- UK Business confidence jumped 6% points to 36% in August 2021 (YoY).

- Approximately 13% of UK businesses that were not stopped from trading at the height of the pandemic reported lower-than-normal stock levels.

- The US GDP rise of 6.6% in Q2 2021 (QoQ) failed to meet analysts’ estimates at 6.7%.

The GBPUSD pair added 0.50% as of August 27, 2021, to close at 1.3780. It gained 1.08% in the week ending as the British pound strengthened on initial jobless claims in the US.

Confidence growth

Business confidence among UK establishments jumped 6% points to 36% in August 2021 (YoY). In a survey conducted by the Lloyds Bank, economic optimism also rose 6% in August 2021 (MoM) after it dipped in July.

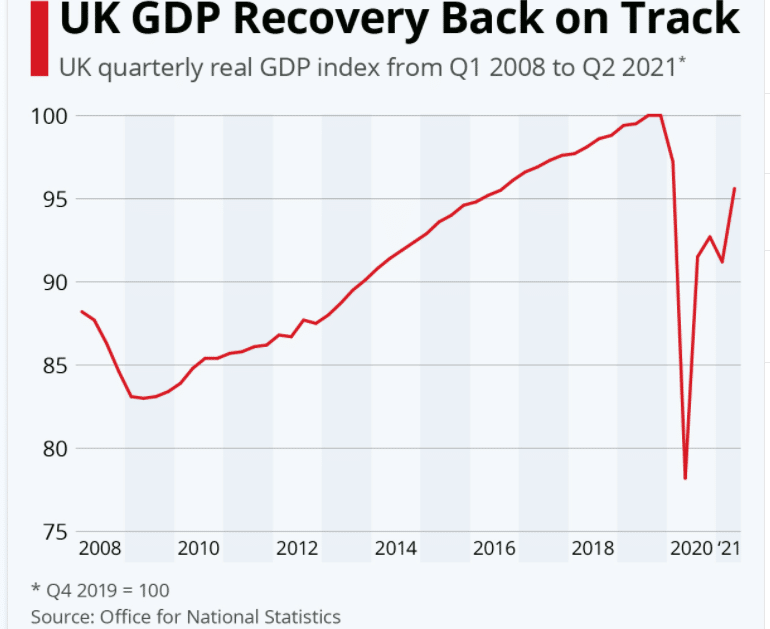

After a 1.6% decline in GDP in Q1 2021, the UK economy gained 4.8% in Q2 2021 after the ease of restrictions occasioned by Covid-19. The three months leading to June 2021 saw monthly GDP estimates rise by 2.2%, 0.6%, and 1.0%, respectively.

Further, a third of UK businesses forecast a 2% pay rise for employees by August 2022, while 17% expected wage growth of more than 3%. This salary increase was the highest since 2018, indicating a strong recovery of the UK economy.

Despite the positive wage numbers, the British pound lost 0.34% against the kiwi owing to an increase in coronavirus cases in the UK.

Low stock levels

Approximately 13% of UK businesses that were not stopped from trading at the height of the pandemic reported lower-than-normal stock levels. Those from the food and accommodation sectors recorded the lowest levels at 27%, followed by wholesale/ retail trade at 25% and manufacturing at 23%.

Despite supply challenges, more than 17% of manufacturing/ construction businesses intimated that they were able to source locally available materials and services.

US GDP

Q2 2021 saw the US GDP rise 6.6% (QoQ) against a previous record of 6.5%. The increase was, however, insufficient to meet analysts’ estimates at 6.7%, thereby hurting investors’ confidence in the dollar.

The US dollar fell 0.91% against the kiwi (NZD), declined 0.43% against the Canadian dollar, and was down 1.27% against the South African rand (ZAR).

An increase in GDP somewhat indicated improved customer expenditures into the second quarter coupled with higher US exports. Spending increased from an estimate of 11.8% to 11.9% in Q2 2021. Exports surged 6.6% against a prior record of 6%. On their part, imports declined from 7.8% to 6.7% in the quarter.

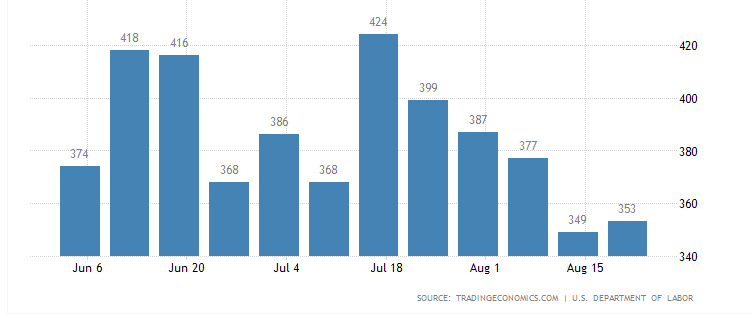

Initial jobless claims rose to 353K from 349K, representing a 1.15% rise in unemployment numbers.

The week that ended on August 21, 2021, saw an increase in worker shortages with the resurgence of the Covid-19 pandemic. Initial jobless claims levels are yet to recover from the 200,000 marks last seen during the pre-pandemic times.

More than 20 US state governors have terminated the federal unemployment claims benefits that also include the weekly $300 payout. This removal was seen as an incentive to help potential workers look for jobs but is yet to bear maximum fruits.

Technical analysis

The GBPUSD pair is currently testing the 1.35390 support levels and has inched up above 1.37000. A breakdown below this level will allow the price to test the psychological level of 1.35314.

The pair is slightly riding above the 9-day EMA at 1.3757, indicating a possible bullish continuation. The 14-day RSI also suggests improved buying momentum at 42.21.

Prices may bounce towards 1.39913 before meeting resistance at 1.40163.

Leave a Reply