- Disappointing economic data continue to pile pressure on NZD, AUD, and the yen against other majors mid-week.

- The Chinese yuan is strengthening against the dollar on impressive PMI data.

- The euro is losing ground against the pound as the COVID-19 situation in France and Germany arouse concerns.

- Gold is also on the back foot amid rising yields.

It’s another busy day in the forex market going by the plethora of economic releases in Europe, Canada, and the US, likely to shape traders’ sentiments. The New Zealand dollar, the Aussie dollar, and the Japanese yen are already under pressure amid a string of disappointing data.

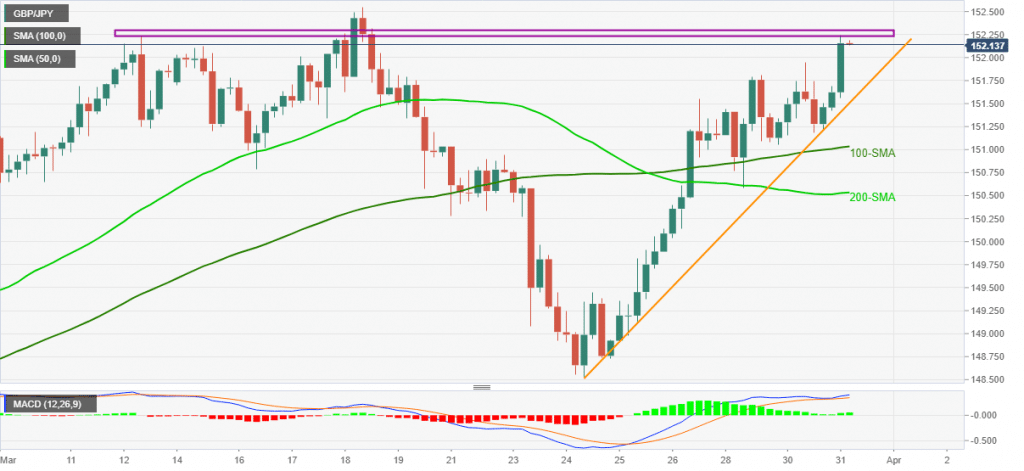

GBP/JPY analysis

The yen came under pressure as industrial production in the island nation fell by 2.1% in February, reversing a 4.3% rise registered in February. The decline came at the back of contraction in the motor vehicles, electric machinery, and chemical industries. The Ministry of Economy, Trade, and Industry warning that production in March is on course to fall by 1.9% continues to weigh heavily on the yen.

The yen is losing ground against the British pound, which has been strengthening across the board. GBP/JPY has already risen to three-year highs and is looking increasingly bullish amid the yen weakness and pound strength.

The pair is on the cusp of rallying to the 152.55 level, the next resistance level. A breach of the resistance level could see the pair rallying to highs of 153.85. Immediate support supporting the recent rally is at 151.50 levels.

The New Zealand dollar also remains under pressure on ANZ Business Confidence Index, declining from 7 to 0. Profit expectation on companies falling from 1.3 to 0.5 all but arouses concerns about the health of the economy.

USD/CNY analysis

China’s economic recovery continues to gather traction even as other economies continue to struggle due to the COVID-19 disruptions. Immediate data indicate that NBS Private Sector PMI figures for March increased from 50.6 to 51.9 as Services sector PMI rose from 51.4 to 56.3.

After hitting strong resistance at 6.58, USD/CNY has started edging lower amid the growing Chinese yuan strength at the back of impressive economic data.

Curtailing yuan strength against the dollar are rising yields that have continued to fuel strength on the greenback.

EUR/GBP analysis

Looking ahead focus will be on the EUR/GBP pair with a series of economic data from the Eurozone. French consumer spending and German unemployment figures should have a significant impact on the euro.

Lockdown restrictions in France and Germany are other developments that should influence sentiments on the euro as well. Amid the broader euro weakness in recent days, EUR/GBP has collapsed to one-month highs.

The pair is staring at the 0.8500 handles the next immediate support level. A breach of the level could result in further sell-offs, with the next support seen at 0.836 level.

There are growing concerns that EUR/GBP weakness could persist as the pound has remained resilient against the euro in recent weeks. Tighter COVID-19 restrictions in Germany and France threaten to curtail economic activity in the two largest economies.

In contrast, the UK has started easing some of the COVID-19 restrictions fuelling hope of accelerated economic activity, explaining the pound’s strength against the euro. The yield spread between the 10-year UK government bond and the 10-year German bond rising also continues to make the pound attractive against the euro.

XAU/USD analysis

Gold sell-off persisted overnight following a plunge below the $1,700 an ounce level in the commodity markets. The yellow metal, which is often seen as a hedge against inflation, is under immense pressure amid rising yields, sending the dollar to four-month highs.

XAU/USD has since plummeted to three-week lows and looks susceptible to further declines amid dollar strength. Strengthening US economic recovery and higher inflation expectations should continue to drive yields higher, negatively impacting the non-interest-bearing metal.

A plunge to the $1,679 level paves the way for $1,673, the next support level. A sell-off followed by a close below the support level could result in a free fall to the $1,650 region the next support level. The current resistance on any bounce back is at the $1,690 level.

Leave a Reply