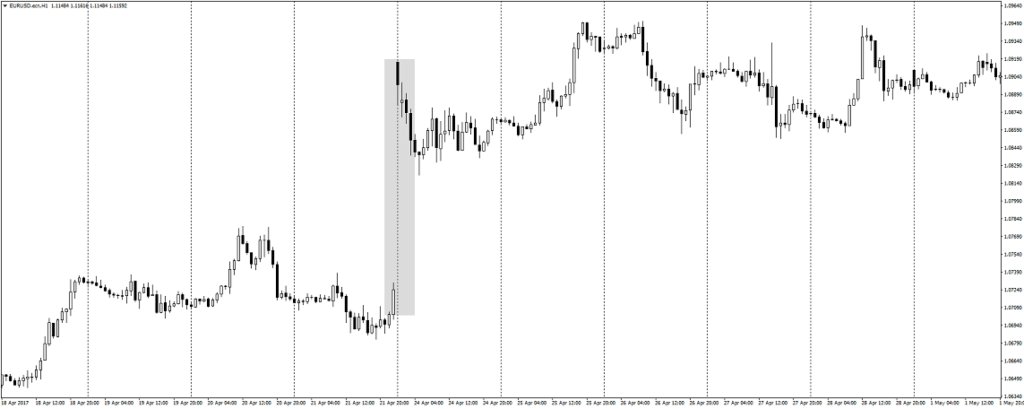

A forex gap is defined as an instance where the previous day’s closing price does not match up with today’s opening price. This results in the creation of an empty space or gap in between the two candlesticks, as shown below:

Forex markets, which are open twenty-four hours every day, are technically closed for the weekend. Only retail traders are barred from participating in the FX market. During weekends, when many banks and hedge funds trade, gaps appear.

Depending on how the market was closed and what variables affected the market while it was closed, a gap can form. If markets were closed because of the lack of public retail traders, there might be a fundamental reason for the gap. Otherwise, a gap may form due to breaking out from a technical level.

The gap begins with the interbank currency market reacting to the weekend’s fundamental news and continuing to trade during the Monday trading session in an environment of high liquidity. On weekends, gaps are expected, but on weekdays, the Forex market normally has no gaps.

For instance, the USDJPY currency pair may close trading on Friday at 110.3745. If your broker opens on Sunday when the price has risen to 110.3945, the resultant gap will be equivalent to 200 pips. The price will rise when the market opens on the next day in order to fill the gap. If it was an upward gap, the price would likely drop to cover it.

It’s possible to benefit in the short term by trading gaps; you can profit by putting your money into currency pairings or indexes that are more likely to have them.

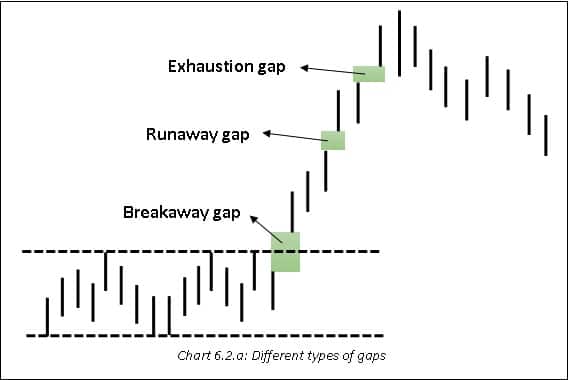

Types of Forex gaps

1. Breakaway gap

Breakaway gaps are associated with the imminent emergence of a new trend. A breakaway gap is a break in the price pattern that occurs when the market is confined to a range and an open gap (i.e., one outside of the range) is formed.

2. Exhaustion gap

Following a sustained and prolonged trend, this kind of gap signals a shift from an upward to a downward movement and vice versa. The most popular approach to exploit the exhaustion gap is to study the candle and price action pattern which follows it.

3. Runaway gap

The runaway gap occurs when the gap is formed in accordance with the existing trend. A good illustration of a runaway gap is when a bearish trend develops and an up gap forms. The opposite happens with bullish runaway gaps.

Look at the visual representations of the three kinds of gaps below.

Depending on the context of the gap in terms of the immediate price action and the stage of a trend, we can expect different outcomes.

Trading strategies based on gaps

There are no indicators in this strategy. Its main source of guidance is price and market movement.

Gaps are valuable in trading because many traders believe that they tend to be filled quickly and that they can give Forex traders a potential edge because, in traders’ minds, gaps tend to lead to the swift fulfillment of trend movement expectations. As a result, they are perceived as easy to predict.

If the present market price returns to the price range, it was in previously, this is defined as filling a gap.

A few essential tips for trading using gaps are included below:

- Do not conclude the week’s trading until you are near the end of the session: A good time to close the trade is around five minutes before the week finishes. An alternative is to exit the position immediately when the gap is filled. Partial trade closure can be achieved by combining different trade exit procedures.

- Using breakout gaps: When a gap forms in the market, this method uses the likelihood that price will test the area around the gap in an effort to return to or break out of the previous support or resistance level. Prices breaking out of support and resistance levels are used to determine the direction of the market.

- When the margin between Monday’s open and Friday’s close is positive, go short.

- The likelihood of an event’s price filling the gap during the weekend is increased when the price fill goes in the same direction as the overall trend.

- You can utilize this weekend price gap phenomenon by placing a trade at the beginning of the new week immediately after a gap forms. We should put our profit-taking points in the old support/resistance levels.

In summary

Forex traders can profit by trading the gaps in the market. Nevertheless, you must be careful when you trade the gaps because it is unknown whether they will be filled. Stop losses are essential for anyone using this trading strategy.

Leave a Reply