The GBPUSD price held steady on Tuesday morning as investors waited for the upcoming American and UK consumer inflation data. The market is also paying a close attention to the emerging Brexit wrangles between the UK and the European Union. It is trading at 1.3845, which is slightly above last week’s low of 1.3800.

US Inflation data

Inflation numbers are closely watched by market participants because they tend to influence the decisions of central banks. Therefore, the next two days will be crucial for the GBPUSD pair as the UK and the US are set to publish their August inflation numbers.

These inflation numbers come at a time when the prices of key items is rising. For example, the price of aluminum, a metal used to manufacture most items, has jumped to the highest level in 13 years. Similarly, other products like crude oil and steel has held steady.

At the same time, the labor shortage in the UK and the US has pushed wages higher. Recent data showed that American wages jumped by more than 4.3% in August. Therefore, all these costs will likely be passed on to consumers, leading to higher inflation.

Economists polled by Reuters believe that the American Consumer Price Index (CPI) rose by 5.3% year-on-year in August. If they are right, the CPI will be a point lower than where it was in the previous month. At the same time, the core CPI, which excludes the volatile food and energy products, is expected to decline from 4.3% to 4.2%.

The Federal Reserve, like other western central banks, have a target of 2.0%. Therefore, if the CPI remains stubbornly high, and with the labor market tightening, there is a likelihood that the Fed will follow through its pledge to tighten in the fourth quarter.

UK inflation and Brexit

The GBPUSD will also react to the UK inflation data that will come out on Wednesday this week. These numbers are expected to show that the headline CPI jumped from 2.0% in July to 2.9% in August. This sharp increase will be because of last year’s “Eat Out to Help Out” program. The core CPI is expected to rise from 1.9% to 2.9%.

The UK is also seeing higher labour shortages. At the same time, the country is facing the challenge of Brexit that has led to significant supply shortages in the country. Indeed, many retailers like Marks and Spencer and Tesco have complained about shortages of key items. Still, the jump in UK inflation will be in line with the BOE estimates that prices will peak at about 4%.

The UK and US inflation and employment numbers will come in play after this month’s monetary policy meetings. Economists expect that the Federal Reserve and the Bank of England (BOE) will sound hawkish during.

GBPUSD technical analysis

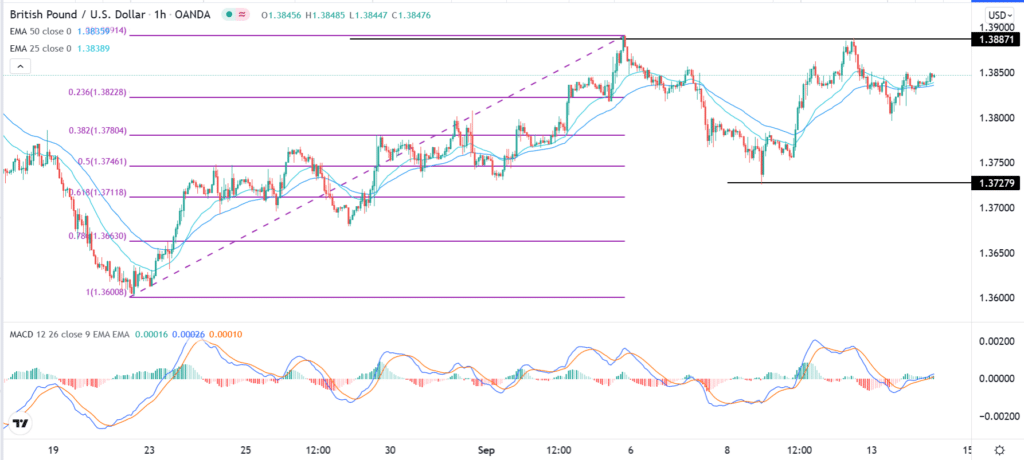

The hourly chart shows that the GBPUSD formed a double-bottom pattern at 1.3887 this month. In price action analysis, a double-top is usually a bearish sign. The pair is also slightly above the 23.6% Fibonacci retracement level while the MACD has moved above the neutral level. It has also formed a small inverted head and shoulders pattern.

Therefore, the pair will likely hold steady in the coming days as investors target the key resistance at 1.3887. The alternate scenario is where the pair retreats to the lower side of the double-top at 1.3727.

Leave a Reply