As a fully automated EA, FX Oxygen claims to be highly profitable and reliable with live results for proof. With so many FX robots available now, it is difficult for a newbie trader to identify the right product. This FX EA from Forex Store assures 20% monthly profits with its reliable trading approach.

Detailed Forex Robot Review

A trader has to know about certain crucial aspects of an ATS before deciding on using it. The features and trading approach are important factors that help in choosing an EA. Unfortunately, FX Oxygen fails to provide pertinent details regarding the features and the approach it uses. The website layout is very simple with very little information provided about the EA.

We could not find info about the vendor or the developer of this system. The vendor does not provide any phone contact or location address. For users to contact the vendor, there is just an online form.

While the vendor states that reliability is important, the lack of transparency shows this is not the case. Besides not revealing info about the vendor, there is no mention of the strategy used and other details like the timeframe, currency pairs, recommendations on the settings, and more.

FX Oxygen Strategy Tests

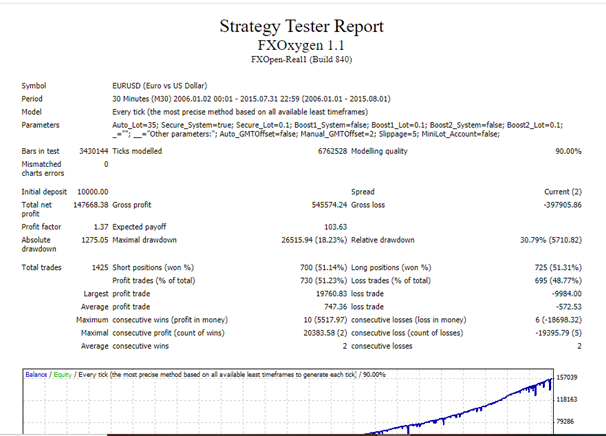

Backtests done since 2006 are shown by the vendor. A screenshot of the strategy tester report is shown below:

From the report, we could see the test has been done with a modeling quality of 90%. This is not sufficient to give a clear insight into the working of the EA. For instance, information related to the slippage, commissions, and spread used will not be shown. The backtesting done on the EURUSD pair using the M30 timeframe reveals a net profit of $147668.38 for an initial deposit of $10000.00. A profit factor of 1.37 and a drawdown value of 18.23 are shown. Considering the duration of the test the drawdown is high.

Live Account Trading Results

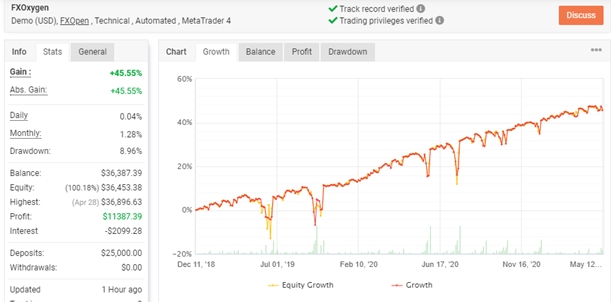

A live account verified by the myfxbook site is featured on the site. But this is a demo account. We would prefer results from a real account. While there is another real account of this EA it has stopped trading in 2019. Here is a screenshot of the live demo account:

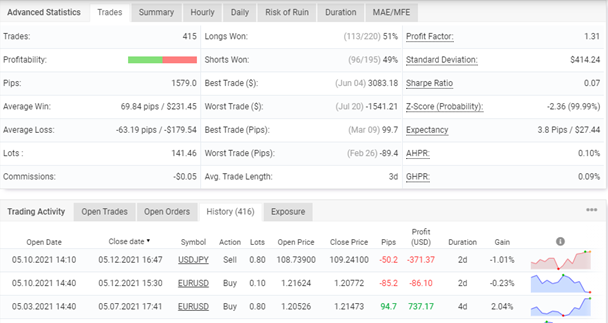

A look at the trading stats shows deposits of $25,000 and a balance value of $36,387. A daily gain of 0.04% and a monthly profit of 1.28% are revealed. The total and absolute profit values are 45.55%. A drawdown of 8.96% is shown. For the trading started in December 2018 a total of 415 trades have been executed. The average win happened at 69.84 pips and the average loss at 63.19 pips. A profit factor of 1.31 is recorded for the account.

The trading history reveals different lot sizes have been used ranging from 0.10 up to 0.80. The main currency pairs traded are the EURUSD and USDJPY pairs. Comparing the backtest report with the demo account results we could see the profit factor is the same, while there is a difference in the drawdown. But without real account results, it is not possible to get the real picture of the system.

Pricing

The price of this FX EA is $210. This amount is actually a discounted price with the earlier price being $295. Features included in the package are two modes namely reliable and highly profitable mode, the FX Oxygen robot, a lifetime license, and free updates.

A detailed user guide and 24/7 support are also offered with this ATS. The vendor also offers a 30-day refund offer. Users can get their money back if they are facing problems with the FX robot or face unsuccessful trading.

Customer Reviews

User reviews for this MT4 tool are not present on reliable third-party sites like Trustpilot, Forexpeacearmy, etc. Without reviews from users, the vendor’s claim of the EA being reliable is not proven. Furthermore, reviews reveal the quality of support provided and other important details like the effectiveness of the FX robot. The lack of reviews shows this FX EA is not reliable.

FX Oxygen from Forex Store is an MT4 EA that fails to provide proof for its claims of profits and reliability. As per the vendor, the FX robot can give 20% monthly profits. But the demo account results reveal a very low monthly profit. While the backtests show decent profits, they are based on historical data and cannot be relied on for predicting future profits.

The lack of vendor transparency and not explaining the strategy and settings are downsides of this ATS that reveal it is an unreliable system. Unless the vendor reveals information related to the strategy and posts verified real account results this EA will remain an unreliable trading tool.

Leave a Reply