- The GBP was boosted by a 0.8% increase in the PPI input for July 2021 (MoM) from a 0.5% rise in June 2021.

- UK house prices rose at an average of 13.2% in the year ended June 2021.

- The Reserve Bank of New Zealand (RBNZ) maintained the official cash rate (OCR) position at 0.25% after a Covid-19 case was realized.

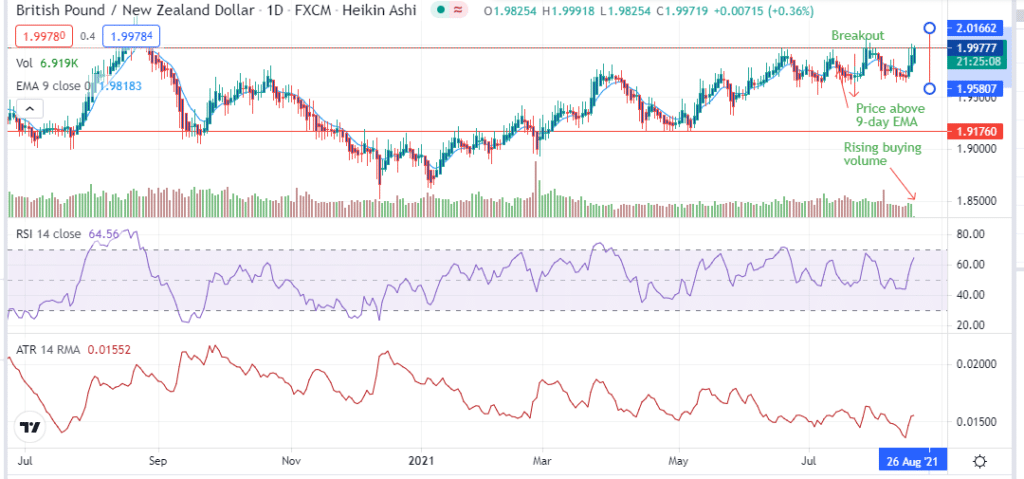

The GBPNZD pair gained 0.71% as of 4:41 pm GMT on August 18, 2021, from the previous day’s close. It opened at 1.9851 and traded to a high of 2.0015 (representing a price change of 0.83%). The British pound was riding high, gaining 0.10% against the euro and 0.12% against the US dollar at the time.

Positive indicators

The British pound was boosted by a 0.8% increase in the producer price index (PPI) input for July 2021 (MoM) from a 0.5% rise in June 2021. It gained 9.9% in the annual analysis, seven beating estimates at 9.1%.

The monthly PPI output for July 2021 (MoM) remained unchanged for July 2021 at 0.6% but still managed to beat estimates at 0.4%. The PPI output rose 4.9% annually against an increase of 4.5% in July 2020.

The strong PPI figures were enough to offset the decline in the consumer price index (CPI) that fell to 2.0% from 2.5% (YoY). The annual CPI (not seasonally adjusted) remained unchanged at 111.30.

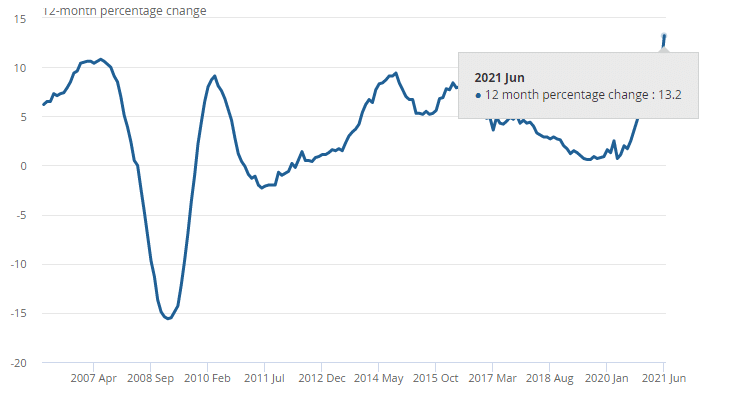

House price index

UK house prices rose at an average of 13.2% in the year ended June 2021.

It rose from 9.8% realized in May 2021 and is regarded as the sharpest annual price growth in UK houses since November 2004.

June 2021 saw the mean price of UK houses jump by £31,000 to £266,000 from £235,000 in June 2020. England recorded the sharpest average rise at 13.3% (£284,000), Wales followed at +16.7% (£195,000), Scotland (+12.0%), and finally Northern Ireland (+9.0%).

In regards to taxation, properties worth more than £500,000 in England and North Ireland (post-Brexit) did not incur any tax. The threshold was lowered in Scotland and Wales where the no-taxation policy began in houses valued at more than £250,000.

Between March 2021 and June 2021, the mean UK prices had risen by £10,000 (+3.91%). Investors are looking for increased economic recovery with the GDP growth dependent on a stringent vaccination program against Covid-19.

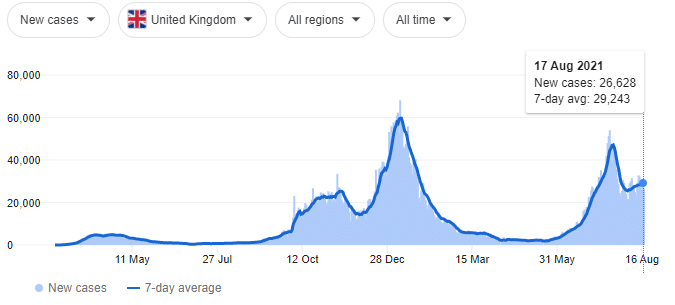

UK Covid-19 cases have risen 10.31% (from 24,139 to 26,628) from August 1, 2021 to August 17, 2021.

The rate has still declined 38.65% since July 21, 2021, with the vaccination now at 61.3%.

RBNZ – no rate hike

The Reserve Bank of New Zealand (RBNZ) maintained the official cash rate (OCR) at 0.25%. Investors were worried about the decision to maintain the OCR after a highly anticipated rate hike projection.

Reports indicated that one new case prevented the central bank from raising the rate. The NZ government went ahead to impose a level-4 lockdown to be observed for 7 days. This case was discovered in Auckland, the first time since March 2021 (6 months).

The NZD went ahead to lose 0.34% against the Japanese yen and 0.61% against the US dollar.

Technical analysis

The GBPNZD pair is headed towards an upward breakout of the 2.0000 resistance. Continuation of the uptrend may see the price hit 2.0166.

Pair moved above the 9-day EMA at 1.9818 to settle at 1.9976. There is an increase in buying pressure with the 14-day RSI at 56.53. We have noted an increase in volatility as the 14-day ATR is at 0.01654.

A reversal may force the pair to move to 1.9581 and, in case of a deeper correction, to 1.9176.

Leave a Reply