For traders who are environmentally conscious, green trading offers a splendid opportunity to gain profits while being socially responsible. There are not many automated systems in Forex trading that focus on the green market. Green Graph EA, as the name implies, focuses on green trading. It claims to provide users with green and big profits.

Designed with AI revising every tick passed feature, the system uses smart trade management to reduce losses. We have done a detailed review of Green Graph EA analyzing various aspects of the system, and provide you with our recommendations regarding the expert advisor’s reliability.

Detailed Forex Robot Review

There is not much information revealed about the developer or the team behind the system. The vendor informs that with the system you can trade with ease. With just a few clicks and placing the EA on the Forex chart, you get to trade efficiently. We could not find info on the location of the company and there is no phone contact provided.

On the working mechanism, the vendor states that the smart AI of the system scans the market and identifies the right trend, calculates the best entry points. A special algorithm based on stochastic, EMA, RSI and a secret formula is used for the trading approach.

With the help of the smart trade management feature, premature losses are averted and drawdowns are managed ensuring profits. A minimum of $100 or 1000 cents is the recommended balance and the recommended leverage is 1:500.

Green Graph EA Strategy Tests

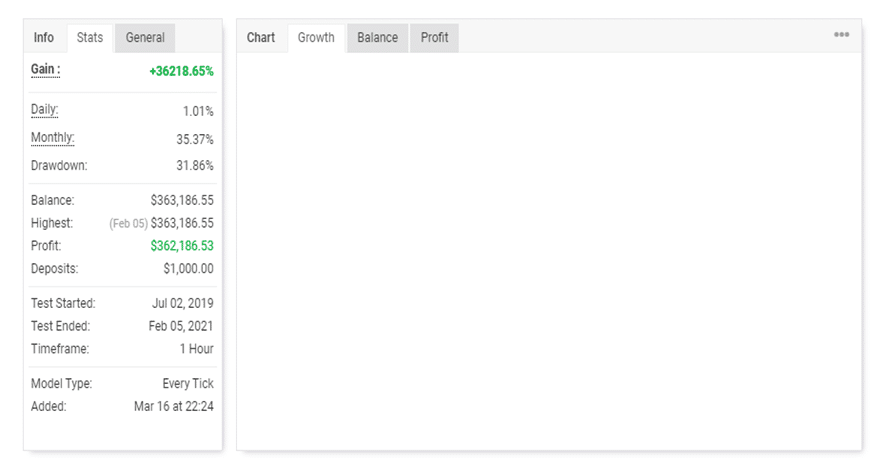

The vendor provides backtests for the system. Here is a screenshot of the backtests done with a modeling quality of 90%.

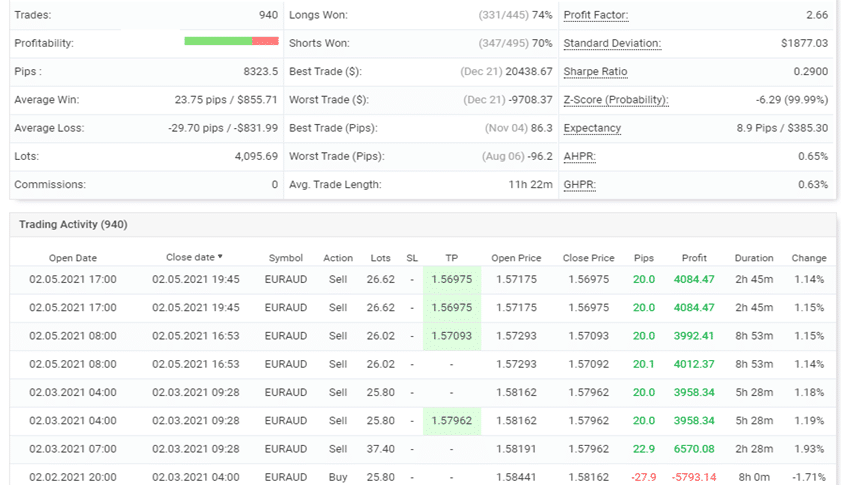

From the backtesting report, we could see the testing has been done from July 2019 up to February 2021 for a timeframe of one hour. The drawdown was 31.86% for a deposit of $1000. The profit factor was 2.66. We prefer backtesting done using a modeling quality of 99.9% as it discloses several details such as slippage, commission, spreads, and more. Besides even if the performance was good, the backtesting results are based on historical data and are not predictive of the future performance of the system.

