- US dollar regains footing after sell-off.

- Gold isunder pressure amid renewed dollar strength.

- USDJPY turns bullish amid improved risk appetite.

The US dollar was in a bounce-back mode on Thursday morning, recouping most of the losses accrued on Wednesday. The dollar index, which measures the greenback strength, bounced above the 96.00 handle after plunging to one-month lows of 95.72.

The rally on the greenback came at the backdrop of US treasury yields gathering their footing. The 10-year yield hit the highest level since late November of 1.56%, all but helping fuel the greenback strength. However, moves on the dollar remain small due to the thinned trading amid the holiday festivities. Additionally, the dollar remains on the defensive as demand for risk appetite continues to improve amid the easing concerns about the Omicron Covid-19 variant.

Gold technical analysis

Amid the renewed dollar strength on rising yields, gold remains under pressure after plunging below the $1800 psychological level. XAUUSD has come under immense pressure in recent days after failing to power through and find support above the crucial $1818 resistance level.

A sell-off followed by a close below the $1800 level leaves the precious metal susceptible to further losses. Short sellers could steer a sell-off to $1788, the next substantial support level. A breach of the support level could leave the yellow metal vulnerable to renewed sell-off to the $1770 level.

On the flip side, gold needs to bounce back and find support above the $1800 resistance level to have any chance of curtailing further downside action.

Gold price action fundamentals

Gold looks set to trade in a tight trading range as traders prepare to close their yearly books. The lack of any major releases could see limited action on the dollar likely to curtail price action on the metal. However, reports on the Omicron should be the center of attention heading, not the year-end.

Additionally, the focus is on the release of US weekly jobless claims data later in the day, likely to trigger some action on the dollar. Amid the expected economic data, year-end flows could turn out to be the main catalyst likely to trigger price action on XAUUSD.

In addition, US treasury yields could significantly affect price action by influencing dollar strength. A recent spike of the 10-year yield to 1.56% has triggered the dollar strength, all but fuelling the downside action on the precious metal.

Stronger yields all but continue to fuel the charter of the Federal Reserve hiking interest rates sooner than later, something that continues to work in favor of the greenback, all but sending the XAUUSD lower.

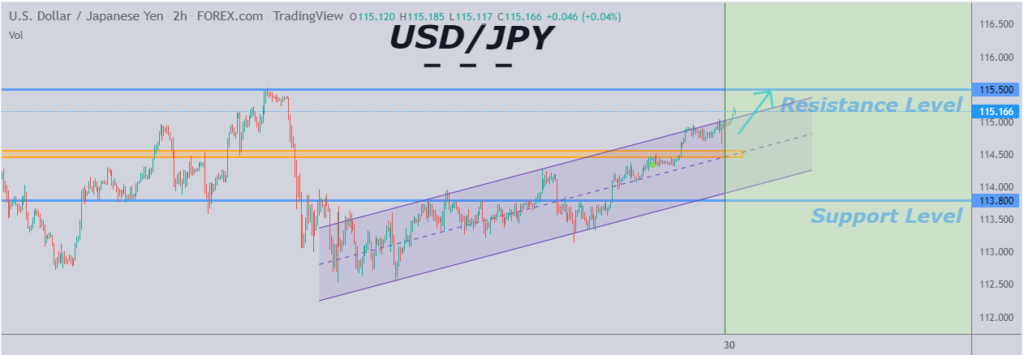

USDJPY turns bullish

Meanwhile, USDJPY powered to one-month highs as traders reacted to a spike in treasury yields. In addition to yields, the upside action on the pair remains supported by the subsiding fears about the long-term impact of the Omicron variant.

A rally past the 115.11 level means USDJPY is within the 115.50 mark, a crucial resistance level. A rally followed by the close above the 115.50 would pave the way for another leg high to 4-year highs of 117.12. On the flip side, the 114.69 is the immediate support level above which the pair remains well supported for further upside action.

The Japanese yen remains under pressure against the dollar amid subsiding demand for safe haven in the currency market. Additionally, the Bank of Japan opting to stick to accommodative monetary policy also supports yen weakness, all but supporting the bullish momentum on the pair.

Optimism that the Omicron variant will be less severe than initially feared should fuel yen weakness which could see USDJPY edging higher. Consequently, the pair looks set to finish the year on a high, with the dollar holding firm amid rising yields.

Leave a Reply