The GBPUSD pair jumped on Thursday after the Bank of England (BOE) delivered a relatively hawkish interest rate decision. The pair rose to 1.3750, which was 1% above this week’s low of 1.3610.

BOE interest rate decision

This was a central bank week as multiple banks met and delivered their interest rate decisions. Among them were the BOE, Federal Reserve, Norges Bank, and South Africa Reserve Bank (SARB). Others were the Brazilian and Turkish central banks.

On Thursday, the BOE concluded its monetary policy meeting and sounded a bit hawkish. It left interest rates unchanged at 0.10% and pledged to continue with its asset purchase program for a while.

But in a statement, Andrew Bailey, the BOE governor, said that some tightening was necessary for the coming months. This tightening will first involve a slowdown in the pace of asset purchases, commonly known as tapering.

Tapering will be followed by the gradually raising interest rate that is expected to start in March next year. Analysts believe that the BOE will be among the first central banks to start raising interest rates.

Inflation estimate

Another notable part of Thursday’s interest rate decision was the estimate of inflation by the BOE. The bank expects that inflation will keep rising and peak at about 4%. Recent data showed that the headline consumer inflation rose from 2% to 3.2%. The BOE has an inflation target of 2%.

There are several reasons why prices are expected to rise. First, there is an ongoing energy crisis that has even pushed some smaller energy prices out of business. This happened as the price of natural gas jumped considerably recently because of Russia’s controls.

Second, there is an ongoing labor shortage in the UK. This has pushed more companies like BP to hike their salaries in a bid to attract more workers. Third, there is an ongoing supply shortage that is affecting most industries. Finally, a shipping challenge globally has forced many companies to hike prices.

Meanwhile, the GBPUSD rallied as investors reflected on fears of stagflation in the UK. Stagflation happens when an economy is slowing down at a time when inflation is rising. Data published on Thursday by Markit showed that the output of UK manufacturers and service providers declined in September.

Federal Reserve

The GBPUSD pair rose after the relatively hawkish Federal Reserve decision on Wednesday. Like the Bank of England, the Fed left interest rates unchanged at between 0% and 0.25%. It also pledged to continue with its $120 billion per month asset purchase program.

The Fed also sounded a bit hawkish, with the dot plot pointing to between 6 and 7 rate hikes between 2022 and 2024. Also, in a statement, Jerome Powell hinted that the Fed will likely start its tapering plan in the coming year.

The Fed decision led to a sharp decline of the US dollar. This was partly because some analysts were expecting the Fed to start tapering later this year.

GBPUSD forecast

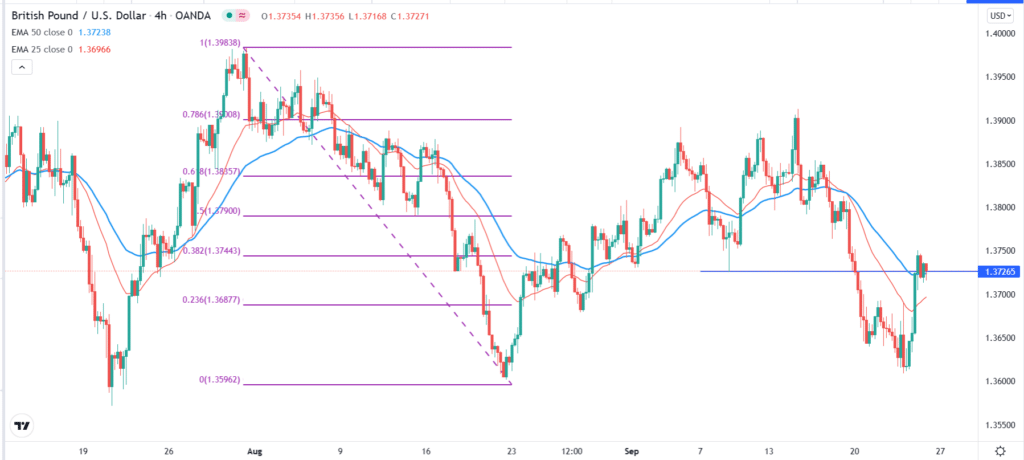

The four-hour chart shows that the GBPUSD is trading at 1.3725. This is a notable price because it is along the neckline of the double-top pattern that happened this month. The upper part of this double-top pattern was at around 1.3900. The pair is also slightly below the 38.2% Fibonacci retracement level. It has also jumped above the 25-day and 50-day moving averages (MA).

Therefore, the pair will likely keep rising as bulls target the key resistance at 1.3790, which is along with the 50% Fibonacci retracement level.

The GBPUSD 4-hour price chart

Leave a Reply