- The ease of travel restrictions between the UK and US will see an exchange of 9.5 million visitors.

- The US CPI index also rose 0.81% to 269.20 from 267.05, beating estimates at 268.47.

- The UK’s recovery is dependent on complete reopening in June 2021.

The GBP/USD pair traded at a +0.42% change on June 10, 2021, from the previous day. It hit a high of 1.4177 after opening at 1.4119.

The British pound edged higher against the US dollar on the day that saw the first in-office meeting between Prime Minister Boris Johnson and President Biden in the UK. The meeting comes days ahead of the G7 summit held in England from June 11-June 13, 2021.

Among the key takeaways from the meeting was the ease of travel restrictions that would see an exchange of 9.5 million visitors. Britain expects 4.5 million tourists from the US, while America will receive 5 million British visitors.

Jobless claims

Data on US jobless claims in the week leading to June 4, 2021, failed to beat estimates at 376,000 instead of the anticipated threshold of 370,000. The claims declined 7.16% from a previous record of 405,000.

However, continuing jobless claims beat estimates by 2.86% by declining to 3.499 million from a forecast of 3.602 million. Continuing jobless claims dropped 6.87% from a high of 3.757 million.

May 2021 also saw CPI data jump 5% year-on-year from a previous record of 4.2% and 0.6% month-on-month. This inflation data was the highest increase since August 2008.

A hike in the prices of used cars was attributed to this surge in CPI. The core CPI for May 2021 (year-on-year) also soared 3.8%, beating estimates at 3.4%.

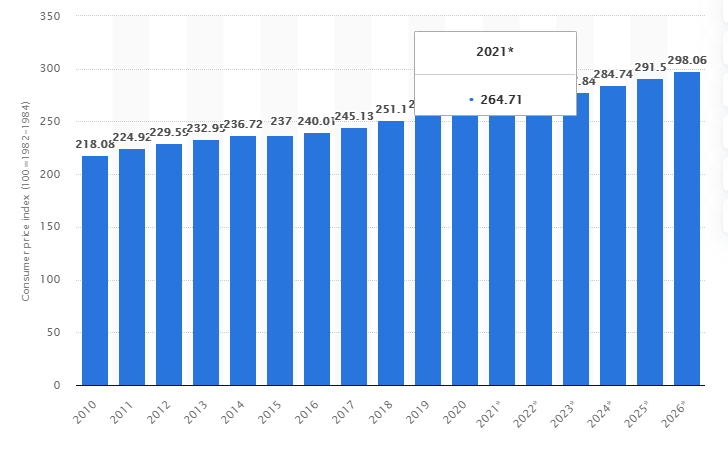

Projected CPI index

The US CPI index also rose 0.81% to 269.20 from 267.05, beating estimates at 268.47. The earlier projection had also indicated that the index would hit 264.71 in 2021.

UK economic growth

The British Chamber of Commerce (BCC) forecast on June 10, 2021, indicated that the British economy would grow by 6.8%. However, the BCC opined that the country’s recovery was dependent on complete reopening later in June 2021.

Continual easing of the restrictions would see growth in Q2 and Q3 of 2021, with a return to pre-pandemic levels expected in Q1 2022 at 5.1%. The increase is, however, dismal compared to the 5.5% predicted earlier.

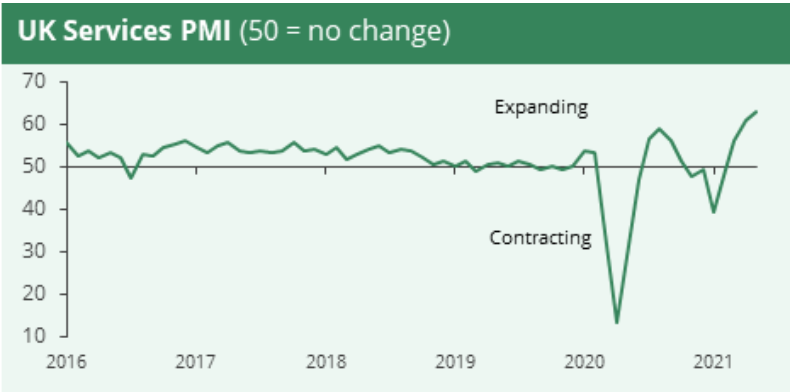

Q4 2020 saw the services sector account for 82% of the UK’s employment and 81% of the total output. The index of services (IoS) rose 1.9% in the two months leading to March 2021. May 2021 saw the UK services PMI surge 62.9 (+3.11%) from the April PMI data.

UK Services PMI (2016-2021)

The PMI increase of 3.11% between April and May 2021 is the quickest expansion in the UK in 24 years, indicating a solid resurgence into Q3 2021.

Atlantic Charter

Ahead of the G7 meeting, the US and UK ratified the Atlantic Charter that will guide the two nations’ cooperation on strategic aspects (globally).

However, the US emphasized that a trade deal between the two nations would be contingent on the UK honoring North Ireland’s peace agreement post-Brexit. The UK is focused on securing the trade deal and will work on securing the relationship by also calling for the US to rejoin the Paris Climate agreement and the WHO.

Technical Analysis

The GBP/USD formed support at 1.4078 and is getting closer to the resistance at 1.4242.

Increased buying momentum is shown by the 14-day RSI at 67.0 (the indicator is in the overbought zone). At 1.4175, the pair is running above the 9-day EMA at 1.4174.

Leave a Reply