For beginners, trading in Forex can be a bit overwhelming. Earning big returns is possible only when you learn to use the right strategy and risk management. Fortunately, Forex robots have made the task easier. Now even beginners can trade skillfully with the help of automated systems. FXMath X-Trader is a Forex robot designed to help traders capitalize on the market trends and maximize returns.

Based on mathematical models that give high returns and low drawdown, this system is fully automated. According to the vendor, the system can generate up to 90% winning trades. We will analyze this system in this detailed review to give you our evaluation of its performance and reliability.

Detailed Forex Robot Review

At the outset, the website of FXMath X-Trader is well designed with separate sections for the features, portfolio, pricing, trading results, and more. However, we could not find any info on the developer of the system or the vendor.

The support is through a contact form provided on the site. There is no location address or phone contact number. All these indicate a lack of transparency on the part of the vendor. Without transparency, it is difficult to rely on a system.

As far as features are concerned, there are only a few which include constant upgrades, instant license activation, compatibility with any broker, and 24/5 support. For using the system, you need to set up an MT4 account with leverage ranging from 1:100 up to 1:1000.

While all currency pairs can be traded, the basic pair focused by the system is the EURUSD pair. Three different account types are present, namely cent, micro, and mini accounts. The working method of the Forex robot is simple. You have to run the installer, and with a few clicks, the system is automated and ready to trade.

FXMath X-Trader Strategy Tests

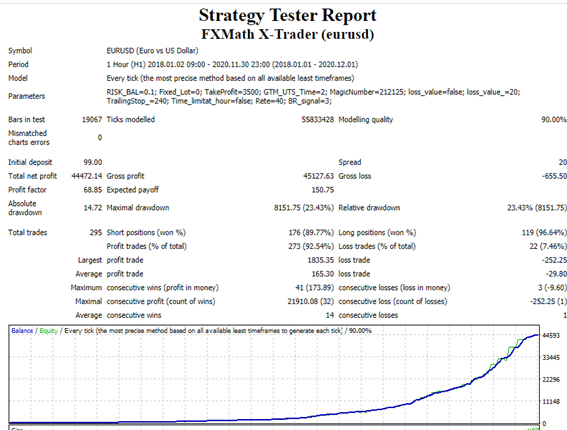

There is no mention of the strategy used by the system other than info about the mathematical logic used for identifying market trends. A single backtest result is posted on the site. The screenshot of the strategy tester report is shown below.

We are not satisfied with the 90% modeling quality of the test as this does not provide a proper perspective of the performance, spread, commissions, etc. From the results shown, we can see that the testing period is two years, starting from January 2018 and ending in December 2020. Plus, a one-hour timeframe is used for the testing with a profit factor of 68.85 and an absolute drawdown of 14.72%.

Real and Live Account Trading Results

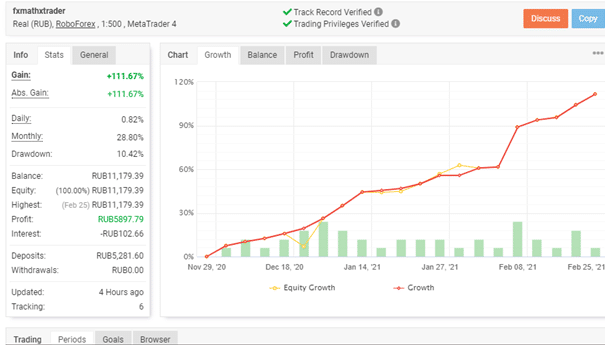

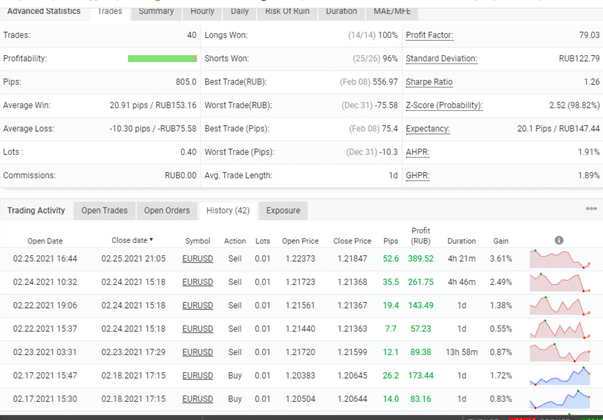

A real and live account trading result verified by the myfxbook site is posted on the official site. The real RUB account uses RoboForex broker and a leverage of 1:500. From the screenshot of the trading result shown below, the system reveals a gain percentage of 111.67%, and the daily and monthly returns are 0.82% and 28.80%, respectively.

A 10.42% drawdown is present with the average win coming at 20.91 pips and average loss at 10.30 pips. The profit factor is 79.08, which is a very high value. From the trading history, we could see the lot sizes are 0.01, which indicates a low-risk trading pattern. When comparing the backtest result with the real account performance, the profit factor and drawdown percentage do not show much of a difference.

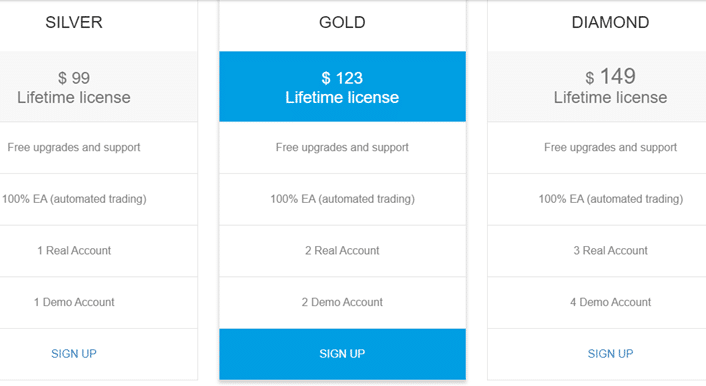

Pricing

Three pricing packages are offered by the vendor, namely, Silver, Gold, and Diamond, priced at $99, $123, and $149. A lifetime license is offered for all three packages, along with free upgrades and support. Other common features include a fully automated expert advisor system, demo, and real accounts.

The number of real and demo accounts offered is the main difference in the packages. Compared to other prevailing Forex robots on the market, the pricing of this automated system is affordable. However, it would have been better with a money-back guarantee.

Customer Reviews

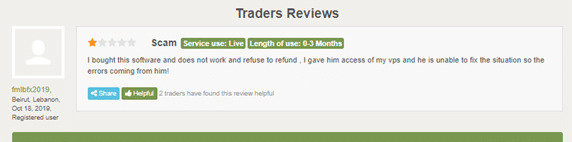

A few testimonials are posted on the official site. But, we cannot consider them as they could be manipulated results. We found a customer review on the Forexpeacearmy site shown in the screenshot below. In the review, the user reveals that the software is not working and the vendor refused to provide a refund.

Wrapping up our review of FXMath X-Trader, the system reveals a few positive and several negative facets. On the positive side, the vendor has provided a backtest report and verified trading results, both of which show a high profit factor value and low drawdown.

The price is another factor that works in favor of the system. However, the lack of vendor transparency and limited strategy explanation are downsides that the system has to address to make it reliable. As the negative client feedback indicates, the lack of refund is another sore point with this system.

Leave a Reply