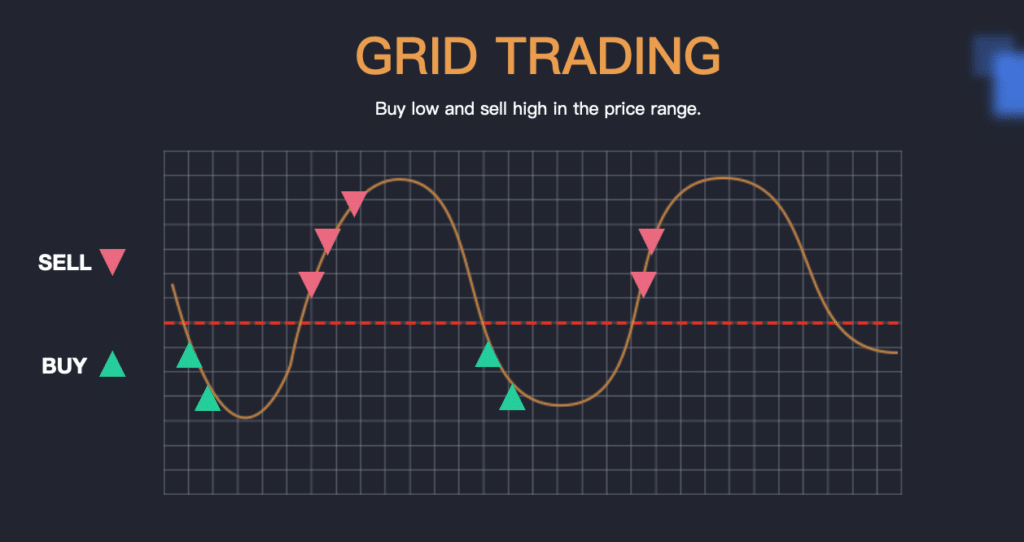

Range bound markets are some of the best to trade as the price fluctuates within well-defined limits. While cryptocurrencies are known for heightened volatility, once in a while, they move sideways. The grid trading strategy is one of the best for profiting whenever such instruments are not trending.

The well-defined lower and upper limit where price oscillates makes it easy to open buy and sell orders. Furthermore, the buying and selling that takes place at the lower and upper limit can be programmed into a trading bot which, in return, executes the orders automatically with limited human intervention.

Understanding grid trading bots

Grid trading bots are automated trading systems programmed to buy low and sell high whenever a cryptocurrency pair moves sideways. The automated trading systems are programmed to continuously place the buy and sell orders as long as the price remains within the specified range. The system won’t execute any orders should the price break through the upper or lower limits.

Grid trading generates some of the best outcomes as it lets traders make profits by taking advantage of small price fluctuations within the ranges.

