FXQUASAR is a fully-automated Forex expert advisor that works on both MT4 and MT5 trading platforms. According to the vendor, this is a highly profitable robot that is compatible with all brokers and account types. Before we can consider the system profitable, however, we need to analyze its live performance along with other aspects.

Detailed Forex robot review

The vendor makes a brief presentation on the official website, so we don’t have adequate information about the robot. We have the links to a live trading account and the backtesting results, however, the features have not been properly explained. There is a contact form on the website but no official contact information. Overall, the presentation doesn’t look very professional.

There is a severe lack of vendor transparency for this Forex robot. The vendor has not shared the company’s service history and we don’t know where it is located. Also, the identities of the team members are unknown.

FXQUASAR supports NFA-regulated brokers. It does not use indicators, instead analyzing the market using an internal algorithm and quotes. It analyzes the current market situation as well as the price shifts over the previous few days. Based on the analysis results, it decides the next actions.

There are a total of six sessions for this EA. Out of them, 3 of them are for buy positions and the other 3 are for sell positions. For each of the sessions, the robot uses different analysis techniques from the point of view of buy or sell positions. The sessions are capable of working independently.

FXQUASAR has a risk-limiting mechanism and the vendor claims that it protects the users from heavy losses. However, they haven’t explained how this feature works, so we don’t know whether it is effective or not.

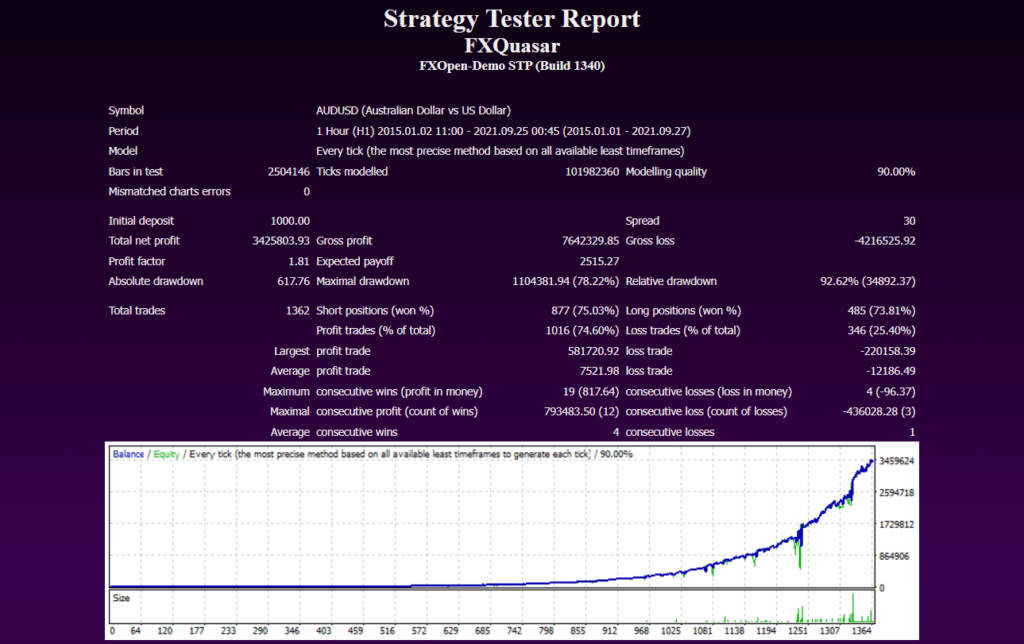

FXQUASAR strategy tests

There is little or no information about the trading strategy used by this Forex robot. Most Forex traders look for strategy related information since it allows them to gauge the profitability of the system to a certain extent. The lack of strategy insight is a major disappointment and it will deter most traders from investing in FXQUASAR.

Here we have the results for a backtest conducted on the AUD/USD pair from 2015 to 2021. During the testing period, the robot placed a total of 1362 trades, out of which it managed to win 1016. This means it had profitability of 74.60%. There were 19 maximum consecutive wins and 4 maximum consecutive losses for this test. The relative drawdown was extremely high at 92.62%, and this is an indication of a high-risk trading strategy that can lead to huge losses.

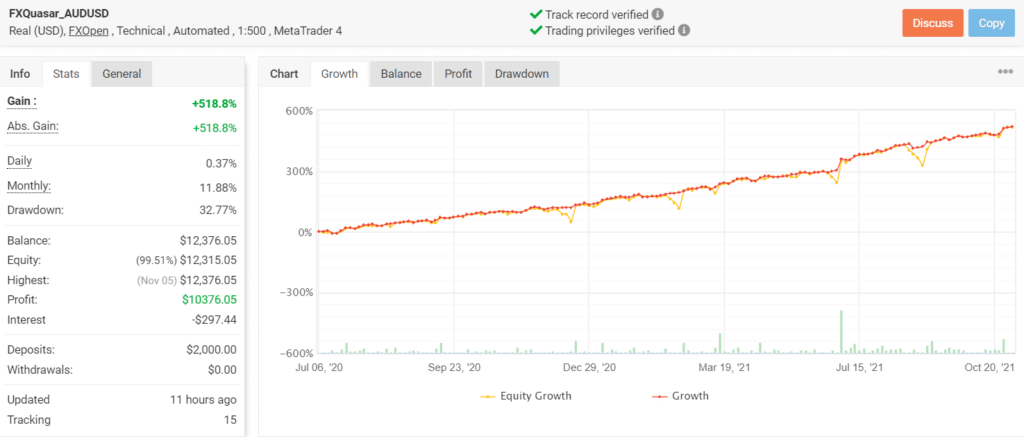

Live account trading results

This is a live trading account on Myfxbook that was launched on July 06, 2020. To date, the robot has placed 317 trades through this account, winning 74% of them. As a result, it has generated a total profit of $10376.05. Currently, the daily and monthly win rates for this account are 0.37% and 11.88%, respectively. The account has a high drawdown of 32.77%, indicating a high risk of ruin. Since both the backtest and the forward test exhibit a high drawdown, we cannot consider FXQUASAR a safe system to trade with.

Pricing

You can purchase FXQUASAR for the price of $279. This gives you access to a single lifetime license for the robot. You can change the account number online and use both live and demo accounts for placing your trades. The vendor provides you with both versions of the EA as well as a detailed user manual. Each customer can also access free updates and 24/7 technical support. The product comes with a 30-day money-back guarantee.

Customer reviews

At this moment, there are no customer reviews for this expert advisor on third-party review websites. It is abundantly clear that not many people are using this system for live trading. The lack of customer reviews indicates a lack of reputation and this does not inspire confidence among buyers.

Leave a Reply