The GBPUSD pair has been under intense pressure in the past few weeks. This trend has happened as Brexit risks return and as the market waits for the upcoming UK inflation and retail sales data. The pair was trading at 1.3435 on Tuesday morning. This price was about 6% below the highest level this year.

Brexit risks remain

The UK and the European Union reached a Brexit agreement in December last year. Since then, the two sides have had a cordial relationship, and trade has gone on well. The UK economy has also done relatively well during this time.

However, in the past few months, the UK has said that it wanted to change some parts of the agreement. The main issue is that the UK wants the EU to change its policy about Northern Ireland, which is a part of the UK.

Precisely, the country wants the UK to remove the European Court of Justice from having a role in it the protocol. It also wants to reduce the amount of paperwork needed for goods moving between mainland Britain and Northern Ireland. These challenges have been blamed for the ongoing UK supply shortages. In its part, the European Union has committed to making concessions to handle the situation.

At the same time, the UK has threatened to abandon Article 16 if the EU fails to meet its demands. If this happens, the country will be open to imposing tariffs on goods from the EU. Of course, the EU will retaliate by adding tariffs to goods from the UK. Such a trade war would have major implications for the UK and the GBPUSD.

UK inflation data

The GBPUSD pair will next react to the latest UK inflation data that will come out on Wednesday. These numbers are important because they are useful when the Bank of England (BOE) meets to deliberate on interest rates.

These numbers are expected to show that UK inflation jumped in October. This trend will be attributed to the energy sector, considering that natural gas, coal, and crude oil prices have rallied substantially in the past few months. Gas has jumped to an all-time high while crude oil is hovering near its highest level in more than seven years.

Economists polled by Reuters expect the data to show that the country’s headline inflation jumped from 3.1% in September to 3.9% in October. Some analysts also believe that prices rose by more than 4% during the month. Core CPI, which excludes volatile food and energy prices, are also expected to have risen from 2.9% to 3.1%.

Additional data are expected to show that the producer price index (PPI) input rose by 12.1% while the PPI input rose 12.1%. In most cases, companies are pushing high costs to customers.

And on Friday, the ONS will also publish the latest UK retail sales data. These numbers are expected to show that the headline retail sales declined by 2.0% in October. Core sales are also expected to have fallen by 3.1% as prices rose.

GBPUSD forecast

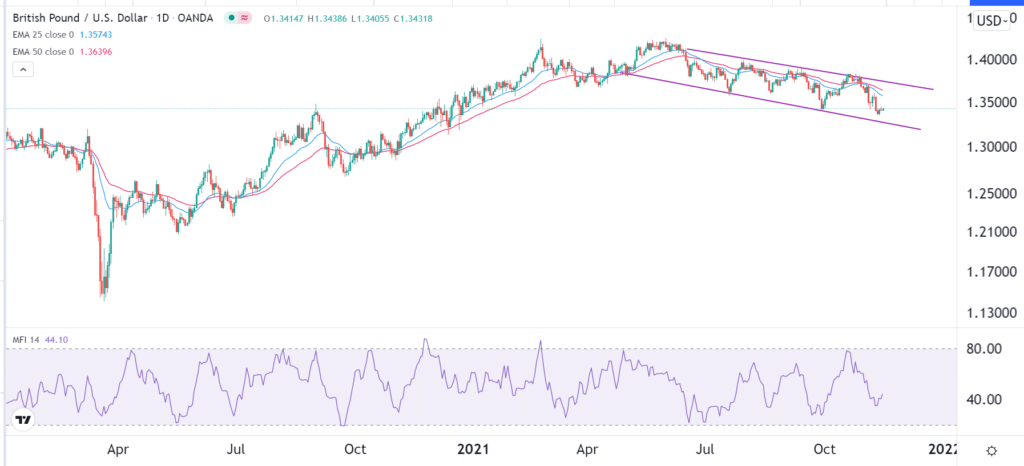

The daily chart shows that the GBPUSD has been under intense pressure lately because of the relatively strong US dollar. The pair has formed a descending purple channel and dropped below the 25-day and 50-day moving averages. The money flow indicator has also dropped and is approaching the oversold level. Therefore, the pair will likely keep falling as investors target the key support at 1.300.

Leave a Reply