Real Live Account Trading Results

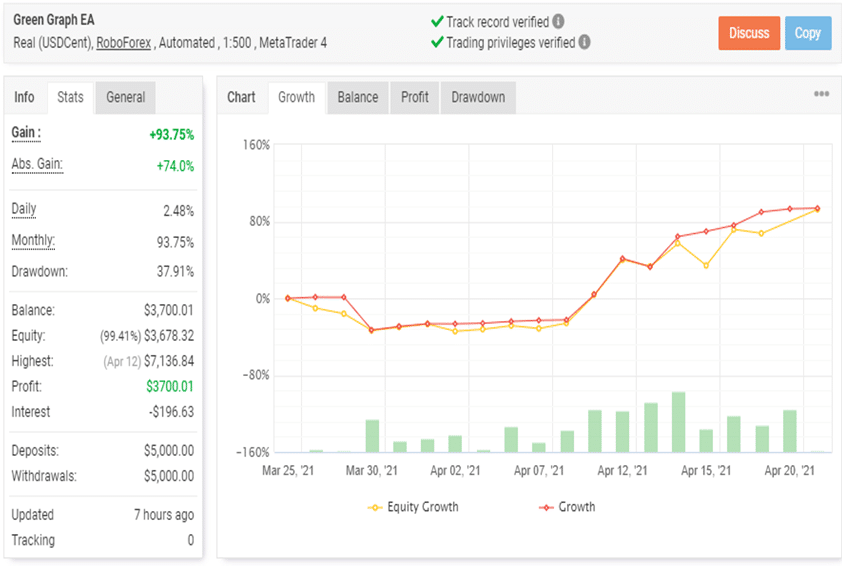

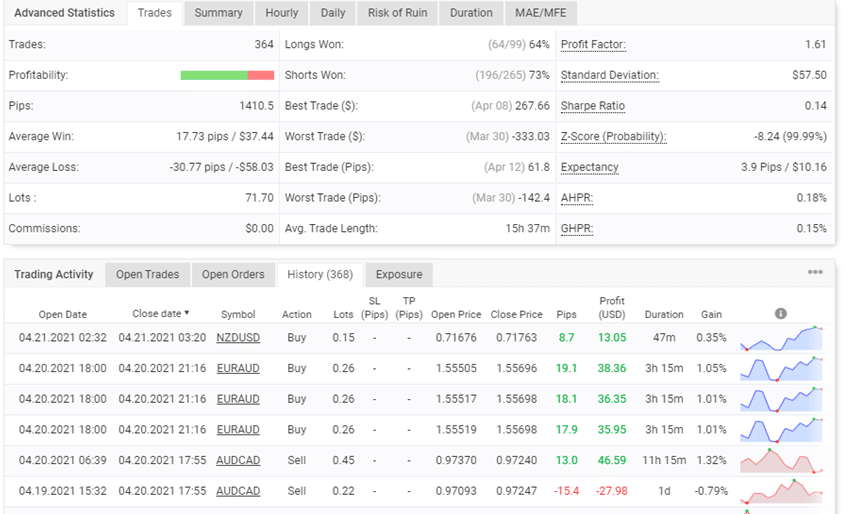

On the official site, the vendor provides real live account trading results verified by the myfxbook site. Here is a screenshot of the results:

From the trading stats, we could see the total profit is 93.5% and the absolute gain is 74%. While the daily gain is 2.48%, the monthly gain is 93.75%. A drawdown of 37.91% is recorded for the account started on a deposit of $5000. The profit factor is 1.61. As per the trading history, the lot sizes vary from 0.10 up to 0.45. Many of the stats including the drawdown, profit factor, and lot sizes reveal that the system uses a very high-risk strategy. Compared to the backtests the drawdown is similar in both but there is variation in the profit factor.

Pricing

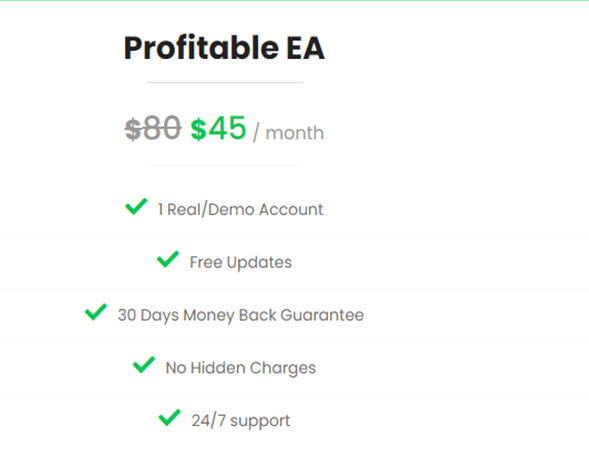

Priced at $45 per month, this expert advisor includes a real account and a demo account, free updates, and 24/7 support. A 30-day money-back guarantee is part of the package. The cost of the prevailing expert advisors is much less than what this system costs.

Customer Reviews

We could not find user reviews for this system on reputed third-party sites such as the Forexpeacearmy site and Trustpilot site. User reviews are important for evaluating a system as they help to know details such as the performance of the system, the support offered, and other relevant information. Reviews help to decide whether the system is worth investing in or not. The absence of user reviews makes it difficult to evaluate the performance and reliability of this system.

Wrapping up our review of the Green Graph EA, we find the system with its green trading initiative has the potential to turn into a reliable system. While the verified trading results are a big advantage for the system, we found a few downsides with the trading results. For one the drawdown is too high which indicates that most traders will not be comfortable trading at such high drawdown levels.

Furthermore, the difference in the total and absolute gain values and the high lot sizes are other aspects that indicated the strategy used is not a low-risk approach. While the refund policy makes the system look reliable, the expensive price and lack of vendor transparency are downsides that prevent it from being a trusted system. We would reconsider the reliability if the downsides are addressed adequately by the vendor.

Leave a Reply