- The end of quantitative easing in the UK and an expected rise in interest rates are likely to boost the GBP.

- The UK economy is on a recovery path following an end to lockdowns and successful mass vaccination, but the energy crisis poses a big challenge.

- USD faces many challenges, with Evergrande still in the red, a debt ceiling crisis, and low jobs being key factors.

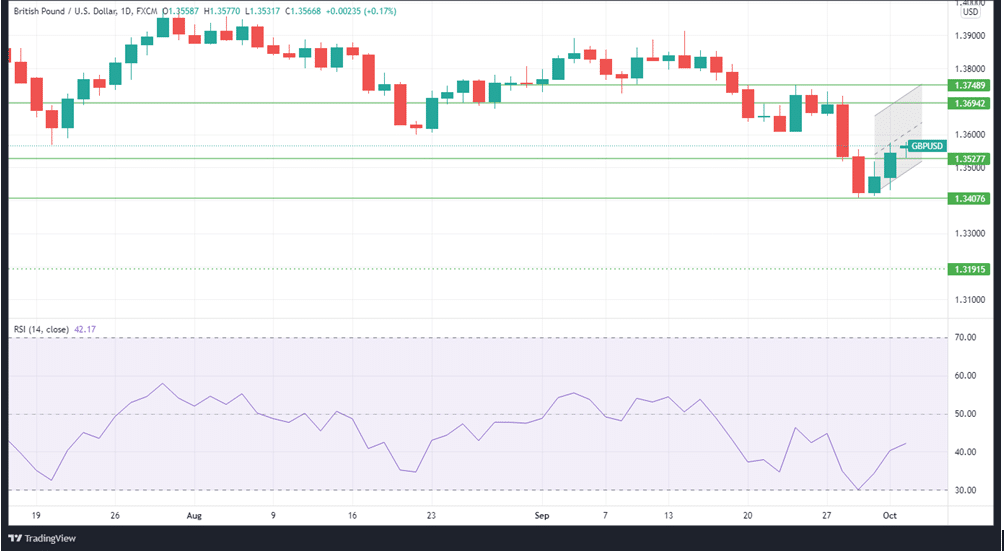

The British pound began the week by strengthening further against the US dollar in early Monday trading, gaining 0.17% in 24 hours to trade at 1.3566. The dollar ended last week in a weak position against the pound, with the GBPUSD pair hitting daily highs of 1.3574 on Friday.

An end to quantitative easing and inflation in sight

The UK is almost coming to an end of its quantitative easing program, and the Bank of England is likely to start raising the interest rate to tackle inflation. As the 895 billion pound bond-buying by the BoE comes to an end, the UK economy is expected to have less liquidity, which could strengthen the British pound.

The other important factor on the UK monetary policy in the medium term will be taking measures to keep inflation low. Currently, the UK inflation is standing at 3.2%, and with the end of the bond-buying spree, the inflation rate is expected to exceed 4% by the beginning of next year. The performance of the pound will also be greatly affected by the rising inflationary pressure, global debt, and the performance of China’s economy.

Evergrande paralysis and low jobs figures eating up the dollar

The US dollar is also fighting to maintain its strong standing in the global market despite the Evegrande situation still weighing it down. Today, the USD lost ground over a majority of currencies, with the DXY dollar index 0.06% lower at the time of writing. GBPUSD, however, may face turbulence as the UK energy crisis worsens.

US debt woes are another significant factor at play. The uncertainty surrounding the push to raise the US debt ceiling is likely to create negative sentiment around the US economy and the USD. In addition, joblessness figures remain a big concern.

In the new week, investors will be keen on the non-farm payrolls data set for release on Friday. An improvement in the number of jobs will be much needed among dollar bulls, especially after the last jobs figures missed the target by more than 50%. If the jobs surpass the 460 K consensus estimates, it will raise hope of the Fed keeping its word about a potential end to tapering before the year ends.

Another catalyst that the traders are expected to keep their eyes on is the US government bond market. The 10 year Treasury yield has finally managed to find support at 1.45% and is focused on the upward direction. This is likely to provide more ground for the USD rise, especially if it hits the 1.50% resistance mark.

Technical analysis

GBPUSD is currently trading at 1.3566, and has been on an uptrend over the last two trading sessions. The pair depicts a strong market momentum, which has seen its RSI rise from an 18-month low of 29 to the current 41 in the past 5 days.

If the bullishness continues, the pair may rise to find the first resistance at 1.3694 and the second support at 1.3748. However, if the bears win back some control, GBPUSD price may slide to the first support at 1.3527 and the second support at 1.3407.

Leave a Reply