Understanding the concept of ‘position’ in forex can open new gateways into trading styles. Position trading can also be of numerous types, which shall be explained in this article, along with the basics of position trading.

What is a Position?

The quantity of a particular financial instrument, security, or currency that an individual or group entity owns is called a position. A position can be either short or long depending on whether the position is first borrowed and then sold (short) or is it the position that is owned and then sold (long).

A position can be profitable or not depending on the changes in market trends. When the position is restated to reflect real value on the market, it is described in the cant of traders as ‘marking-to-market.’

Position basics Explained

The nominal term ‘position’ is used in various scenarios, the examples of which are given below:

- When dealers keep a cache of long positions in securities so as to facilitate rapid trading.

- When traders close a position, resulting in a profit or loss.

- When an importer of spices has a short position in dollars naturally since the dollars are going in and out of his hands all the time.

An individual can have a speculative position or a natural position as a consequence of being in a particular business. For instance, a trader can purchase USD assuming that it will appreciate in value in the near future and that is considered a speculative position. On the other hand, a business trading with the USA will be paid in US dollars and that is a long natural position of being in the business.

The trader holds his speculative position up until he decides to trade it in and get a profit or loss. But, in the natural position of the business, one cannot just let go of the dollars in the same way. The businesses then, in order to cushion themselves against the fluctuations in the currency rates, may maintain a ‘hedge’ and filter their incomes via an offsetting position.

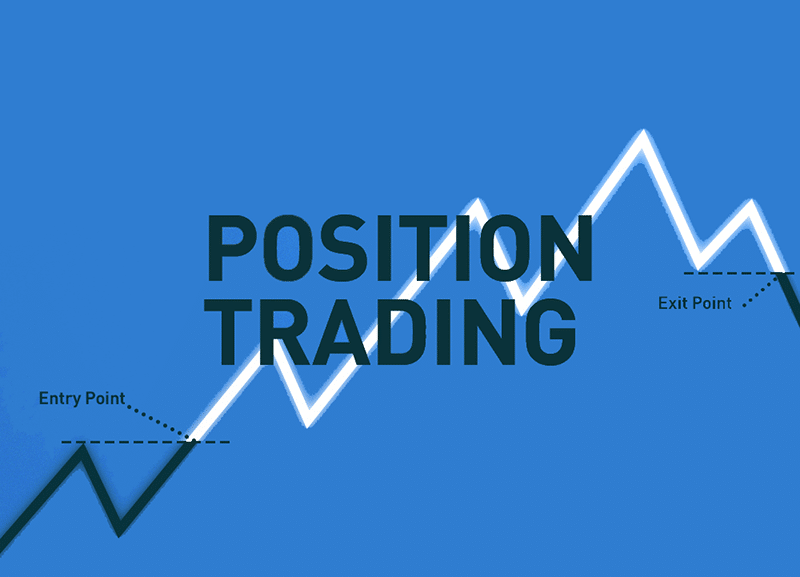

Position Trading

This form of trading also involves the longest time spans, which can have trades lasting from many months to years. Such traders do not mull over price movements in the short term and profit from looking at trends over a long period of time.

To understand position trading better, one has to have a sufficient understanding of its fundamentals and how the economic data impacts the trends of currency pairs in the long term.

Since this type of trading involves long stretches of time, one can expect the stop losses to be quite big but the profits are also incredibly huge. A trader needs to have a lot of capital, patience, and a thick skin to execute this type of trading. One’s analysis has to be spot on as well if one is to get through the tides of market swings.

Position trading also involves technical analysis and it benefits traders as much as fundamental analyses do.

Some of the tools and strategies that position traders utilize include the following:

- Trend trading using Moving Averages (MA)

- Trading using Support and Resistances

- Breakout trading

- Pullback trading

Conclusion

The concept of ‘position’ is basic to the forex world and traders. Trading based on positions is also another style that one has to know about but one that requires great resources, both monetarily and psychologically. Both fundamental and technical analyses are used to better judge the market conditions and price movements to execute long-term trades.

Leave a Reply