- The U.S. dollar turned bullish on Thursday following a hawkish FED report that signaled rate hikes.

- The British pound remains under pressure amid a resurgent greenback also weighed down by COVID-19 concerns.

- EUR/JPY also turned bearish amid euro weakness and the Japanese yen that continues to hold firm against the major.

- Concerns about rate hike are the catalysts weighing heavily on U.S. stocks curtailing gains on indices.

The U.S. dollar is the center of attention in the aftermath of a hawkish Federal Reserve decision. The FED signaling it will start raising interest rates as early as 2023 has sent shockwaves in the market, sending majors, and commodities lower.

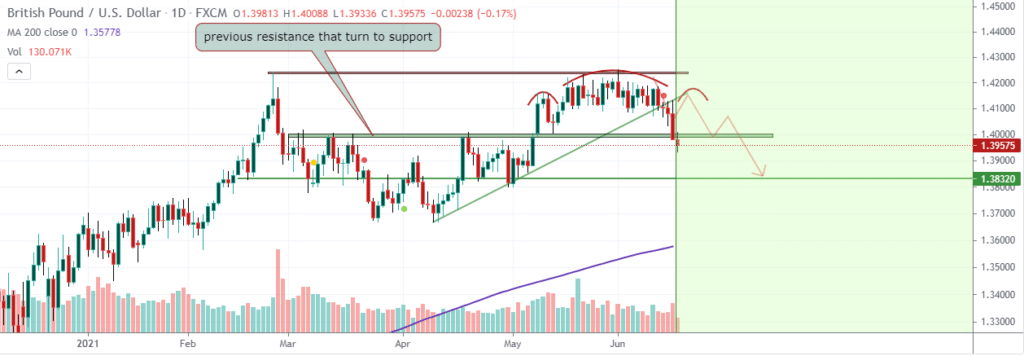

GBP/USD is one of the pairs under immense pressure in the aftermath of the dollar index powering through the 91 levels and heading towards the 92 levels. The pair has tumbled to one-month lows and remains under immense selling pressure.

GBP/USD slipped through the 1.40 level amid raising concerns about a spike in COVID-19 cases in Britain. The Delta variant is causing havoc raising serious concerns about economic recovery. Additionally, the Northern Ireland protocol standoff pitying the European Union also weighs heavily on the pound.

EUR/JPY drop

EUR/JPY is one of the crosses under immense pressure as the euro remains under pressure amid renewed bid tone on the dollar. The pair has since dropped to one month-lows and looking increasingly bearish as the common currency continues to lose ground against the majors.

The pair is struggling for support near the 132.00 level, a crucial level below which further sell-offs could come into play.

The euro has come under immense pressure in recent days on the European Central Bank failing to provide clarity on the next course of action on the monetary policy front.

Gold under pressure

Gold snapped its recovery mode in the commodity market and edged lower Wednesday morning as it continues to feel the full force of a resurgent U.S. dollar. XAU/USD has since dropped below the $1800 level and looks increasingly bearish.

With sellers in control, the focus is on the $1780 level, a key support level below which XAU/USD could tank to the $1750 level.

The bulls will have to push the pair above the $1817 level to have any chance of regaining control from bears.

Rate hikes prospects rattle indices

The FED signaling that it could hike interest rates sooner is the catalyst piling pressure on the precious metal that struggled to find support above the $1900 level. Amid the Fed-induced blow, focus now shifts towards the U.S. jobless claims data for new trading signals.

Major U.S. indices remain under pressure on the FED, fuelling the suggestion of rate hikes in the stock market. A rate hike would be detrimental as it could push borrowing costs up, which could take a significant toll on many companies.

Fears of a spike in borrowing costs explain the 265 points slide in Dow Jones Industrial Average immediately after the FED report to 34,033.67. Tech-heavy NASDAQ also came under pressure tanking 0.2% to 14,039.68. The S&P 500 also snapped tanking 0.5% to 4,223.06

The FED failing to indicate when it plans to begin cutting back on the aggressive bond-buying program helped avert further slides in the stock market. The FED has been buying $120 billion worth of bonds every month, a development that has helped offer support to the equity markets.

Cryptos struggling for direction

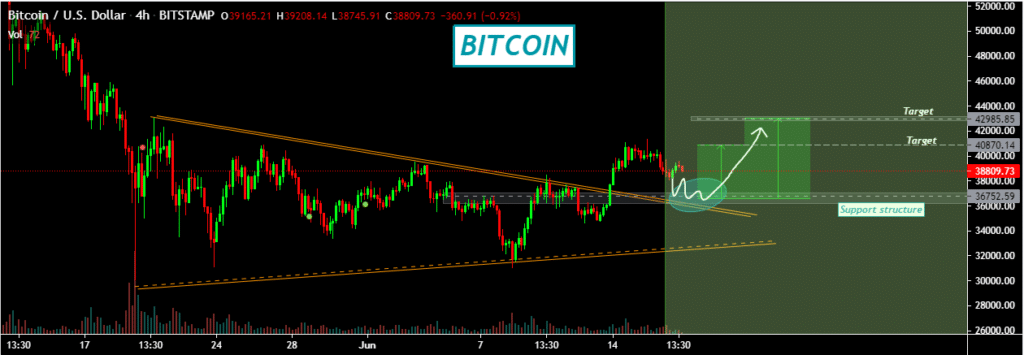

In the cryptocurrency market, Bitcoin and Ethereum were struggling for direction in the aftermath of the dollar turning bullish. BTC/USD tanked from above the $40,000 psychological level as bulls struggled to push the pair higher after the recent spike.

Bitcoin failing to rally and find support above the $40,000 level could trigger renewed sell-off given the lack of catalysts needed to fuel price gains.

Ethereum also remains susceptible after a 40% plus slide from record highs. The second-largest cryptocurrency by market cap has been struggling for direction ever since it dropped from record highs above the $4,300 level.

Leave a Reply