Technical aspects

When we look at the price action of the EURJPY, we realize that it is a pair that takes trend direction consistently because it maintains a good trading volume.

However, the downside is that volatility spikes distort the price in the middle of these trends, making it challenging to analyze.

Nevertheless, although it is difficult for the day trader, it can be advantageous if the movement is anticipated in the right direction.

What’s the best time to trade EURJPY?

Usually, the hours of volatility will be found between 07:30 and 14:30 UTC.

In the chart above, you can see the times of the session when the pair is the most active.

Strategy to trade the EURJPY

In the example of the first strategy you can apply, we combine price action analysis, Relative Strength Index (RSI), and volume. We should concentrate on detecting divergences in one-hour time frames.

In the chart below, we can see how the price makes a new high, but the RSI does not accompany it, while the volume is low near the resistance zone.

This combination of factors increases the probability of the price reversal. Therefore, it is advisable to place a sell position once the divergence is identified.

Thus, always adjust the trade with an appropriate risk/reward ratio because the loss will be capped if the trade does not turn out positive.

Conclusion

As we have seen throughout this trading guide, the EURJPY is one of the most attractive pairs for traders. The euro and the Japanese yen are two of the strongest currencies in the world economy, making this pair quite liquid.

Suppose you want to profit from short-term trading. In that case, it is essential to have a good strategy with indicators from technical analysis to generate good results. If, on the other hand, your bets are in the long term, then you should be aware of the economic indicators mentioned by the central banks.

Leave a Reply