How it works

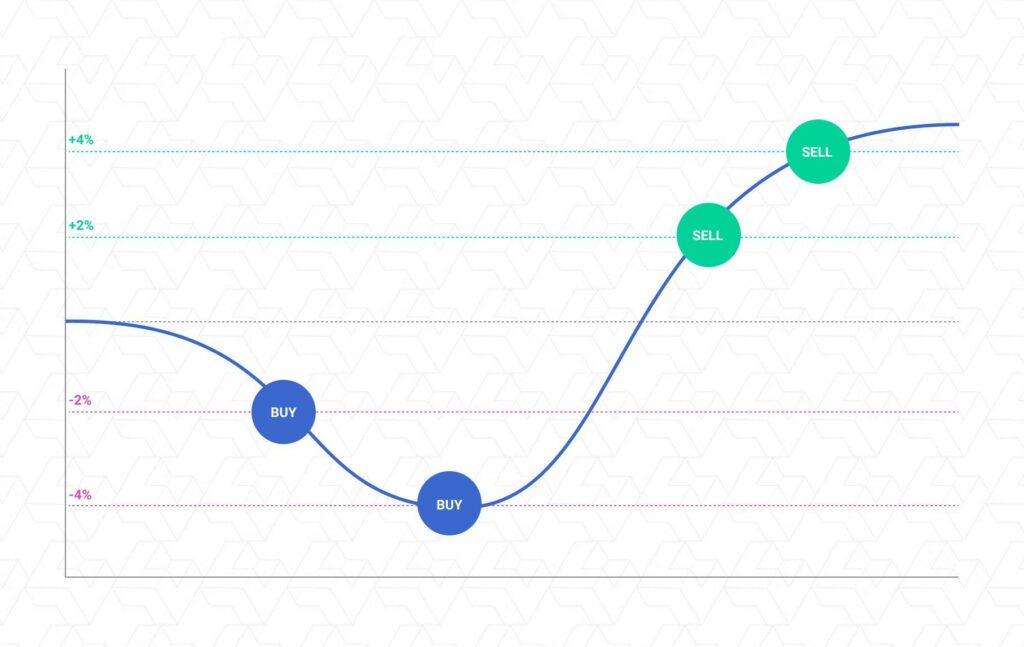

The working principle of a grid trading bot is the same on all platforms. A buy order is opened when the price moves lower and nears the lower limit of a defined trading range. If it continues moving lower, another buy order will be opened as long as the price is still within the range. Finally, a stop-loss order would be used to avert losses accumulating on price, breaching the lower limit and edging more down from the range.

Once the price reverses course and starts moving up on getting rejected near the lower limit, the two buy orders will start accumulating profits. As prices move up, it is essential to place take-profit orders for each of the two trades near the upper limit. This way, you will be able to lock in profits when the price nears the upper limit where a reversal is likely to happen.

Similarly, as the price moves up and nears the upper limit, opening a short or sell position is essential to take advantage of a reversal at the resistance level. As the price continues to move up, place another sell position to end up with two sell positions before the reversal happens. The two sell positions should be accompanied by two stop-loss orders above the upper limit. The stop-loss orders will close the two sell positions once the price powers through the upper limit and continues moving up.

If you had two buy positions as the price moved up, you should also have two sell orders before the price corrects and starts moving lower. The two buy orders should be scattered at the same distance. The two sell orders should also be spread over the same distance.

Setting up a grid bot

While setting up a bot to automatically execute the grid strategy, the first step is to identify the trading range of a given cryptocurrency pair. If the cryptocurrency is moving sideways, identify the upper limit, which should be the level whereby the price tends to get rejected and move lower. It is essentially a point of strong resistance. Likewise, identify the lower limit, the level whereby the price gets supported and bounces back every time it tries to move lower. This should be a level of strong support.

Once the upper and lower limits are defined, determine the entry point and the buy and sell orders interval. The first buy order can be slightly higher, followed by a second buy order that is a little bit lower and near the lower limit. Similarly, the first sell order should be a few pips from the upper limit, followed by a second sell order much closer to the upper limit.

In addition to defining the entry points, it is essential to determine the take-profit orders for the buy and sell orders to lock in profits as the price oscillates from one end to another in the range. Stop-loss orders should also be placed to close the orders whenever the price breaks out and moves above or below the upper and lower limits.

Once all these parameters are defined, they can be programmed into a trading bot that will continuously place the orders and start a new cycle after the last sell order is closed.

Benefits of grid trading bot

It is a trustworthy trading strategy that allows traders to take advantage of price oscillating within a well-defined range. The bot automatically places the buy and sell orders enabling a trader to profit from the price moving up and when it is moving lower.

Stop-loss orders ensure positions are closed automatically whenever the price breaks out of the defined range. In addition, profit-take orders make it easy to lock profits continuously as long as the price oscillates within the defined range. The grids can be set up to get hundreds of trades every hour and lock in the smallest of profits.

Trading bots make it possible to execute the optimum number of orders as long as the price moves within the range. Therefore, one does not have to stay glued to the screen, waiting for the price to be near the lower or upper limit to execute orders.

Additionally, the grid trading strategy is straightforward as it does not involve any sophisticated calculation measurements or use of indicators. In addition, it can be applied to any cryptocurrency pair as long as it is moving sideways and not trending.

What to remember while using the grid trading bot

While trading using the grid trading bot strategy, it is important to factor in fees levied for opening and closing orders. The more the orders, the more the fees. Therefore, it is important to settle on an exchange that charges the lowest fees and offers periodic zero-cost events. Some exchanges offer fee refunds. The lower the fees, the more optimum amount of profits one would end up with.

It is also essential to settle on the best pairs with sufficient liquidity, which can drive the price higher and lower within the defined limits.

Leave a Reply