FXMAC offers Forex managed accounts and promises to give you an edge over your competitors. According to the vendor, the service allows novice traders to grow their accounts with the help of asset managers. However, we need to analyze the various aspects of the system to determine whether it is truly worth investing in.

Detailed Forex robot review

On the official website, the vendor shares some general information on Forex trading and managed account services. They have briefly explained how the system works and highlighted the various investment programs that are offered. On this website, you will also find some blog articles on Forex trading.

FXMAC was founded in 2012, but there is no data on the founders or the team members. The headquarters of this company is located in Saint Vincent and the Grenadines and they have an office in London as well. We have a contact form on the website that you can use to send a message to the team. The vendor has also shared an email address and a phone number.

FXMAC has four investment programs with different strategies and risk levels. By signing up with this service, you can get a money manager who will place trades on your behalf. First, you need to inform the company how much money you wish to invest in the account. After this, the service team will get in touch with you and suggest you an investment program and a strategy.

The vendor has not elaborated much on the features available with this system. For example, we don’t know how it sends notifications or if it has any advanced security measures in place. According to the live trading statistics, FXMAC trades in pairs like GBP/USD, USD/CAD, USD/JPY, EUR/USD, NZD/USD, USD/SEK, AUD/USD, USD/ZAR, EUR/NOK, and USD/NOK.

FXMAC strategy tests

The first investment program follows a strategy involving Fibonacci Levels, Moving Average, and Candlestick Patterns. While the regular version has an annual profit target of 150%, the high-risk version has a 300% profit target but also trades with twice the risk. Investment Program 2 is an intraday strategy for night trading and it is based on a complex neural network model.

The third investment program is a trend-following scheme with an average monthly profit target of 4.17%. For the fourth investment program, the system uses an aggressive strategy that combines intraday and trend schemes.

The vendor has not shared the backtesting result for any of the strategies, which is quite disappointing. It is vital for developers to test their strategies using archival data, since it reveals, to a great extent, the ability of the system to deal with different market scenarios. The lack of backtesting data is a major red flag that most Forex traders would not ignore.

Real account trading results

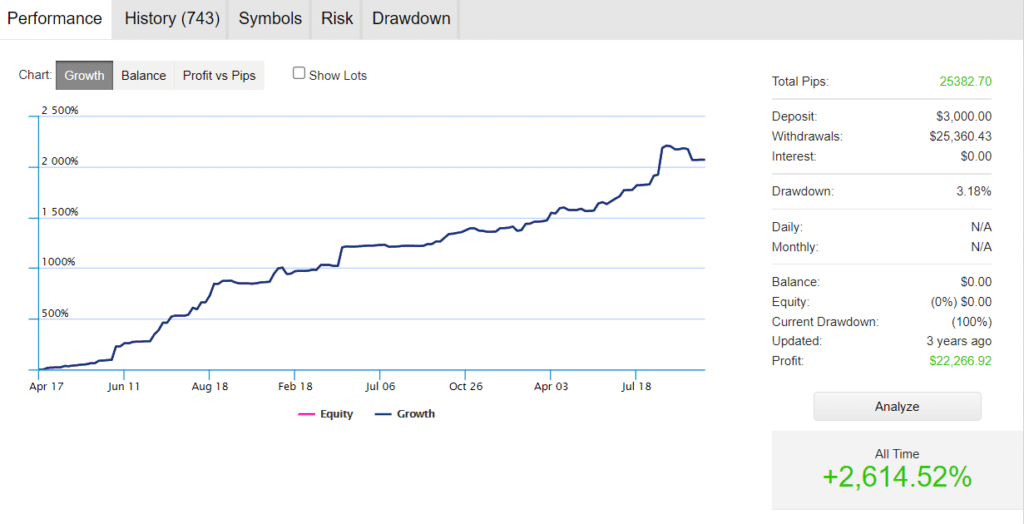

This is a verified live trading account for FXMAC on the FXStat website. As you can see, the account was last updated 3 years ago. There are multiple trading accounts for this system on the FXStat website, and none of them has been updated for the last 3 years. This tells us that the system has not been tested with the latest market conditions, and this makes it a risky investment.

For this account, FXMAC placed a total of 904 trades, winning 794 out of them. Therefore, the win rate is 87.83%. The average profit and loss for this account are $270.72 and -$397.57 respectively, and this means the system is prone to suffering large losses while trading. Currently, the daily and monthly gains for this account are 0.47% and 10.25%, respectively, while the profit factor is 8.86.

Pricing

The vendor charges performance fees for the investment programs based on how much you’ve invested for the trading account. For a balance exceeding $5k, the performance fee is 35% for the first investment program. This is reduced to 30% for a large account balance exceeding $25k. When you have deposited more than $50k into your trading account, you will be charged a fee of 25%. There is no mention of a money-back guarantee.

Customer reviews

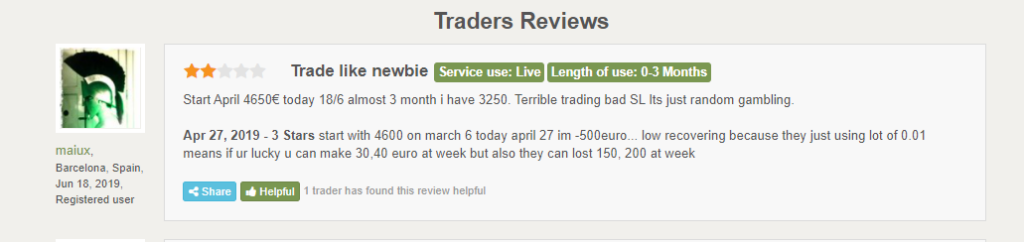

There are a few reviews for this service on Forexpeacearmy. One user has claimed to have started with 4650 Euros and after three months, they had a balance of 3250 Euros. They have stated that the system uses erroneous stop losses.

We cannot recommend this managed service account service to traders, since the live trading results have been discontinued. Moreover, the service carries high performance fees and the vendor has not tested the strategies using historical data.

Leave a Reply