The GBPUSD rose on Friday after the weak US consumer confidence data. The pair ended the week at 1.3870, which was slightly higher than the day’s low at 1.3972.

UK economic data

The GBP/USD will be in focus this week as the UK is set to publish several important economic numbers.

With the UK economy recovering, analysts anticipate that the country’s labour market will continue to tighten. They expect that the unemployment rate remained unchanged at 4.8% in June. If accurate, the unemployment numbers will be better than that of the US and the European Union average.

Further, they assume that wages also continue growing. Without bonuses, wages grew from 6.6% to a record high of 7.4%. With bonuses included, wages grew from 7.3% to 8.7%. The numbers will also likely show that the claimant count fell substantially in July.

The Office of National Statistics (ONS) will then publish the latest UK inflation numbers on Wednesday. Analysts expect that the headline inflation fell from 0.5% to 0.3% in July on a month-over-month basis. They also expect that the CPI retreated from 2.5% to 2.3% on a YoY basis.

At the same time, they expect that the so-called core CPI declined from 0.5% to 0.2% and from 2.3% to 2.2% on the MoM and a YoY basis, respectively. Last week, data from the US showed that the headline inflation remained at a 13-year high of 5.4%, while core CPI retreated slightly to 4.3%.

In its recent monetary policy meeting, The Bank of England (BoE) said that it expects inflation to pick around 4% and then fall back to its 2% target.

The ONS will also publish the July PPI input data, which is expected to be at 10.8% from 9.1% on a YoY basis. The PPI output data is also expected to rise to 4.8% from the previous 4.3% on a YoY basis.

UK retail sales data

The retail sector is an important indicator of consumer spending. Therefore, the GBP/USD will also react to the UK retail sales numbers that will come out on Friday.

UK’s retail sales are expected to moderate at 6.4% from 9.7% on a YoY basis, while the MoM retail sales are expected to remain unchanged at 0.5%. The Core retails also expected to remain unchanged at 0.3% on the basis, but they are expected to moderate at 5.3% from 7.4% on a YoY basis.

These numbers will come after the US has released its own retail sales data. The MoM is assumed to drop from 0.6% to -0.2%. The core retail sales are also expected to drop from 1.3% to 0.2% on a month-over-month basis.

While the retail sector is expected to do well, the biggest risk for the economy is the new Delta Variant of Covid-19. On Friday, the UK reported more than 32000 cases which are significantly higher than where they were between March and June.

GBPUSD technical analysis

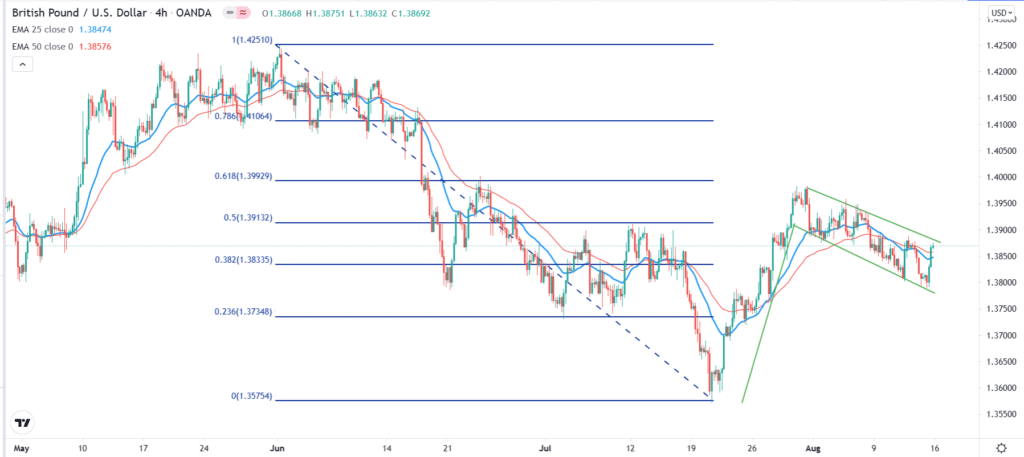

Turning to the four-hour chart, we see that the GBP/USD has formed several bullish patterns. For one, it has already moved above the 25-day and 50-day Exponential Moving Averages (EMA). Further, it has formed a bullish flag pattern that is shown in green. It has also formed an inverted head and shoulders pattern and is approaching the 50% Fibonacci retracement level.

Therefore, the pair will likely maintain a bullish momentum later this week. If this happens, the next key level to watch will be the July 31st high of 1.3980.

Leave a Reply