Beginner traders often feel bombarded by common forex jargon that can confuse and confound their understanding. In order to better one’s understanding of the market and stock phrases that accompany currency data, one has to know what those phrases stand for. In today’s article, we go through the definition of ‘quote’ currency and explain it in context.

What is the quote currency?

Currency pairs are made up of the currencies of two different economies. The quote currency is the counter or the second one of the two, which determines the value of the first, base currency. This second currency is the foreign one in a direct quote, and in the indirect quote, the domestic one.

Quote currency explained

Those looking to start trading currencies would do well to understand the pricing structure and quotation of currencies. Currencies are traded either directly or indirectly because novice traders must understand the secondary currency mechanics.

In the exchange rate of a pair, the value of the counter currency indicates how much of it has to be sold or purchased to purchase or sell one unit of the primary currency. If its value falls, the rate of the pair increases, regardless of whether one is trading directly or indirectly.

For instance, the rate of the Euro and the U.S. Dollar is indicated as EUR/USD, as an indirect quote. The USD is the secondary currency, while the former is the primary one. In a way, one can see the USD as a reference to ascertain one Euro’s value. From the perspective of the Euro, USD is the domestic currency.

Seen in another way, the USD/CAD is a cross of the US Dollar and the Canadian Dollar and is a direct quote with the CAD as the foreign currency determining the value of one unit of the USD.

Reading currency pair and quotes

There are a number of ways in which the secondary quote, along with the primary one, can be interpreted. Let’s take a look at a few ways that traders utilize the currency rate information.

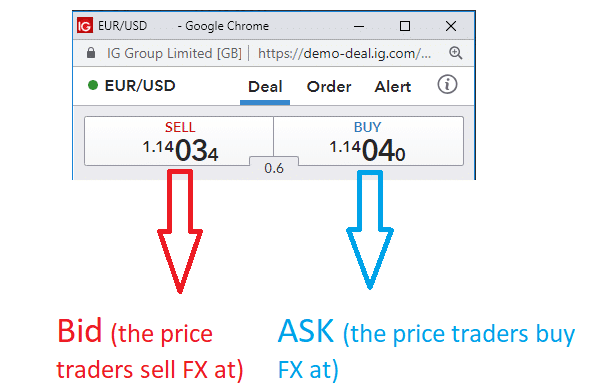

Bid and ask prices

The quote currency in a pair is also the ask price or the price at which traders buy the forex pair. On the other hand, the bid price is the rate at which the pair is sold. When prices are low, traders look to buy and sell when they rise.

If traders anticipate that a currency is going to depreciate, they can sell it now and buy it back later at a lowered price.

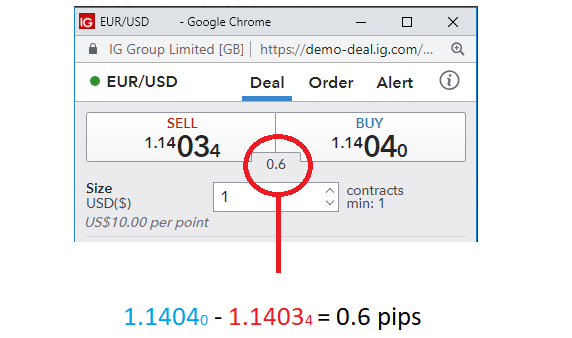

Spreads

There is always a difference between the price at which one buys a currency and sells, with the former being usually bigger than the latter. This difference is termed the ‘spread.’ This is also where most brokers take a cut for executing a trade. Spreads are smaller for currencies that are most traded due to their volatility and liquidity.

Tips for reading forex quotes

Here are a few simple tips and tricks that should assist a beginner in reading forex quotes:

- The concept of the bid and ask prices is only for the broker. Traders always purchase currency at ask and sell at the bid price.

- The quote currency is the second currency, while the base is the first one.

- The spread of a pair is the initial cost that traders have to satisfy as this pays for the broker executing the trade.

Conclusion

Understanding the fundamental ideas and concepts of forex is essential for those looking to initiate trading currency pairs. Internalizing the basic idea of a quote, and in conjunction, the base currency is critical as everything else is that follows from there.

Leave a Reply