- Japan is likely to ease restrictions on May 5, 2021, as it struggles with the Olympics question.

- The UK is likely to increase exports to Japan in 2021.

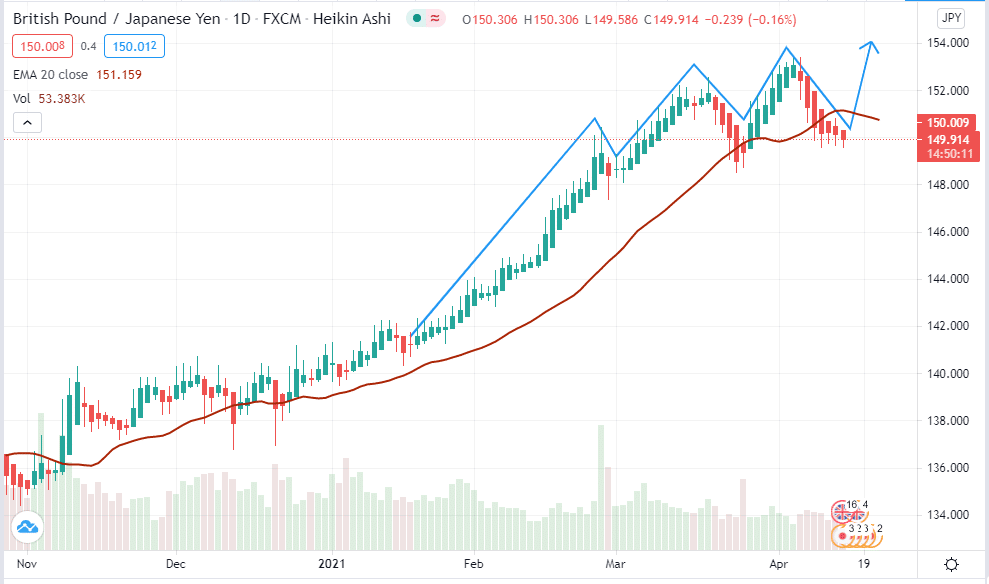

- The GBP/JPY is below the 20-day EMA at 151.159.

The GBP/JPY pair closed at a +0.05% change on April 13, 2021, from previous day trading. The pound was basking in positive industrial production data showing February 2021 figures were up -3.5% from -4.3% year-on-year. Month-on-month data also showed industrial production stood 1.0% from a low of -1.8%. Manufacturing production in Britain also inched up 1.3% from a decline of -2.3% month-on-month. Britain emerged from one of the longest global lockdowns with its first reopening phase on April 12, 2021. Japan’s core machinery order as of February 2021 declined -8.5% month-on-month from a previous low of -4.5%. It also lowered -7.1% from a high of 1.5% year-on-year.

Extended restrictions

Japan expanded its COVID-19 restrictions to its capital city Tokyo on April 9, 2021, to help curb the pandemic before hosting the Olympics in the summer. The emergency is expected to be lifted on May 5, 2021, a week after its intended reopening of April 29, 2021.

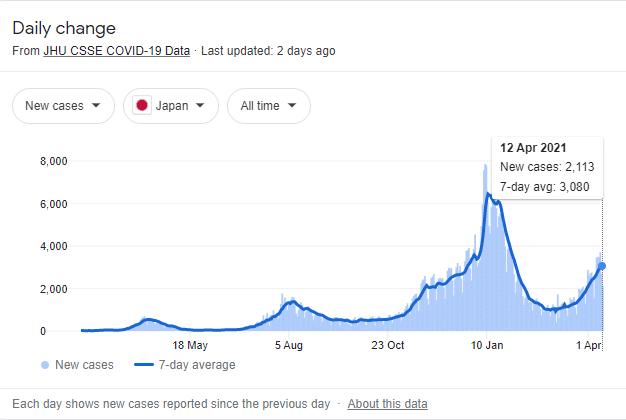

Coronavirus cases in Japan

Daily cases hit 2,113 on April 12, 2021, from a 7-day average of 3,080 after topping 4,575 on January 12, 2021. Japan is facing a new COVID-19 mutation that has ravaged inhabitants of important cities like Osaka and Hyogo.

