- A -2% drop in the FTSE 100 index is likely to see a rise in UK inflation above 1.2% in 2021.

- UK retail sales increased by 7.3% in April 2021.

- March 2021 saw US unemployment insurance benefits surged 37.79% to $5.36 billion.

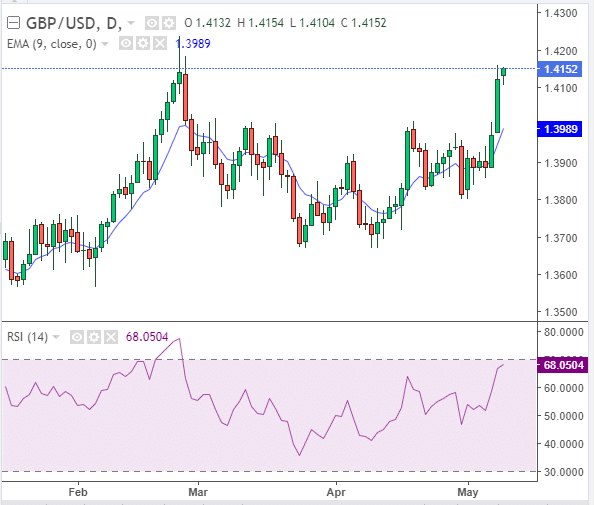

The GBP/USD edged 0.10% higher on May 11, 2021, to 1.4135 after closing 1.4120 the previous day. The economic forecast for the UK grew to 5.7% in April 2021 compared to February’s 3.4% growth prediction by the National Institute of Economic and Social Research (NIESR).

PM Johnson’s Conservative Party won majority seats in the local UK elections, setting the government’s stage for improved job training. While intending to level up employment opportunities, the government also wants to improve new home construction laws.

However, the pound growth was impeded by the FTSE 100 index that declined 2.34% on May 11, 2021, to open at £6,957.01. Many UK businesses had entered the second quarter of 2021 in financial distress (the quickest in 7 years), with most facing insolvency due to the COVID-19 pandemic.

However, the retail market is expected to boost the economy as the government reopening takes shape after a vast vaccination exercise.

Retail sales and inflation

April 2021 saw retail sales inch up 7.3% compared to April 2019. Data by the British Retail Consortium (BRC) also indicates that sales of non-food items sold online increased 57% in the month compared to 4.3% in 2019.

However, the boost in retail sales has not reflected a rise in employment numbers since almost 530,000 retail sector employees are still on leave. Further, after the FTSE 100 index declined more than 2%, UK companies are set to worry about the rising inflation.

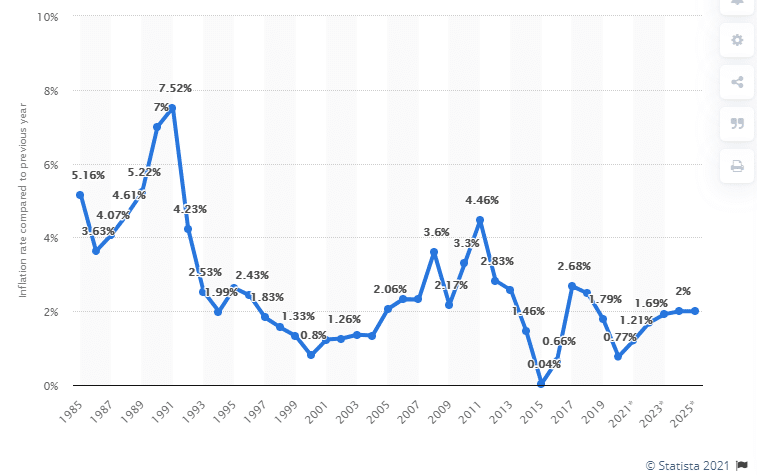

Inflation forecast for the UK economy

Inflation is likely to rise to 1.21% in 2021, after a drop to 0.77% in 2020. The target of 2% may be attained by 2025 due to increasing food and non-food prices after the ease of the lockdown.

The UK economy has rebounded sharply after a 2.2% GDP decline in January 2021. Monthly data saw a 0.4% expansion in February 2021 as businesses increased their inventory stock-build in preparation for the reopening.

Additionally, after the IHS Markit Construction PMI increased to 61.6 in April 2021, the house prices have gone ahead to increase by 1.4% MoM. UK house prices surged +8.2% year-over-year at an average price of £258,204.

US unemployment benefit worries

The US has come under fire over increasing unemployment benefits as compared to the number of jobs added to the market. The unemployment rate jumped 6.1% in April 2021 after 266,000 jobs were added in the US.

While analysts had predicted an additional employment range of between 900,000 to 2 million into the second quarter of 2021, about 7.4 million posts were unfilled. The view is seen that individuals will reject suitable employment on the pretext of continuing to receive the unemployment benefits under Biden’s rescue plan.

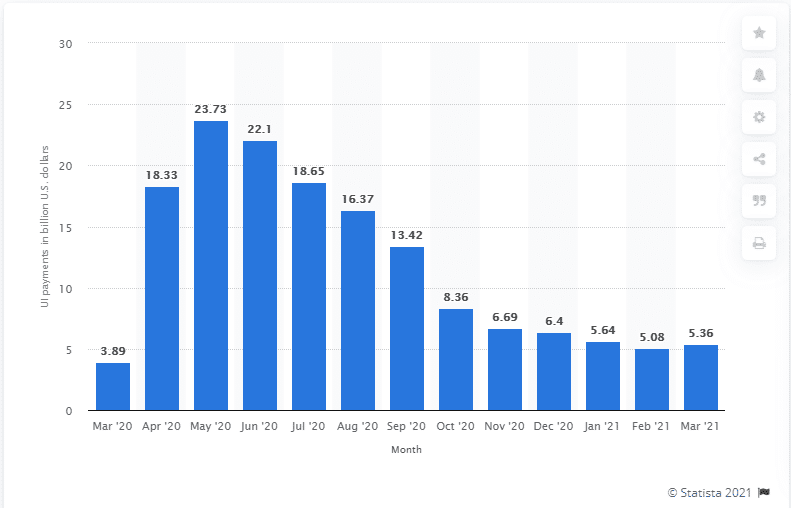

Total unemployment insurance benefits paid by the US since March 2020

Unemployment insurance benefits have surged 37.79% in the US YoY as of March 2021 at $5.36 billion. May 2020 saw the government hit its highest payout in the sector at $23.73 billion. This provision may decrease into Q2 2021 as the government seeks to encourage employment firms to incorporate return-to-work formulas.

The government had hoped to hit 1 million jobs by the end of the first quarter. Thus 260,000 is slightly an understatement. US President Biden reiterated that the economic rescue plan was pegged on employment through a fair wage system and the provision of a proper working environment.

Technical analysis

The GBP/USD trading pair rose above the 9-day EMA that stood at 1.3989. The pair is headed towards the 1.4200 resistance zone as the buying pressure continues to grow.

GBP/USD trading pair analysis

Continual surge in the pound may see the pair break this barrier. The 14-day RSI registered a strong upward momentum at 68.0504.

Leave a Reply