The GoodMorning EA is a fully automated scalping bot. It applies strict rules in qualifying trades and always utilizes stop loss orders to minimize risk. It is compatible with both MetaTrader platforms, as it is coded in their native MQL language.

Detailed forex robot review

Essentially, GoodMorning EA is a night scalping bot. It uses smart algorithms to better time trade entries when the market is least volatile. It also has several exit techniques for securing the most out of your profits. Notably, it does not utilize dangerous trading tactics such as martingale and grid trading. According to its vendor, it only opens one order at a time and places tight stop losses with each trade. Typically, it will only actively place trades for about 2 hours in a day.

This bot is operates with several pairs, namely

- AUDCAD

- CHFJPY

- EURAUD

- EURCAD

- USDCHF

- GBPUSD

- GBPCHF

- GBPCAD

- GBPAUD

- EURGBP

- EURCHF

- EURUSD

However, the vendor recommends using it to trade EURUSD, EURCHF, GBPUSD, and USDCHF. The best timeframe for it is the M5.

Its main features include:

- Has a fully automated mode

- It is capable of detecting and switching between GMT and DST broker time-zones

- Can utilize pending orders which minimize slippage

- Features several exit mechanisms for taking profits

- Minimum allowable deposit is $50

GoodMorning EA strategy tests

This bot offers two strategies to choose from. One is the basic strategy, while the other is called the smooth strategy. The latter is recommended by the vendor as it does not require the user to manually adjust the currency pairs to be traded. Instead, it chooses the best-performing pairs each month based on their historical and recent volatility, then trades them.

Unfortunately, the bot’s official website does not go into detail on what the basic strategy entails. Nor does it give any further information on the smooth strategy. This raises doubts about the viability of their strategies. Nevertheless, the vendor insists that the bot works best with brokers offering low spreads and slippage costs. Therefore, if you’re going to use this bot, you best employ the services of an ECN broker.

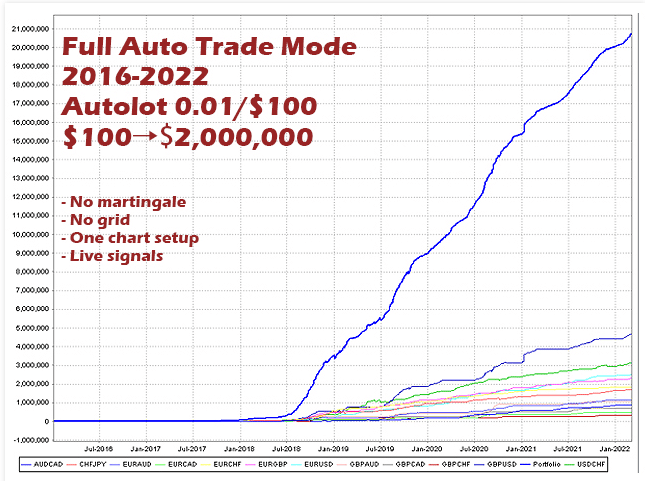

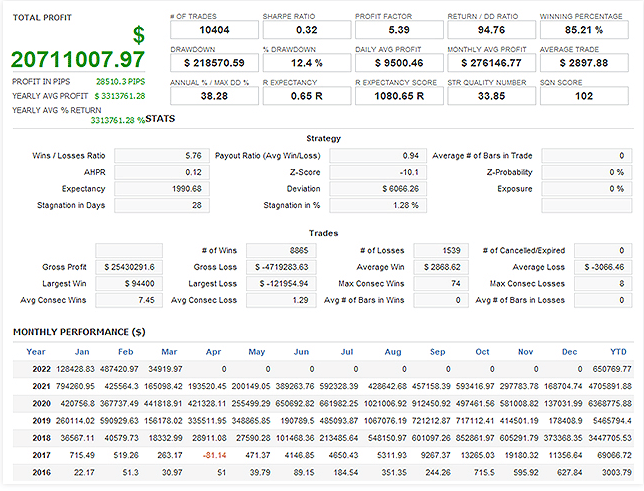

There are numerous detailed backtest results provided on the EA’s official page on MQL5. We analyzed one of these results, which belonged to a test running from 2016 to 2022.

The backtest was run in the fully automated mode of the bot, using the smooth strategy. It began with an initial deposit of $100. The bot posted a win rate of 85.21%, which grew the initial deposit to a balance of $20,711,007. This was a profit factor of 5.39, obtained over a total of 10,404 trades. Within this period, the maximum drawdown was 12.4%. These impressive results speak highly of the bot’s profit potential.

Live account trading results

Unfortunately, the bot’s official presentation does not contain any evidence of a live test carried out on the bot. We could not find any results of any such test on authoritative third-party websites like Myfxbook and FxStat. This is very unsettling as there is no way to tell if the profitability seen in the back-tests holds up in live market conditions.

Pricing

There are two subscription options to the GoodMorning EA. The first is a monthly subscription that goes for $99 monthly. Alternatively, you could buy a lifetime subscription for $699.

If the back-test results are anything to go by, the lifetime fee is quite fair. The monthly subscription, however, is higher than most bots in the industry. The is no mention of a money-back guarantee on the official site. However, there is a free demo version for users who would wish to try out the bot first.

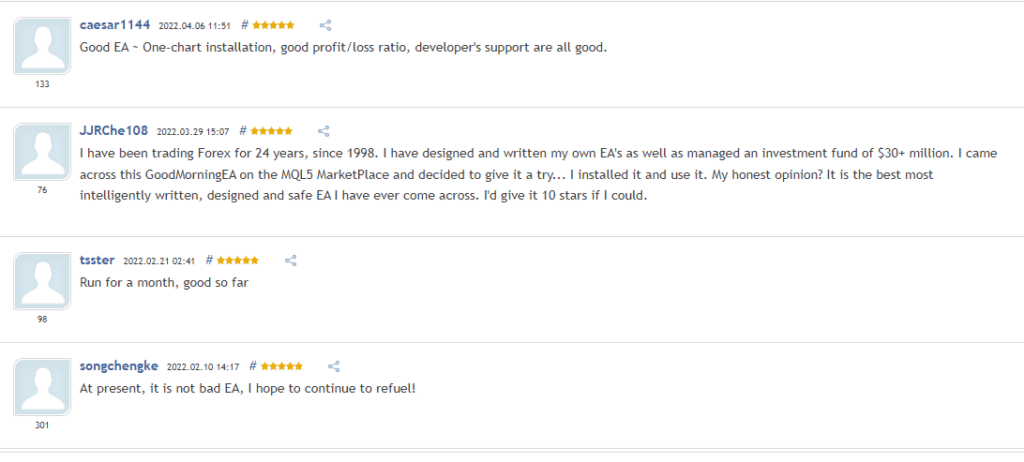

Customer reviews

We could not find any user feedback on trusted third-party sites such as Trustpilot and Forex Peace Army. However, the bot’s official site contains several glowing reviews of the GoodMorning EA. It is possible that these have been cherry-picked to paint it as a great product, which makes them unreliable. Nevertheless, here are some examples.

Leave a Reply