- MPC’s Prof. Haskel viewed labor and productivity as essential in developing monetary policy.

- The UK government is scheduled to release its net borrowing prospects in the public sector for June 2021 (MoM), which stood at £23.6 billion in May 2021.

- New Zealand’s credit card spending report stood at 27.2% in the prior reading.

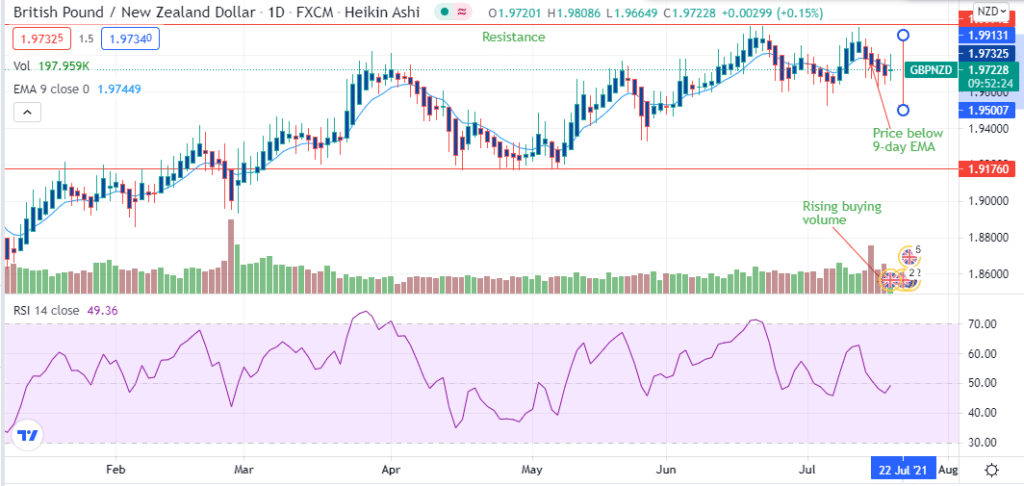

The GBPNZD pair added 0.48% as of 5:30 am GMT on July 20, 2021, from the previous day’s close. It opened at 1.9683 and traded to a high of 1.9810. The British pound was buoyed by Prof. Haskel- UK’s Monetary Policy Committee’s (MPC) member’s speech on the country’s resilience against the Covid-19 pandemic.

UK’s productivity growth

Part of what had increased the UK’s resilience was heavy investment in research & development (R&D), software, and digitization that has boosted the supply side of the economy. As a long-term prospect, Prof. Haskel viewed a tight monetary policy as devoid of the right structure to improve the economy, especially if the labor market was disregarded.

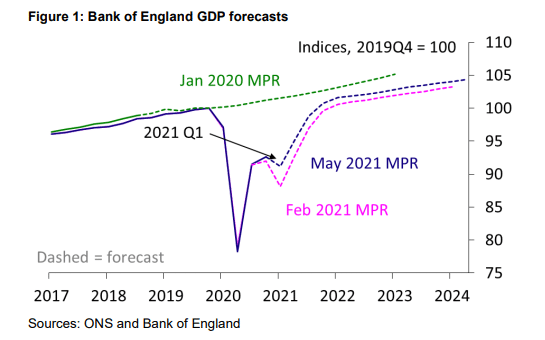

UK GDP forecasts

After attaining a peak of 100% in 2019, quarterly GDP declined 22% to 78% in Q2 2020 before recovering 19% in Q4 2020. In Q1 2021 there was an increase in output that was also marked by an increase in per-hour productivity.

