FXDD is a well-known European forex broker which since 2002 has been providing financial services in the field of currency trading. The company positions itself as an experienced, technological and safe exchange intermediary, combining the best personnel team and impeccable customer service. Let’s check that this is true: we will study the conditions and draw our conclusions.

The FXDD broker is aimed at European and Asian traders who are fluent in the following languages: English, Italian, Spanish, Portuguese, Chinese, Arabic and Vietnamese. The site is not adapted to Russian and other languages of the world, and therefore most users from the CIS will have many language difficulties. At the same time, there are no problems with regulation: the company is under the supervision of the MFSA Maltese regulator, complying with the EU MiFID Directive॥ and conducts its activities following the rules of the European Economic Area (EEA). There is also a separate bank account allocated specifically for storing customers’ funds.

General information

| Year of foundation | 2002 |

| Regulation | MFSA, MiFID॥, EE |

| Platforms | Metatrader 4, Metatrader 5, WEBTRADER, ZuluTrade |

| Markets and Products | Currency pairs, CFDs, cryptocurrencies, metals, indices |

| Spreads | From 0.2 pips |

| Minimum deposit | 1 $ |

| Maximum leverage | 1: 500 |

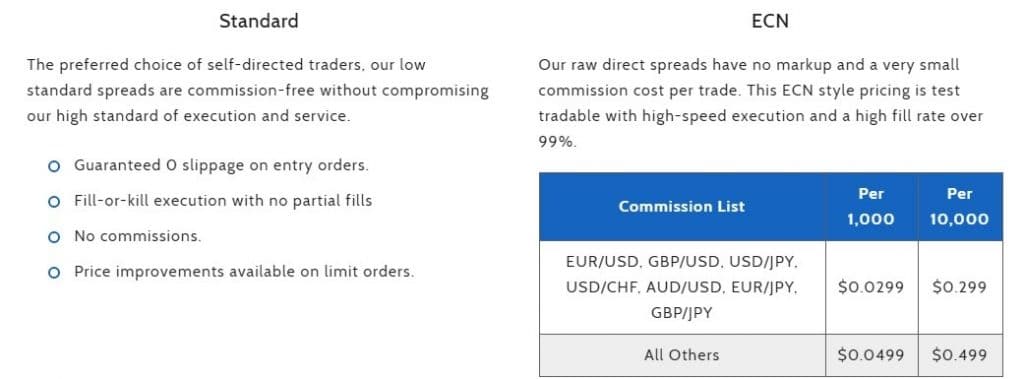

| Account Types | Standard, ECN |

| Deposit and withdrawal | Neteller, Visa, MasterCard, UnionPay |

Trading platforms

The main trading terminal is the Metatrader 4 program. It can be installed on a PC (Windows, Mac OS), used via mobile devices (iOS, Android) or opened in popular browsers. Metatrader 5 can be installed as a desktop version on a Windows PC and Android mobile devices. WEBTRADER and ZuluTrade are adapted for all mobile devices and browsers. Trading Instruments

The FXDD broker offers more than 50 currency pairs, 7 instruments from the metal market, 3 energy resources (varieties of gas and oil), 11 largest indices, 10 CFD-contracts for shares and 6 crypto assets traded in conjunction with the dollar, euro, and yen. See the complete list of tools in the Markets section.

Fees and charges

When working with the Metatrader 4, Metatrader 5 and ZuluTrade terminals, no transaction fees are charged, however, a floating spread system is provided in the amount of 0.2 (for MT4 and MT5) and 1.2 (for ZT). For the WEBTRADER terminal, both spreads (starting at 1.2) and additional fees for transactions with different types of currency pairs are provided. See all conditions in the “Platforms and Tools For All” section.

Support

For advice, go to the Contact section and use any available means of communication: there are several Maltese numbers, mail and a form for sending messages through the site. On all pages, the buttons to order a phone call and call online chat are nailed to the right side of the site – at the time of review, these buttons work once and for a significant part of the day can only perform a decorative function. As soon as the buttons become clickable, then you can live chat with the operator.

Educational program

The resources section is responsible for the training. In it, you can sign up for live trainings of FXDD analysts, watch useful videos, participate in webinars, work with trading tools and find a lot of reference material on the basics of making forex earnings. The section is well structured, but a significant part of the information is collected from scans of textbooks, so without knowledge of a foreign language, even with machine translation, it is difficult to understand the context of the content.

Features

The site provides for the “Partnerships” section, which sets out the conditions for financial companies that can direct clients through channels to the FXDD broker. Unfortunately, this is not a public offer and to start cooperation it is necessary to fill out a contact form, which spells out several mandatory requirements for a partner candidate. Traditional promotions and bonus programs on the site are not provided. There is also no referral program for private traders.

FXDD: advantages and disadvantages

Advantages:

- There is a license from the financial regulator and segregated bank accounts are provided where customer deposits are kept.

- There are different versions of trading platforms that are adapted for all gadgets and are not limited to the standard functionality of Metatrader 4.

- A wide range of trading assets and a diverse training program.

Disadvantages:

- There are not enough ways to contact technical support managers. Especially there is a lack of round-the-clock working online chat through which you can quickly solve many current problems.

- Most trading terminals have limited leverage (1:50), which is not suitable for many traders who expect to get tangible profits with little capital.

- There is no welcome bonus and classic referral program.

Leave a Reply