When it comes to the sheer trading volume, no market is comparable to the forex. On a daily basis, it turns out trade in excess of $5 trillion. The pairs on this market are traded, which is why it is incumbent upon anyone looking to get a piece of the forex pie to get thoroughly acquainted with currency pairs. Starting out with forex trading requires one to understand how currency pairs function?

But what are currency pairs? Currency pairs consist of two different currencies with coupled exchange rates.In this article, we will go through the basics and see which currency pairs make up the bulk of the trade. An example of this is shown in the image below.

The pegging of the two against one another indicates their comparative market value. The quantity of one currency necessary to get one unit of the other constitutes the pair. All of them have codes that are exclusive to them, which is how traders recognize specific currencies.

Currency Pair Basics

The pairs are speculated and traded in the forex market. It is also where most of the conversion takes place for the purposes of investment, tourism, and trade. The market is open throughout the day and has a five-day week.

Even though both currencies are being simultaneously bought and sold, we can consider the pair as a single entity. Where stock markets include one of the two, trading currency pairs involves both – buying and selling – together.

Their respective valuation is determined by many factors, some of which are listed below:

- Interest rates

- Economic news

- GDP

Major Currency Pairs

Not all currency pairs are traded equally. In fact, there are a few that constitute the lion’s share of the trading that takes place every day. These are seen as the major pairs for they are responsible for most of the forex volume. These include the following:

There are a few of these that represent commodity-rich countries and are deemed commodity pairs. It is these changes in the price of the particular commodity that affects their value. Most of these tend to have very small spreads.

Minor Pairs and Exotic Pairs

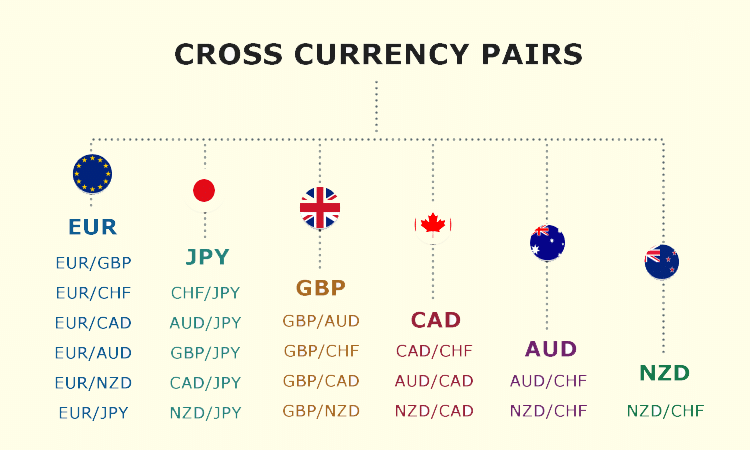

All the ones that do not trade against the USD but still make up a decent amount of daily trade are considered as minor pairs. Also referred to as crosses, their spreads are comparatively larger, though not quite as liquid as the major pairs. Some of these are mentioned below:

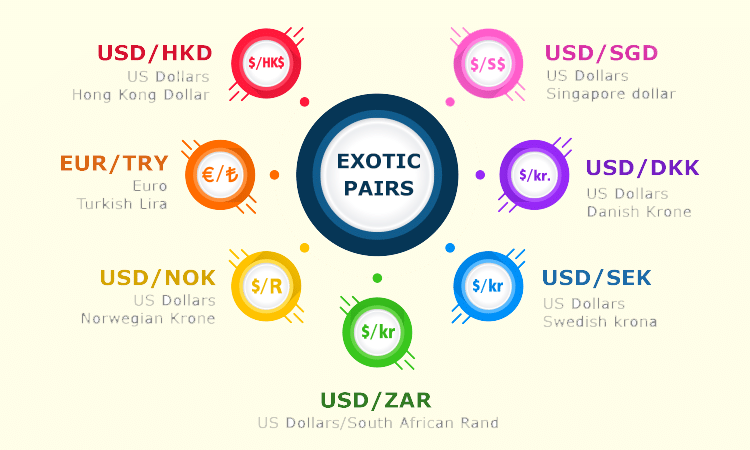

Lastly, there are some pairs that constitute the economies of upcoming and developing markets. These are termed exotic pairs. They represent only a very small portion of the forex pie and they tend to have spreads that are bigger than the other two types of pairs. Some of them are given in the image below:

Conclusion

There are a few other names and classifications of pairs that traders use in their daily cant. But, their usage is restricted to traders trading those particular pairs. In general, as long as one knows and understands the basic pairs, one is good to go.

The information contained in this article should be seen as a primer into the world of forex and the business of currency trade. There is much to learn about them and the more one knows, the better decisions one will be able to make. From here on out, one has to start considering how these pairs are influenced by economic information and how to trade them.

Leave a Reply