The IMF has expressed optimism that postponement or cancellation of the Olympics in 2021 may not adversely affect the Japanese economy. The global financier’s forecast for Japan in 2021 was upgraded to 3.3% based on a surge in exports and stimulus support.

In the medium term, Japan’s inflation is expected to stay below 2%. This situation means that the Bank of Japan (BOJ) will keep interest rates at -0.1%. With the country fighting to manage the economic impact of COVID-19, the BOJ may not be in a hurry to continue slashing rates.

The BOJ has opted to give varying interest rates to commercial banks that deposit money at the central bank as incentives. Increased negative rates would also accelerate the rewards to be gained by the banks in lending money to the central reserve.

UK-Japan ties

The UK and Japan are working to intensify their trade ties as Britain completes its post-Brexit deal agenda. Trade between the two countries reached £31.6 billion as of 2019 accounting for 9.2% of the global GDP in 2018 and 2.2% of the UK trade.

The Japan-UK trade deal dubbed the Comprehensive Economic Partnership (CEPA) that also includes Northern Ireland was expected to be ratified in January 2021. We expect the deal to come into force by the end of 2022.

The UK economy inched up 0.4% in February 2021 supported by exports to the EU that grew by more than 50%. A free-trade agreement between the UK and Japan signed at the end of Q4 2020 is slated to boost bilateral trade by up to £15 billion.

As of 2019, the UK exported pharmaceutical products worth £0.76 billion. The FTA is expected to give British businesses a 99% tariff-free experience with Japan, a move that will benefit life sciences during the COVID-19 era. Japan is the Asian leader in scientific research but it has a large trade deficit in pharmaceuticals. As of 2019, it imported $20.4 billion worth of the product against export of $6.7 billion worth (about 11%).

Technical analysis

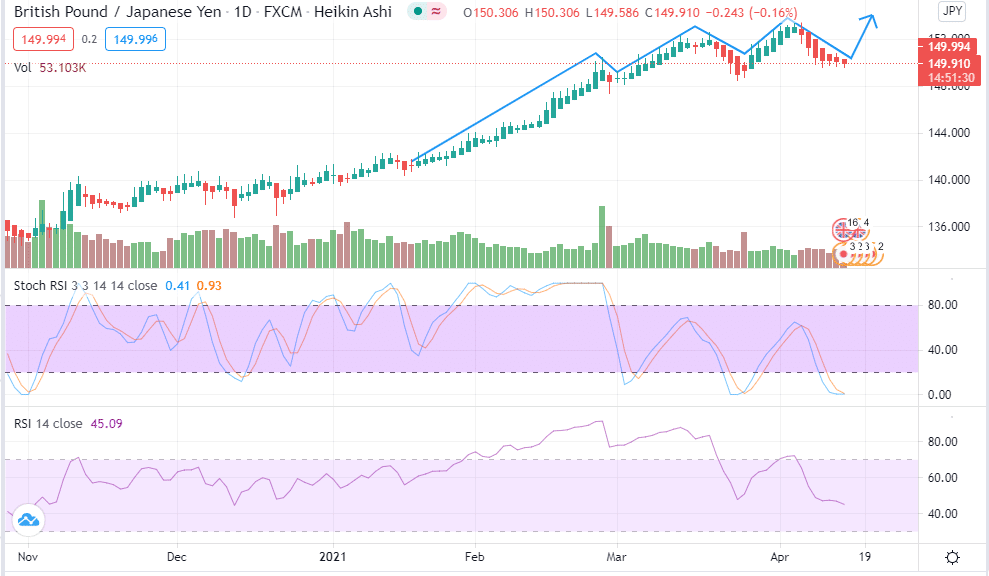

GBP/JPY RSI

GBP/JPY trading chart

The daily GBP/JPY trading chart indicated that the price was moving below the 20-day exponential moving average (EMA) that stood at 151.159. We may still see a reversal towards 154.000 as the pair looks for the resistance level. The 14-day RSI stood at 45.09 showing that the GBP/JPY was in the neutral zone with the possibility of increasing the buying activity.

Leave a Reply