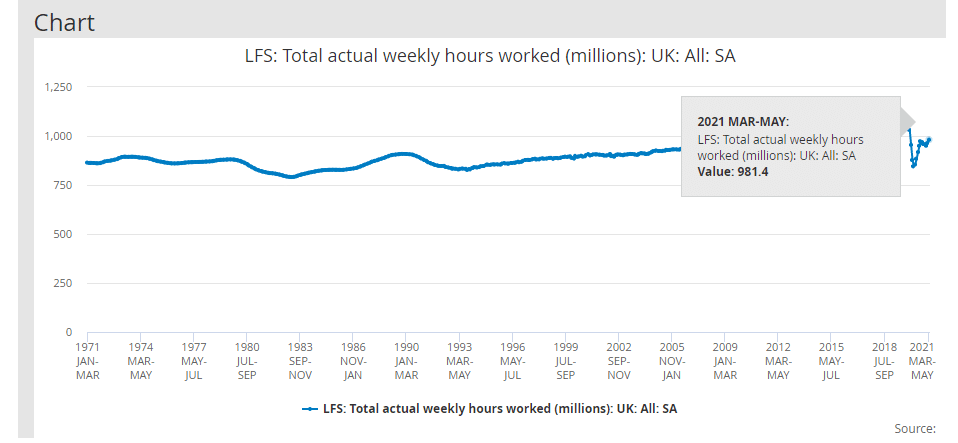

UK Per-hour productivity

The total number of hours worked weekly (in the UK) in the March to May 2021 quarter increased 1.39% from 950.4 million to 963.6 million. This productivity has increased 14% since the April-June 2020 quarter.

The UK government is scheduled to release its net borrowing prospects in the public sector for June 2021 (MoM) on July 21, 2021. The record stood at £23.6 billion in May 2021. Other financial statistics set for release and which will impact the pound is the net cash requirement for June 2021. This amount stood at £21.70 billion in May 2021.

Competition drive among UK digital firms

The UK government set out proposals to spice up competitions among digital firms in a bid to improve competition and drive productivity. Among the proposals is the issuance of fines up to 10% of the turnovers on competition breeches. Another proposal is to level the operational field for startups in the tech business.

Under the Digital Markets Unit (DMU) launched in April 2021 within the Competition and Markets Authority (CMA) tech firms are required to adhere to a code of fair trading and transparency. Aspects such as alterations to terms and conditions (T&Cs) and unfair algorithms will see tech firms fined up to 10% of turnovers or face suspension.

PM Johnson kept his promise to reopen most of the economy on July 19, 2021, including the removal of legal restrictions to social gatherings. The restaurant business, including nightclubs, is set to jostle back to life.

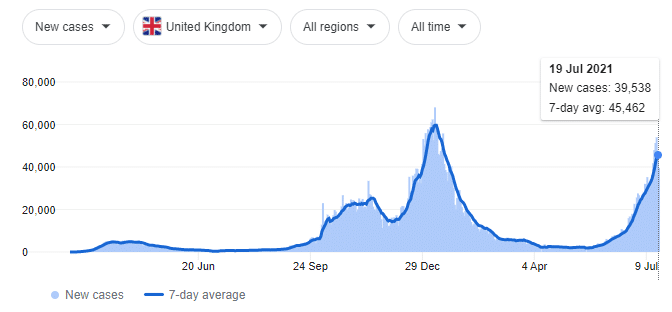

Covid19 cases in the UK

However, Covid-19 daily cases soared to 39,538, witnessing a 100% growth since May 18, 2021, when it stood at 0. Deaths have, however, reduced by 69.84% since July 15, 2021, with the vaccination rate at 54.2%.

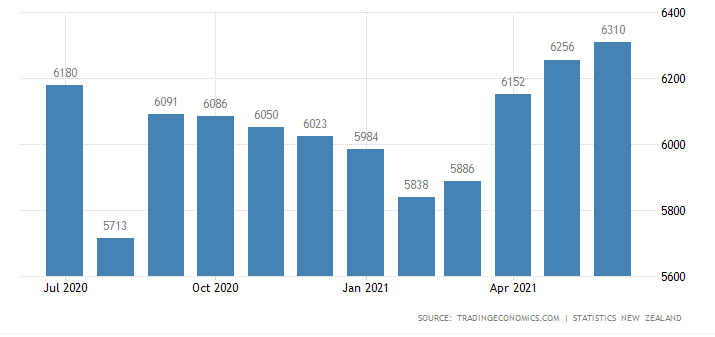

Credit card spending in NZ

New Zealand is set to release its credit card spending report on July 20, 2021. It stood at 27.2% in the prior reading.

Credit Card transactions in NZ

June 2021 saw card transactions rise 0.9% to NZ$6.130 billion (MoM). The increase was fueled by a 1.8% increase in consumables, durables at +0.4%, and fuel at +1.8%. Retail e-credit card expenditures (YoY) also rose 4%.

Technical analysis

The GBPNZD hit resistance at 1.9920 and rebounded, falling to the area around 1.9720.

The 14-day RSI shows a slight increase in buying action at 49.36, with the volume slightly rising as well. However, at the price of 1.9720, the pair is still below the 9-day EMA at 1.9745. Increased buying may push the price towards 1.9913. Failure to break out above 1.9913 resistance may push the price to 1.9500.

Leave a Reply