Entry orders are ideal for those who seek to sell or buy at a particular price and do not have the luxury of time to observe the market until the price gets met.

What is a stop-limit entry order?

Stop limit orders combine limit orders and stop orders. It begins by using a stop-limit order upon reaching a stop price, this order thus turns to limit order and a commodity gets sold or bought at a particular amount or more. Such order types share similarities with stop limit on stop and quote on quote orders.

These order types are perfect for investors and traders who choose to do trades that have features of both limits and stop orders. In a situation where a trader implements a limit entry order, such a trader believes that the prevailing market price will change direction after they reach the entry limit order price.

How to use stop and limit orders

- When you are in the row you desire, go to the limit columns and select it. When there, select a limit and make your choice for such an order.

- Navigate to the open position window and get it right-clicked. Choose the limit and select the order preference.

- When you get to the trade tab, select limit. After doing this, proceed to choose the position you desire in the Set Limit Order icon. Go on to set the preferences for your limit order.

What are limit orders?

A limit order is an order which can get implemented on an open or pending position. In the case of an open position, the order will get the position closed in a situation where the asset attains the pre-set value and this makes sure there is profitability. Such an order is also known to take profit orders. Also, a profit order assists traders to sell or buy an asset at a price or even better.

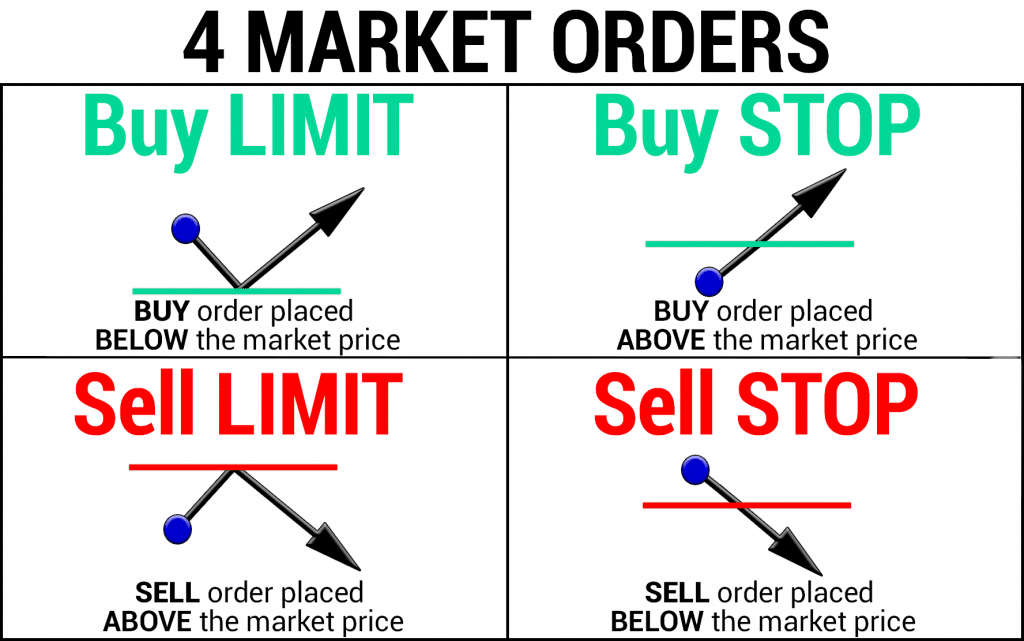

Limit orders come in two forms, which are sell limit orders and buy limit orders. Sell limit orders entail selling of an asset at a price in line with the limit price or beyond. A buy limit order has to do with purchasing an asset at a particular price or lower than it. Such orders are quite important for investors as they help in mitigating risk exposures while scaling profits.

How limit orders work

- Sell limit orders: Sell limit orders represent a pending order requesting to open a sell position in a situation where the value of an asset rises to or beyond a value. What the trader does is to create a sell limit. It happens in a situation where the trader believes that the value of the asset will fall when the position gets opened.

- Buy limit order: A buy limit order represents a pending order requesting to buy an asset in a situation where its value falls to or below a certain amount. The trader proceeds to create a buy limit if she or he feels the value of the asset will rise when the position gets opened.

- Sell stop orders: Sell stop order is a pending order, which creates a sell position in a situation where the value of an asset falls to or below a fixed number. What the trader does is to open a sell stop if she or he opines that the value of the asset will fall further after the opening of the position.

- Buy stop orders: This is a pending order designed for purchasing an asset in a case where the inherent value climbs to or beyond the fixed value. What the trader does is to create a buy stop if she or he opines that the value of the asset will grow after the opening of the position.

Recap

Understanding entry orders is important for investors looking to avoid the traps found in trading. Limit and stop entry orders determine when to dive in and pull out, and they play a great role in minimizing losses and making a reasonable profit.

Leave a Reply